I read that Tropicana Gardens Mall is going to be sold to IOI for over RM700mil, so could be from there. They've already sold W Hotel KL and Mariott Penang

Bond kaki lai, DRB HICOM bond coming

Bond kaki lai, DRB HICOM bond coming

|

|

Mar 3 2024, 04:51 PM Mar 3 2024, 04:51 PM

Return to original view | Post

#21

|

Senior Member

5,574 posts Joined: Aug 2011 |

I read that Tropicana Gardens Mall is going to be sold to IOI for over RM700mil, so could be from there. They've already sold W Hotel KL and Mariott Penang

|

|

|

|

|

|

Mar 3 2024, 06:00 PM Mar 3 2024, 06:00 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

5,574 posts Joined: Aug 2011 |

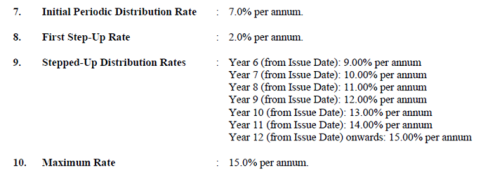

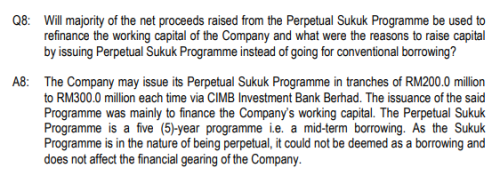

QUOTE(BWassup @ Mar 3 2024, 05:54 PM) What about Tropicana issuing another sukuk to refinance the one callable in September 2024? If there is demand, wouldn't they be able to do that at below 9% (+ 1% each subsequent year it is not called)? The dividend and capital stopper clause for the perpetual sukuk prohibits any dividends, distributions or other payments to shareholders or junior debt obligations. This enforces the higher ranking of obligations for debt and perpetual sukuk holders above the common shareholders. As such, if the Issuer wishes to declare any dividends, they would have to first satisfy any outstanding deferred periodic payments.On the possibility of Tropicana deferring future expected distributions, are they allowed to defer them indefinitely, in which case, it could become a rolling snowball which may never be paid? Weird. Their credit standing would plummet. Secondly, another repercussion would be the poorer reputation of the issuer in the market. To elaborate on the implications of this, a large corporation like Tropicana deferring on periodic payments may send an unfavourable message to the market. Being a property developer requiring consistent funding for upcoming developments, deferring on payments may result in banks withdrawing their credit facilities, imposing stricter lending requirements or higher borrowing rates. Furthermore, it will be harder for them to tap into the bond market for financing, and even if they manage to do so, they will most likely have to offer a much higher interest to investors. Given the implications, deferring on payments is often the last resort for issuers, as it may snowball into a bigger problem for them down the road. Additionally, in the event of a non-call the first coupon step-up of 2% per annum and an additional 1% per annum for the year following that will make servicing the debt more expensive for the issuer and will be an incentive for them to call the perpetual sukuk on the first call date as shown below.  This post has been edited by contestchris: Mar 3 2024, 06:02 PM |

|

|

Mar 3 2024, 06:03 PM Mar 3 2024, 06:03 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

5,574 posts Joined: Aug 2011 |

QUOTE(BWassup @ Mar 3 2024, 05:54 PM) What about Tropicana issuing another sukuk to refinance the one callable in September 2024? If there is demand, wouldn't they be able to do that at below 9% (+ 1% each subsequent year it is not called) on secured basis? I think no more demand, look at the yields on the secondary market. Tropicana can forget about tapping into the bond market in the next few years if they fail to redeem the 7.00% perp in Sep 2024.On the possibility of Tropicana deferring future expected distributions, are they allowed to defer them indefinitely, in which case, it could become a rolling snowball which may never be paid? Weird. Their credit standing would plummet. |

|

|

Mar 6 2024, 08:10 PM Mar 6 2024, 08:10 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

5,574 posts Joined: Aug 2011 |

Guys, there are two different things:

1) Not exercising call option but continue to pay coupons at progressively higher interest until it hits a cap of 15%. This is mildly considered "credit negative". 2) Not exercising call option and choose to defer paying coupons. By doing this, Tropicana cannot pay any dividends or pay any coupons to bonds ranked equal or less to the perpetuals. This is heavily considered "credit negative" even though it does not amount to a default. This is the absolute worst case scenario and WILL NOT HAPPEN in the next 6 to 12 months. |

|

|

Mar 17 2024, 06:52 PM Mar 17 2024, 06:52 PM

Return to original view | IPv6 | Post

#25

|

Senior Member

5,574 posts Joined: Aug 2011 |

QUOTE(BWassup @ Mar 17 2024, 06:36 PM) Tropicana 7% sukuk has been actively traded since 29 January, and the yield has dropped sharply: The default action is to recall the bond. That's why there is a hefty step up penalty.Trade Date Input Time Amount Price Yield (%) Value Date 08-Mar-2024 04:49:38 PM 0.25 98.26 10.39 12-Mar-2024 08-Mar-2024 09:11:36 AM 0.25 98.25 10.39 11-Mar-2024 07-Mar-2024 03:58:50 PM 0.25 99.30 8.34 11-Mar-2024 07-Mar-2024 03:57:12 PM 0.25 99.25 8.45 11-Mar-2024 06-Mar-2024 09:09:09 AM 0.25 98.22 10.38 07-Mar-2024 05-Mar-2024 09:21:14 AM 0.45 99.82 7.32 06-Mar-2024 05-Mar-2024 09:20:47 AM 1 99.82 7.32 06-Mar-2024 05-Mar-2024 09:15:51 AM 0.5 99.46 8.00 06-Mar-2024 05-Mar-2024 09:14:55 AM 0.5 98.06 10.67 06-Mar-2024 27-Feb-2024 12:27:30 PM 0.5 98.71 9.35 29-Feb-2024 27-Feb-2024 12:26:59 PM 0.5 98.66 9.45 29-Feb-2024 22-Feb-2024 09:04:18 AM 0.3 97.85 10.84 23-Feb-2024 21-Feb-2024 03:34:16 PM 0.25 98.00 10.64 23-Feb-2024 21-Feb-2024 03:31:02 PM 0.25 96.00 14.29 23-Feb-2024 21-Feb-2024 09:20:28 AM 0.25 98.11 10.35 22-Feb-2024 21-Feb-2024 09:19:51 AM 0.25 98.11 10.35 22-Feb-2024 06-Feb-2024 09:09:58 AM 0.25 97.85 10.57 07-Feb-2024 05-Feb-2024 09:19:10 AM 0.25 97.84 10.57 06-Feb-2024 02-Feb-2024 09:26:41 AM 0.3 97.96 10.35 05-Feb-2024 29-Jan-2024 04:24:59 PM 0.25 91.00 22.68 31-Jan-2024 https://www.bixmalaysia.com/security-info-p...nformation-tab6 Pleasant surprise. :thumbsup: Chances of a call in September increased significantly? |

|

|

Mar 20 2024, 04:25 PM Mar 20 2024, 04:25 PM

Return to original view | Post

#26

|

Senior Member

5,574 posts Joined: Aug 2011 |

|

|

|

|

|

|

Mar 21 2024, 01:49 PM Mar 21 2024, 01:49 PM

Return to original view | Post

#27

|

Senior Member

5,574 posts Joined: Aug 2011 |

|

|

|

Mar 22 2024, 02:08 PM Mar 22 2024, 02:08 PM

Return to original view | Post

#28

|

Senior Member

5,574 posts Joined: Aug 2011 |

|

|

|

Mar 22 2024, 02:12 PM Mar 22 2024, 02:12 PM

Return to original view | Post

#29

|

Senior Member

5,574 posts Joined: Aug 2011 |

QUOTE(guy3288 @ Mar 21 2024, 06:19 PM) I mean they only know as best as the next person.Company has been clear that the perpetual sukuk is a 5 year program. The step-up interest from Y6 onwards is a hefty penalty for non-redemption.  https://www.tropicanacorp.com.my/files/TCB%...th%20AGM%20.pdf But of course, Tropicana retains the flexibility to not call, or even then defer the coupon payment. But these will only happen because "shit hits the fan". |

|

|

Mar 25 2024, 03:36 PM Mar 25 2024, 03:36 PM

Return to original view | IPv6 | Post

#30

|

Senior Member

5,574 posts Joined: Aug 2011 |

How long does it take to receive bond coupon payments?

|

|

|

Mar 26 2024, 03:53 PM Mar 26 2024, 03:53 PM

Return to original view | IPv6 | Post

#31

|

Senior Member

5,574 posts Joined: Aug 2011 |

|

|

|

Mar 26 2024, 06:07 PM Mar 26 2024, 06:07 PM

Return to original view | Post

#32

|

Senior Member

5,574 posts Joined: Aug 2011 |

|

|

|

Mar 26 2024, 09:43 PM Mar 26 2024, 09:43 PM

Return to original view | IPv6 | Post

#33

|

Senior Member

5,574 posts Joined: Aug 2011 |

QUOTE(guy3288 @ Mar 26 2024, 09:13 PM) technical hiccup only Oh wait, so you're saying 7.00% semi-annual doesn't simply mean 3.50% every 6 months? They actually count the actual number of days between Sep 26 to March 25, then again from March 26 to Sep 25? Meaning which, the next coupon will be 7% * 184/365? In which case, the total amount will actually be slightly above 7.00% as it is a leap year?Rm60k x7% x182/365 did you withdraw from FSM cash Account to bank? My last withdrawal money almost instantly received This time need wait 1 day?? soemthing is wrong again This post has been edited by contestchris: Mar 26 2024, 09:44 PM |

|

|

|

|

|

Apr 17 2024, 09:47 PM Apr 17 2024, 09:47 PM

Return to original view | IPv6 | Post

#34

|

Senior Member

5,574 posts Joined: Aug 2011 |

QUOTE(guy3288 @ Apr 16 2024, 09:09 PM) Yield is too low. |

|

|

May 29 2024, 12:54 AM May 29 2024, 12:54 AM

Return to original view | IPv6 | Post

#35

|

Senior Member

5,574 posts Joined: Aug 2011 |

|

|

|

Jun 4 2024, 02:55 PM Jun 4 2024, 02:55 PM

Return to original view | Post

#36

|

Senior Member

5,574 posts Joined: Aug 2011 |

QUOTE(hksgmy @ Jun 4 2024, 12:03 PM) A slight detour of a question - when you buy fractions of a bond (usually a whole bond is issued in tranches of SGD or RM250,000), is it difficult to find buyers when you wish to dispose of your holdings? Or, do you have to sell back to the platform from which you bought? Fractional bonds can only be sold back to the platform. Rarely they will buy, and if yes, they might only have a bid for a smaller quantum. Also, the spread is quite bad - you may need to take a larger haircut. So basically, if you buy fractional bonds from a platform, be ready to HTM as there's a good chance you may not sell it back at all, or sell it back at a hefty haircut. This post has been edited by contestchris: Jun 4 2024, 02:55 PM hksgmy liked this post

|

|

|

Jun 12 2024, 12:25 PM Jun 12 2024, 12:25 PM

Return to original view | Post

#37

|

Senior Member

5,574 posts Joined: Aug 2011 |

All Tropicana perpetual sukuk holders rejoice. MARC recently lifted the outlook from NEGATIVE to STABLE. At the same time, MARC anticipates that Tropicana will redeem all outstanding perpetual sukuk and refinance by issuing new Sukuk under the existing or new IMTN program. https://www.marc.com.my/rating-announcement...look-to-stable/ guy3288 liked this post

|

|

|

Sep 4 2024, 10:43 PM Sep 4 2024, 10:43 PM

Return to original view | IPv6 | Post

#38

|

Senior Member

5,574 posts Joined: Aug 2011 |

|

|

|

Sep 12 2024, 01:25 PM Sep 12 2024, 01:25 PM

Return to original view | Post

#39

|

Senior Member

5,574 posts Joined: Aug 2011 |

MARC Ratings has assigned a preliminary rating of AIS to Tropicana Corporation Berhad’s proposed RM1.5 billion Islamic Medium-Term Notes (IMTN) (Sukuk Wakalah) and concurrently affirmed its ratings of AIS on the RM1.5 billion IMTN (Sukuk Wakalah) and A-IS on the RM2.0 billion Perpetual Sukuk. The outlook on all ratings is stable.

