Outline ·

[ Standard ] ·

Linear+

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

|

elea88

|

Aug 14 2024, 10:36 AM Aug 14 2024, 10:36 AM

|

|

QUOTE(TOS @ Aug 14 2024, 10:30 AM) Last day to bid 6M T-bill. Do so by 9 pm today ya. MAS published last bid quote (by primary dealers) of BS24115A maturing 04 Feb 2025: 3.34% p.a. https://eservices.mas.gov.sg/statistics/fda...ssuePrices.aspxI bid 2k SGD 3.4% p.a... Betting against the wind... 3.4% so low... |

|

|

|

|

|

SUSTOS

|

Aug 14 2024, 10:38 AM Aug 14 2024, 10:38 AM

|

|

QUOTE(elea88 @ Aug 14 2024, 10:36 AM) That's more like 3.47% p.a. if using FD interest rate count convention. But yea it's low... FED should raise rates not cut rates... We savers have been penalized for too long already... |

|

|

|

|

|

SUSTOS

|

Aug 15 2024, 01:03 PM Aug 15 2024, 01:03 PM

|

|

Today's 6M bill auction result: | % of Competitive Applications at Cut-off Allotted | Approximately 30% | | % of Non-Competitive Applications Allotted | 100% | | Bid-to-Cover Ratio | 2.32 | | Cut-off Yield (Price) | 3.34% p.a. (98.335) | | Median Yield (Price) | 3.2% p.a. (98.404) | | Average Yield (Price) | 2.83% p.a. (98.589) |

Source: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-08-20Bid failed, money move back to MoneyOwl Wisesaver... |

|

|

|

|

|

SUSTOS

|

Aug 20 2024, 01:20 PM Aug 20 2024, 01:20 PM

|

|

This week's MAS Bill auction results: | Tenure | 4-week | 12-week | | Cut-off yield | 3.69% | 3.6% | | Median yield | 3.6% | 3.55% | | Average yield | 3.35% | 3.31% | | BTC ratio | 2.05 | 1.87 |

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-08-2312-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-08-23OMG COY is very bad. Dropped 20 basis points from last auction... |

|

|

|

|

|

SUSTOS

|

Aug 27 2024, 01:22 PM Aug 27 2024, 01:22 PM

|

|

This week's MAS Bill auction results: | Tenure | 4-week | 12-week | | Cut-off yield | 3.55% | 3.47% | | Median yield | 3.45% | 3.39% | | Average yield | 3.31% | 3.05% | | BTC ratio | 1.97 | 1.87 |

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-08-3012-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-08-30Wow, full blown impact on MAS Bills side as well. Dropped another 15 basis points from last week auction... I will skip tomorrow's 6M T-bill bid...  |

|

|

|

|

|

elea88

|

Aug 27 2024, 02:17 PM Aug 27 2024, 02:17 PM

|

|

QUOTE(TOS @ Aug 27 2024, 01:22 PM) This week's MAS Bill auction results: | Tenure | 4-week | 12-week | | Cut-off yield | 3.55% | 3.47% | | Median yield | 3.45% | 3.39% | | Average yield | 3.31% | 3.05% | | BTC ratio | 1.97 | 1.87 |

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-08-3012-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-08-30Wow, full blown impact on MAS Bills side as well. Dropped another 15 basis points from last week auction... I will skip tomorrow's 6M T-bill bid...  moving forward game over for TBILLS? |

|

|

|

|

|

SUSTOS

|

Aug 27 2024, 03:23 PM Aug 27 2024, 03:23 PM

|

|

QUOTE(elea88 @ Aug 27 2024, 02:17 PM) moving forward game over for TBILLS? Fed cut rates...  No choice, have to go to VOO, QQQM, DBS, UOB and OCBC... |

|

|

|

|

|

SUSTOS

|

Aug 29 2024, 01:54 PM Aug 29 2024, 01:54 PM

|

|

Haha looks like my choice of skipping the bid was worth it all. Today's 6M bill auction result: | % of Competitive Applications at Cut-off Allotted | Approximately 0% | | % of Non-Competitive Applications Allotted | 100% | | Bid-to-Cover Ratio | 2.35 | | Cut-off Yield (Price) | 3.13% p.a. (98.439) | | Median Yield (Price) | 3% p.a. (98.504) | | Average Yield (Price) | 2.62% p.a. (98.694) |

Source: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-09-03 |

|

|

|

|

|

TSikanbilis

|

Aug 29 2024, 05:36 PM Aug 29 2024, 05:36 PM

|

|

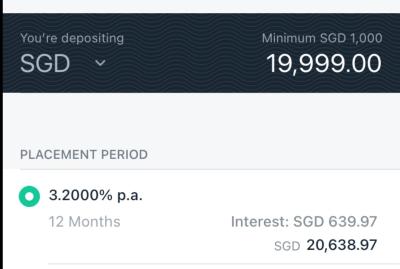

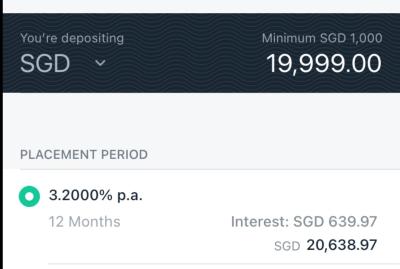

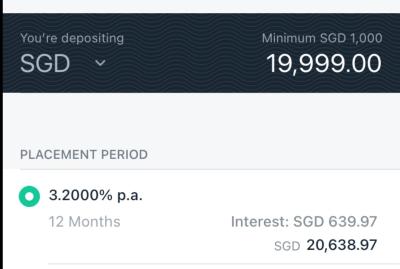

Those with DBS can put FD 3.20% one year tenure. Downside is limited to SGD19,999 only.  This post has been edited by ikanbilis: Aug 29 2024, 05:36 PM

This post has been edited by ikanbilis: Aug 29 2024, 05:36 PM |

|

|

|

|

|

SUSTOS

|

Aug 30 2024, 12:50 PM Aug 30 2024, 12:50 PM

|

|

QUOTE(ikanbilis @ Aug 29 2024, 05:36 PM) Those with DBS can put FD 3.20% one year tenure. Downside is limited to SGD19,999 only.

