I just got mine approved not long ago. Just updating my situation and see if it helps fellow bros and sis here with their iMiliki application.

AFAIK, there are several criteria to meet before we can submit the application to LHDN to get approval, as below:

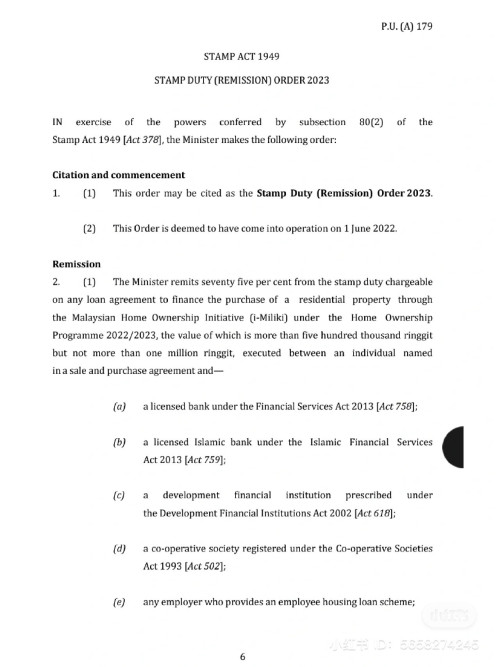

1. Must be residential project (this includes commercial title under HDA, and SOHO inclusive as well)

2. Price must be under RM1mil (The mentioned price here is the price that the developer submits to KPKT during project approval phase, idk what they call it but I call it KPKT price)

3. The purchase must be at least 10% discount from KPKT price (Not SPA price)

3. Purchaser does not have any sorts of property under his/her name (not sure if property of inheritance counts)

4. Must be a purchase directly from developer (means new project only)

5. The developer must be a participant of this program (To me this is very vague, be careful when you visit showroom. Agents sure tell you this can, that ada. Till you signed the papers everything cannot U-turn baru they tell the truth)

6. SPA must be EXECUTED by latest 31st December 2023 and STAMPED by latest 31st January 2024. (Better don't delay until last minute else if they drag your stamping you'll then not be eligible for the program)

After fulfilling the above criteria, what you need to do BEFORE signing your SPA:

1. Check with your lawyer on the iMiliki application (in this case usually is developer panel lawyer la because they waive your legal fees)

2. During SPA signing day, request for the iMiliki application forms first. They will sure prepare for you as they'll need your signature for the forms.

3. There are 3 forms for you to sign, 1 is confirmation of 10% discount, another 1 is first house declaration, and the last one is the application form itself

4. The form is basically all the details of your purchased unit and the information only can get from developer, so look through everything and sign.

Attaching some reference links for you guys to study:

KPKT Official Site for iMiliki:

https://www.kpkt.gov.my/index.php/announcements/view/9810% discount Form:

https://www.kpkt.gov.my/kpkt/resources/user...UN_27102023.pdf1st House Declaration Form & iMiliki Application Form:

https://www.kpkt.gov.my/kpkt/resources/user...ama_4_jenis.pdf (Note that 2 types of form with 2 price bracket are in here, page 5 to 8 is for purchase less than RM500K, and page 1 to 4 is for RM500,001 to RM999,999)

iMiliki official FAQ:

https://www.kpkt.gov.my/kpkt/resources/user...10_27102023.pdfUpon successful application, your lawyer will then notify you with a surat from LHDN stating the latest amount to pay for the stamp duty, then just pay accordingly. For those who have paid upfront can get refunded, but I'm not in this case so I can't share how the flow will be.

Fingers crossed for fellow peeps who are applying to get approval!

Hope this helps!

Apr 18 2023, 04:57 PM, updated 3y ago

Apr 18 2023, 04:57 PM, updated 3y ago

Quote

Quote

0.0309sec

0.0309sec

0.91

0.91

6 queries

6 queries

GZIP Disabled

GZIP Disabled