could be. the question is, will it still be higher than versa or stashaway simple

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Jul 21 2022, 10:17 AM Jul 21 2022, 10:17 AM

Return to original view | Post

#61

|

Senior Member

3,496 posts Joined: Jan 2003 |

could be. the question is, will it still be higher than versa or stashaway simple

|

|

|

|

|

|

Aug 1 2022, 11:01 AM Aug 1 2022, 11:01 AM

Return to original view | Post

#62

|

Senior Member

3,496 posts Joined: Jan 2003 |

QUOTE(Davidtcf @ Aug 1 2022, 09:33 AM) Aggressive Growth should have more equities, but this one mostly bonds and same as "balanced" type. Confusing KDI is trying to time the market, this used to be aggressive allocationQUOTE(Medufsaid @ Mar 1 2022, 10:44 AM) Davidtcf liked this post

|

|

|

Aug 4 2022, 01:17 PM Aug 4 2022, 01:17 PM

Return to original view | Post

#63

|

Senior Member

3,496 posts Joined: Jan 2003 |

even if RM3k free, KDI has custodian fees (for StashAway, when they say no fees, confirm no fees. i had 3 months free BFM promocode, then 3 months free under DRJASON promocode. i think i understand why, the StashAway promo is due to them subsidising the cost with the startup funds?)

the AI may monitor 24/7, but the decision the AI make you might or might not like it. markets has been going up in the past 1 month, as of Aug 1, seems like the aggressive portfolios are still on Bonds only. too slow to react or waiting for bigger crash to come before going in? can only claim tax for Bond ETFs, stocks ETFs deducted as normal This post has been edited by Medufsaid: Aug 4 2022, 01:24 PM |

|

|

Aug 14 2022, 05:26 PM Aug 14 2022, 05:26 PM

Return to original view | Post

#64

|

Senior Member

3,496 posts Joined: Jan 2003 |

i think is 1 profile, 5 different days of screenshot

|

|

|

Aug 14 2022, 10:10 PM Aug 14 2022, 10:10 PM

Return to original view | Post

#65

|

Senior Member

3,496 posts Joined: Jan 2003 |

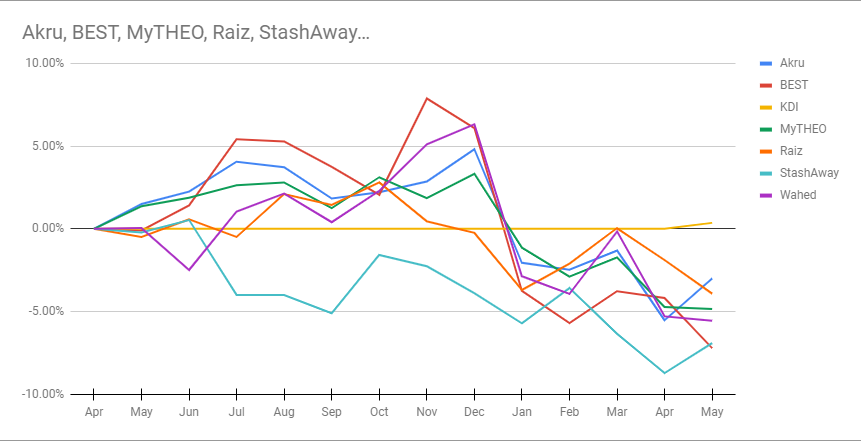

QUOTE(guy3288 @ Aug 14 2022, 09:31 PM) StashAway? See lah already 1 year now..paper loss RM3500, KDI started this year only, if u want to compare, you need to start with RM100 in SA and RM100 in KDI on the same start date. There's a bear market after Jan so KDI will have a better starting pointHad i put that SA money in KDI invest , now gain RM7000+ goyang kaki 6 months only  chart compiled from fiholicMD's experiment -> https://twitter.com/fiholicMD/status/1531111914096340993 This post has been edited by Medufsaid: Aug 14 2022, 10:11 PM |

|

|

Aug 14 2022, 10:27 PM Aug 14 2022, 10:27 PM

Return to original view | Post

#66

|

Senior Member

3,496 posts Joined: Jan 2003 |

|

|

|

|

|

|

Aug 14 2022, 10:52 PM Aug 14 2022, 10:52 PM

Return to original view | Post

#67

|

Senior Member

3,496 posts Joined: Jan 2003 |

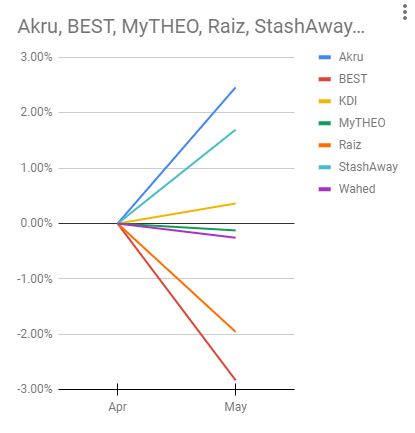

QUOTE(Wolves @ Aug 14 2022, 10:30 PM) No more new data from him already (June/July onwards), maybe liquidated for better stuffs... but your comment gave me an idea... here's the 1 month performance if normalised back to 0.00%  This post has been edited by Medufsaid: Aug 14 2022, 10:55 PM honsiong liked this post

