QUOTE(Icehart @ Apr 1 2022, 08:49 PM)

Good for you.

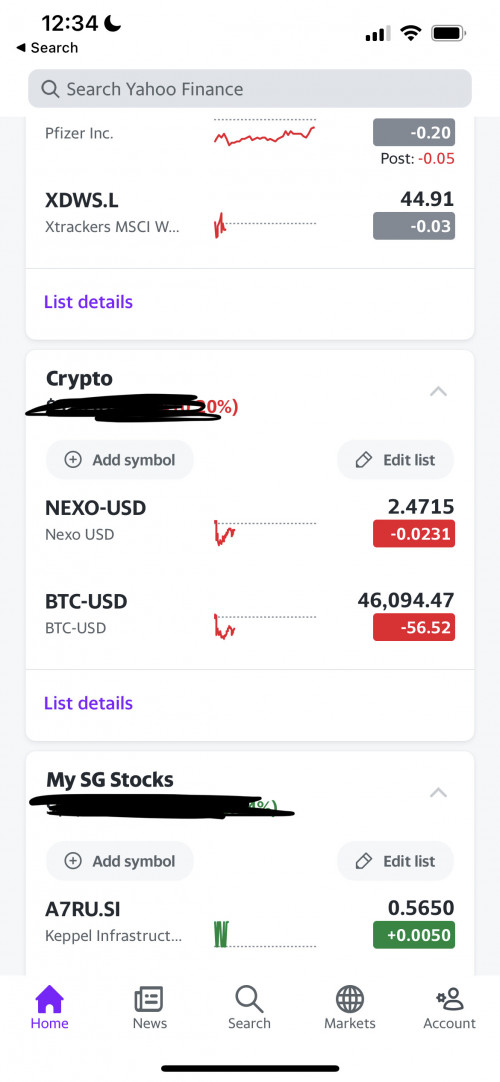

My original suggestion of stablecoins staking is not for investment, but rather for the purpose of emergency 6 months cash that can be withdrawn and used immediately, yet still enjoy relatively high APY.

Can you show me some articles on the danger of staking, just to see if I've missed anything.

Also if u compare with MMF funds, staking is dealing with volatility of crypto also.. when they lose value what you stake will lose value in its entirety. My original suggestion of stablecoins staking is not for investment, but rather for the purpose of emergency 6 months cash that can be withdrawn and used immediately, yet still enjoy relatively high APY.

Can you show me some articles on the danger of staking, just to see if I've missed anything.

Other dangers listed in articles such as these. So yes once again much higher risk. Stablecoins sure less volatility, what if the crypto get stolen like so many news we heard getting hacked etc?

https://trustwallet.com/blog/top-7-risks-of-staking-crypto

An article about stablecoins. Threats from regulators and its long term sustainability:

https://www.france24.com/en/technology/2022...-global-markets

This post has been edited by Davidtcf: Apr 1 2022, 09:47 PM

Apr 1 2022, 09:37 PM

Apr 1 2022, 09:37 PM

Quote

Quote

0.0375sec

0.0375sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled