QUOTE(Pikichu @ Apr 16 2023, 08:41 AM)

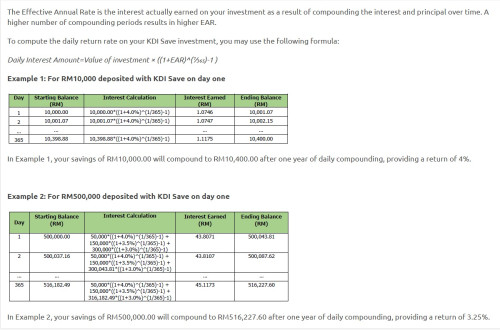

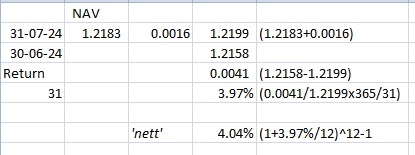

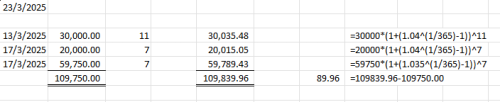

- KDI Save's returns : $10,000*(1+3.5%)^(1/365)-1 = $0.9425 interest daily

I had wanted to raise queries, but I came to these conclusions, am I wrong?

no, KDI interest will not be constant at 0.9425 dailyI had wanted to raise queries, but I came to these conclusions, am I wrong?

QUOTE

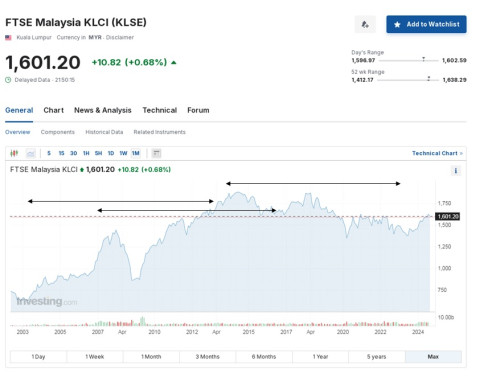

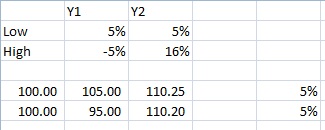

1. I thought compound interest is superior to regular FD but in a real world, both FD and KDI Save rate "compounding the interest and principal over time" after a year results 10,350 same as FD.

so what is wrong with compounding > simple?

Apr 16 2023, 06:59 PM

Apr 16 2023, 06:59 PM

Quote

Quote

0.0873sec

0.0873sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled