Its out but anyone has any idea where to find the imiliki projects, i checked on kpkt website but none

Financial Stamp Duty Exemption, Stamp duty exemption in malaysia

|

|

Jun 10 2023, 07:12 PM Jun 10 2023, 07:12 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

343 posts Joined: May 2009 |

|

|

|

|

|

|

Jun 11 2023, 11:29 PM Jun 11 2023, 11:29 PM

Return to original view | Post

#2

|

Junior Member

343 posts Joined: May 2009 |

QUOTE(Smoothpow @ Jun 11 2023, 10:51 PM) Not whatever property. Property mentioned must be registered under Home Ownership Programme. Yes, you can ask your lawyer to proceed for refund from LHDN if duty stamped paid but make sure you hit all criteria in the gazette. |

|

|

Jun 12 2023, 04:27 PM Jun 12 2023, 04:27 PM

Return to original view | Post

#3

|

Junior Member

343 posts Joined: May 2009 |

|

|

|

Jun 14 2023, 09:46 AM Jun 14 2023, 09:46 AM

Return to original view | Post

#4

|

Junior Member

343 posts Joined: May 2009 |

QUOTE(9926 @ Jun 14 2023, 08:33 AM) Its included. The definition of residential property is defined in the gazette. “residential property” means a house, a condominium unit, an apartment or a flat, purchased or obtained solely to be used as a dwelling house, and includes a service apartment and small office home office (SOHO) for which the property developer has obtained an approval for Housing Developers’ Licence and Advertising and Sales Permit under the Housing Development (Control and Licensing) Act 1966, Housing Development (Control and Licensing) Enactment 1978 [Sabah No. 24 of 1978] or Housing Development (Control and Licensing) Ordinance 2013 Sarawak [Cap. 69]; |

|

|

Jun 14 2023, 10:59 AM Jun 14 2023, 10:59 AM

Return to original view | Post

#5

|

Junior Member

343 posts Joined: May 2009 |

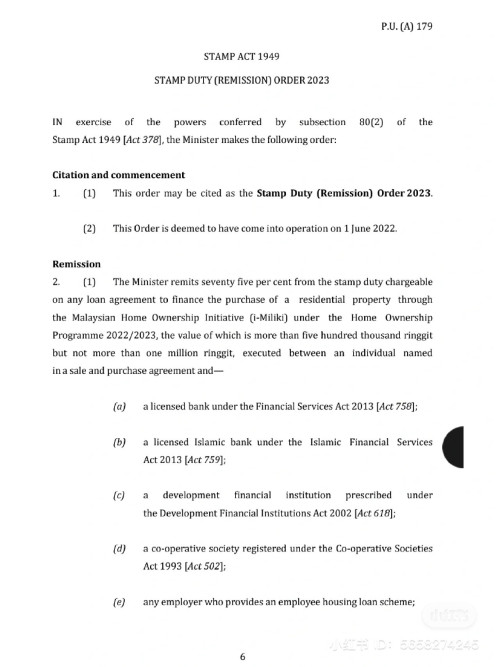

QUOTE(9926 @ Jun 14 2023, 10:36 AM) Thanks for the answer, so I should check with my lawyer or sales agent on this? I signed SPA back in August last year, I am not sure am I eligible, tried googled but could not find a place where all information is listed, only news. Yes, for your extra info, u just let your lawyer knows which PUA you are referring toPUA 177 - property 500k and below, exemption on MOT PUA 176 - property 500k and below, exemption on stamp duty on loan PUA 179 - property more than 500k but less than 1 mil, 75% remission on MOT PUA 180 - property more than 500k but less than 1 mil, 75% remission on stamp duty on loan SUBJECT STRICTLY that the property is registered under Imiliki and purchaser HAS NOT owned any property before! 9926 liked this post

|

| Change to: |  0.0194sec 0.0194sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 10:23 AM |