|

|

|

Aug 22 2022, 09:11 AM Aug 22 2022, 09:11 AM

Return to original view | Post

#68

|

Senior Member

3,496 posts Joined: Jan 2003 |

|

|

|

Sep 2 2022, 04:12 PM Sep 2 2022, 04:12 PM

Return to original view | Post

#69

|

Senior Member

3,496 posts Joined: Jan 2003 |

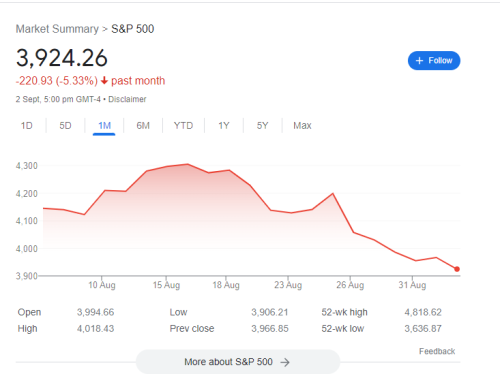

... 16% use to buy back malaysian shares

but anyway, we don't know when did KDI buy back into shares ETF right? if middle of aug, means reentered at high This post has been edited by Medufsaid: Sep 2 2022, 05:48 PM |

|

|

Sep 2 2022, 07:23 PM Sep 2 2022, 07:23 PM

Return to original view | Post

#70

|

Senior Member

3,496 posts Joined: Jan 2003 |

QUOTE(download88 @ Sep 2 2022, 05:30 PM) seem like now is another good time to start enter Invest? i don't think KDI Invest is transparent with how they time the market. so better you ask yourself if you want to take the leap of faith or not. if market is bad they'll help you time the market anywaynot sure if now transfer from Save to Invest still sempat to catch the great timing or not Davidtcf liked this post

|

|

|

Sep 5 2022, 10:54 AM Sep 5 2022, 10:54 AM

Return to original view | Post

#71

|

Senior Member

3,496 posts Joined: Jan 2003 |

QUOTE(tadashi987 @ Sep 5 2022, 10:23 AM) yea thisQUOTE(Medufsaid @ Sep 2 2022, 04:12 PM) we don't know when did KDI buy back into shares ETF right? if middle of aug, means reentered at high  QUOTE(tadashi987 @ Sep 5 2022, 10:23 AM) don't consider this as transparent as they might just be saying what is publicly allowed to be saidThis post has been edited by Medufsaid: Sep 5 2022, 03:59 PM |

|

|

Sep 14 2022, 09:41 AM Sep 14 2022, 09:41 AM

Return to original view | Post

#72

|

Senior Member

3,496 posts Joined: Jan 2003 |

|

|

|

Oct 12 2022, 09:48 AM Oct 12 2022, 09:48 AM

Return to original view | Post

#73

|

Senior Member

3,496 posts Joined: Jan 2003 |

|

|

|

|

|

|

Oct 18 2022, 10:14 PM Oct 18 2022, 10:14 PM

Return to original view | IPv6 | Post

#74

|

Senior Member

3,496 posts Joined: Jan 2003 |

big fish like KDI invest get charged different commission rates by their brokers unlike small fries like us, don't be too worried over the transaction fees

instead, compare against other robo and see if KDI outperforms those other robos after management fees |

|

|

Dec 6 2022, 09:16 AM Dec 6 2022, 09:16 AM

Return to original view | Post

#75

|

Senior Member

3,496 posts Joined: Jan 2003 |

QUOTE(phoenix24 @ Dec 5 2022, 09:35 PM) Anyone still has their money in the invest section of portfolio? Haemorrhage like mad. Wondering how long I have to hold the bag, or if I should just cut loss and call it a day. investment is a long term game, just leave it there for 3-5 years, or withdraw to DIY for 3-5 years |

|

|

Dec 6 2022, 11:55 AM Dec 6 2022, 11:55 AM

Return to original view | Post

#76

|

Senior Member

3,496 posts Joined: Jan 2003 |

|

|

|

Dec 12 2022, 11:24 PM Dec 12 2022, 11:24 PM

Return to original view | Post

#77

|

Senior Member

3,496 posts Joined: Jan 2003 |

QUOTE(BrookLes @ Dec 11 2022, 05:41 PM) See you cannot even tell me that their FD rates are higher then PBB or at least justify using actual rates compare to PBB i think i can say with some certainty that he's xander83. even a statement like, "I ate McD this afternoon", i'll not trust without any proofHow can I trust your advise? LoTek liked this post

|

|

|

Dec 24 2022, 09:12 AM Dec 24 2022, 09:12 AM

Return to original view | Post

#78

|

Senior Member

3,496 posts Joined: Jan 2003 |

a difference of 1.1%... could it be forex conversion from MYR to USD, then USD back to KDI save?

|

|

|

Nov 17 2023, 09:52 AM Nov 17 2023, 09:52 AM

Return to original view | Post

#79

|

Senior Member

3,496 posts Joined: Jan 2003 |

at least KDI is more transparent with what they deduct. UT is a black box, u only see the NAV unless u dig into annual reports

This post has been edited by Medufsaid: Nov 17 2023, 10:09 AM |

|

|

Jan 23 2024, 05:07 PM Jan 23 2024, 05:07 PM

Return to original view | Post

#80

|

Senior Member

3,496 posts Joined: Jan 2003 |

KDI UI might be subpar, but KDI save you can withdraw faster, and can deposit amount to the sen (e.g., deposit RM699.69) SA Malaysia Simple withdraw slow, and can only deposit rounded to Ringgit. but SA Singapore Simple (open with passport) withdraw is as quick as KDI Save Ramjade liked this post

|

| Change to: |  0.1058sec 0.1058sec

0.42 0.42

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 01:22 AM |