Proceeds from the initial drawdown of RM350 million under the new programme will be largely utilised to redeem the first tranche of its Perpetual Sukuk of RM248 million on the first call date on September 25, 2024. Further issuances under the new programme over the next three years would be to redeem the remaining two Perpetual Sukuk tranches and refinance the outstanding notes under the existing Sukuk Wakalah, which currently has an outstanding of RM745.5 million (end-2023: RM855.5 million). https://www.marconline.com.my/press/60538900469806 |

|

|

Sep 12 2024, 11:21 PM Sep 12 2024, 11:21 PM

Return to original view | IPv6 | Post

#40

|

Senior Member

5,574 posts Joined: Aug 2011 |

What the fuck, received an "Exchange Offer" from Tropicana. Seems like they are strong-arming sukukholders to accept this new shitty deal. If I read it correctly, if 75% of the sukukholders vote yes in the EGM, we have no choice in the matter and will be binded by the decision of the EGM!

-------------------- Last year, we published a write up on Tropicana, flagging out their liquidity issues and consistent delays in their asset disposal. Since then, the Group has made significant progress to recover from their high debt load through successful disposal of low yielding assets. To briefly summarise their progress, Tropicana has managed to lower their total borrowings from RM3.5 billion in 1H23 to RM2.7 billion in 1H24, lowering their Debt-to-Equity ratio from 68% to 53%. They are expected to continue improving their balance sheet, with their announced sales of Tropicana Gardens Mall to IOI for RM680 million and a sale of a parcel of land in Gelang Patah for RM383 million. Despite their liquidity issues showing signs of improvements, it still remains a concern in the short term. Nevertheless, the new Sukuk Programme of RM1.5 billion, together with the new issuance of RM450 million will support their refinancing of their maturing debt. Additionally, the planned refinancing aims to reduce interest costs from their perpetuals which is subjected to a coupon step-up of 2% upon the first call date.We are overall optimistic that they are able to reduce their leverage to a comfortable level, especially with an additional announced sales of RM1.2 billion, expected to be realised by the end of 2024. We opine that this will bring down their total borrowings to around RM2.3 billion with a Debt-to-Equity ratio of 45% and provide financing cost savings of around RM 24 million p.a. On another note, earnings have improved YoY from RM19 million in 1H23 to RM60 million in 1H24, while unbilled sales of RM2.4 billion provides some earnings visibility in the short to medium term. Furthermore, we expect the positive sentiment surrounding Johor’s property market to continue to support Tropicana’s future outlook, given their sizeable landbank in the area. In summary, we believe that the option to accept the New Sukuk is the best course of action given the overall less risky structure, fairly priced coupon rate and the added benefit from the 0.25% consent fee. This email serves as a notification and no actions are required from you. FSMOne shall vote on your behalf to accept the exchange offer. Please feel free to contact us should you need further assistance. Best Regards, Client Service Client Help, Your Friendly FSMOne Manager Hotlines:+603 2149 0567 (KL), +604 6401 567 (PG) FSMOne - To Help Investors Around The World Invest Globally And Profitably This post has been edited by contestchris: Sep 12 2024, 11:30 PM Attached File(s)  Tropicana___Proposed_Exchange_Offer___Explanatory_Notes_and_FAQ__For_dis.._.pdf ( 793.1k )

Number of downloads: 8

Tropicana___Proposed_Exchange_Offer___Explanatory_Notes_and_FAQ__For_dis.._.pdf ( 793.1k )

Number of downloads: 8 Splash._Exchange_Offer_Memo.pdf ( 465.96k )

Number of downloads: 4

Splash._Exchange_Offer_Memo.pdf ( 465.96k )

Number of downloads: 4 Issuer_Letter___Notice_of_EGM__Appendix_3_.pdf ( 285.28k )

Number of downloads: 4

Issuer_Letter___Notice_of_EGM__Appendix_3_.pdf ( 285.28k )

Number of downloads: 4 |

| Change to: |  0.0341sec 0.0341sec

0.86 0.86

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 04:47 PM |