Wow I just notice that 1-year SG T-bill yields the same as 12-month DBS SGD FD. https://eservices.mas.gov.sg/statistics/fda...ssuePrices.aspxTimes have changed! Those who don't have CDP account can now deposit straight into DBS SG SGD FD! |

|

|

|

|

|

SUSTOS

|

Sep 3 2024, 06:26 PM Sep 3 2024, 06:26 PM

|

|

This week's MAS Bill auction results: | Tenure | 4-week | 12-week | | Cut-off yield | 3.44% | 3.4% | | Median yield | 3.3% | 3.3% | | Average yield | 3.04% | 3.01% | | BTC ratio | 1.86 | 1.82 |

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-09-0612-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-09-06The curve is flattening very rapidly on the short-end. 4-week COY dropped another 10 basis points from last week's auction despite the cool response (BTC < 1.9). |

|

|

|

|

|

SUSTOS

|

Sep 10 2024, 02:28 PM Sep 10 2024, 02:28 PM

|

|

This week's MAS Bill auction results: | Tenure | 4-week | 12-week | | Cut-off yield | 3.35% | 3.3% | | Median yield | 3.28% | 3.23% | | Average yield | 3.09% | 2.89% | | BTC ratio | 1.8 | 1.97 |

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-09-1312-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-09-13Another 10 basis points drop for BOTH 4-week and 12-week COY!  3 more weeks like that and it will be below 3%...  |

|

|

|

|

|

SUSTOS

|

Sep 10 2024, 02:29 PM Sep 10 2024, 02:29 PM

|

|

Side note: Non-SG citizens and non SG PRs kindly withdraw your CPF monies ASAP... https://www.sinchew.com.my/news/20240910/johor/5908407 |

|

|

|

|

|

SUSTOS

|

Sep 11 2024, 01:26 PM Sep 11 2024, 01:26 PM

|

|

Last day to bid 6M SG T-bills today. Will skip this round as well... Latest yield data shows around 3.1x% p.a. only. https://eservices.mas.gov.sg/statistics/fda...ssuePrices.aspx |

|

|

|

|

|

TSikanbilis

|

Sep 11 2024, 11:43 PM Sep 11 2024, 11:43 PM

|

|

QUOTE(TOS @ Sep 11 2024, 01:26 PM) Last day to bid 6M SG T-bills today. Will skip this round as well... Latest yield data shows around 3.1x% p.a. only. https://eservices.mas.gov.sg/statistics/fda...ssuePrices.aspxI am skipping this round t-bill as well, after placing DBS 3.2% 12-month FD. |

|

|

|

|

|

SUSTOS

|

Sep 12 2024, 11:14 PM Sep 12 2024, 11:14 PM

|

|

Today's 6M bill auction result: | % of Competitive Applications at Cut-off Allotted | Approximately 61% | | % of Non-Competitive Applications Allotted | 100% | | Bid-to-Cover Ratio | 1.95 | | Cut-off Yield (Price) | 3.1% p.a. (98.454) | | Median Yield (Price) | 3.01% p.a. (98.499) | | Average Yield (Price) | 2.9% p.a. (98.554) |

Source: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-09-17CPF and retail investors all gone. BTC dropped below 2. And notice when the retail/CPF monies are gone the COY is close to the median and average yield... Now you know who's screwing up stuffs all the while...  |

|

|

|

|

|

SUSTOS

|

Sep 17 2024, 03:02 PM Sep 17 2024, 03:02 PM

|

|

This week's MAS Bill auction results: | Tenure | 4-week | 12-week | | Cut-off yield | 3.43% | 3.23% | | Median yield | 3.22% | 3.13% | | Average yield | 3.11% | 2.86% | | BTC ratio | 1.64 | 1.95 |

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-09-2012-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-09-204-week COY went up by 10 basis points but more likely due to the cooler auction. This post has been edited by TOS: Sep 18 2024, 04:30 PM |

|

|

|

|

|

ccschua

|

Sep 23 2024, 01:59 PM Sep 23 2024, 01:59 PM

|

|

last week I still manage to get 3.2% on SYFE. Today its 3%.

|

|

|

|

|

|

SUSTOS

|

Sep 23 2024, 03:58 PM Sep 23 2024, 03:58 PM

|

|

QUOTE(ccschua @ Sep 23 2024, 01:59 PM) last week I still manage to get 3.2% on SYFE. Today its 3%. Yea rate cuts coming swiftly... No choice savers about to get penalized again... |

|

|

|

|

|

SUSTOS

|

Sep 24 2024, 05:19 PM Sep 24 2024, 05:19 PM

|

|

This week's MAS Bill auction results: | Tenure | 4-week | 12-week | | Cut-off yield | 3.29% | 3.17% | | Median yield | 3.15% | 3.02% | | Average yield | 2.96% | 2.89% | | BTC ratio | 1.87 | 1.81 |

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-09-2712-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2024-09-27Tomorrow is deadline for 6M T-bill bidding. |

|

|

|

|

Aug 14 2024, 10:36 AM

Aug 14 2024, 10:36 AM

Quote

Quote

0.0268sec

0.0268sec

0.40

0.40

6 queries

6 queries

GZIP Disabled

GZIP Disabled