I help u summarise, AA last time

confident, so start to buy a lot of planes, then rent the planes to its own compannies within the Group. But core earnings from its flying business was still low. Resulting in AA showing high growth n earnings when the core business is not growing tat fast.

During tat time, everyone happpy, bankers get to do IPO, the AA group show nice profits, shareholderrs happy cos AA share price went up.

Not forgetting that it was due to accounting treatment rather than true business growth that make everyone happy, now the down time takes all the 'happy happy' time away edi..

Sorry I would not use the word 'confident'. I would consider it as reckless.

But if wanna a summary... post

otherwise you can read the detailed summary inside...

Tracing how AirAsia got where it is today....

1. I recall that record breaking deal with AirBus... (google search boleh!)

https://www.bbc.com/news/business-13884433That happened on June 2011.

QUOTE

Malaysia's low-cost carrier AirAsia is buying 200 of the A320neo jets, in a deal worth about $18bn (£11bn).

and this statement...

QUOTE

Altogether, AirAsia has now placed firm orders for 375 aircraft from the A320 family, with 89 already in service.

So AA had an order of 175 planes. AirBus supplied 89. So company has a backorder of planes not yet supplied 86 planes (worth 19 billion) but it goes on a record buying spree of 200 new planes worth 58 Billion ringgit (based on exchange rate then)(If this is not excessive, what is?)

2. I then checked on the QR report before June 2011.

https://www.malaysiastock.biz/GetReport.asp...t_1Q%202011.pdfCash balances then 1.8 Billion...

Total debts then 7.8 Billion! (from page 27. Previous debt the previous year same period is 7.1 Billion. Ballooning debt issue!)

Capital commitment to buy those 86 planes remaining is 19 billion.

3. I remember AirAsia before this, had problems taking delivery of new planes. They had to asked AirBus to defer delivery of new planes. (go search 'Airasia defer plane delivery)

https://www.thestar.com.my/business/busines...partly-deferredQUOTE

AirAsia became the largest customer of the Airbus A320-200 in December 2007 after it placed a firm order for a total of 175 aircraft, with an option for 50 more. Deliveries are expected to run until 2014. For 2010 and 2011, the airline is slated to take delivery of 24 aircraft each year.

Now putting the pieces together....

AirAsia went on a plane buying spree. Ignoring the fact that it's core cash flow balance had always be weak.

In 2007, buy 175 new planes....

In 2009... choking already... no money... (2009 account showed 700 million in cash and over 7 biillion in loans. How to complete delivery for 19 billion worth of new planes?) So it had to ask AirBus to defer delivery (which is a good thing to do)

By 2011.. cash balance did improved to 1.8 billion but debts remain high at 7.8 Billion.

But in 2011... it went bonkers and ordered another 58 billion new planes (source of problem? Overbuying of new planes... exploding debts?)

But this is where the damning thing is... as we now learned.... AirBus USD50 million bribery scandal with AirAsia happened in 2012!!!!

The year AFTER AirAsia made the insane 58 billion new plane order!!!In 2015.. the news of the massive Sale and leaseback of planes started....

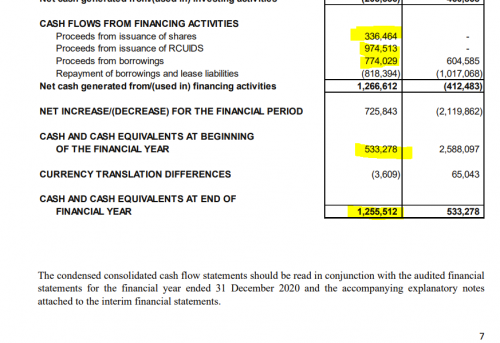

https://www.todayonline.com/business/airasi...lise-operationsIn Nov 2016. Cash balances 1.5 Billion. Total debts 10.3 Billion. Plane backorder is now worth 91 billion!

https://www.malaysiastock.biz/GetReport.asp...32016_24Nov.pdfIn Jan 2017. Completes 1 billion special special ownself share placement to boss 1 and boss 2..

https://www.theedgemarkets.com/article/aira...-shareholders-0In March 2018. The sale and lease back started....

https://www.reuters.com/article/us-airasia-...t-idUSKCN1GD3VPIn 2018 AirAsia started to pay huge chunk of dividends. Note how the company, which was weak financially, started paying interim dividends in 2017, right after that special special ownself share placement to boss 1 and boss 2.

the numbers and the dates are all there........

And here we are ... 2020.... company is asking for bailout? ( Isn't it crystal clear the company management farked up?) It was choking in debts, it had to the sale and leaseback of planes to ease the debt. But instead of prudently handling the money, AirAsia went on a frenzy and started throwing money back to its shareholders!

So assume AA gets the 2 billion it is asking for.... okay.... no problem...

but we have to address the issue of what next?

Why?

The core fundamental weakness of the company will still remain... which at is... the company simply has way too many planes on back order. Cos once this virus blows over and AirAsia somehow survive, AirAsia will soon have to start take delivery of new planes....

which means....ahem.... new financing!!!

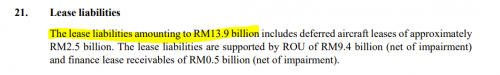

which will also means.... either the leasing amount, which as of today, is at 12 Billion, will balloon much higher...

or else.... the company will have to take on new debts.

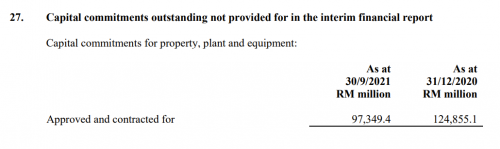

Remember backorder of new planes is over 110 billion!!!!

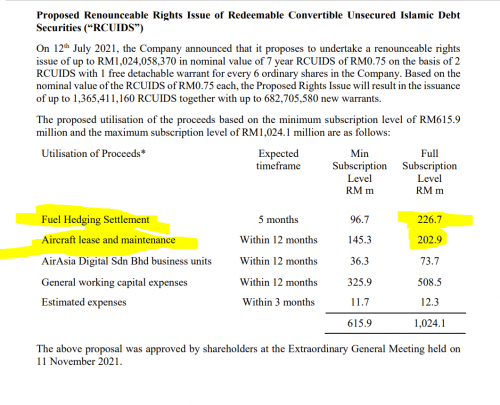

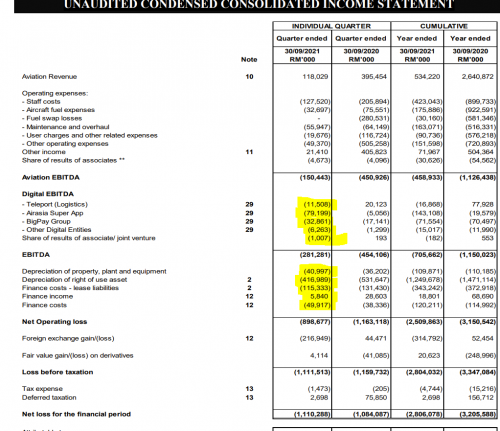

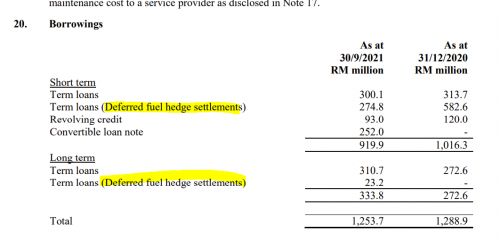

and then we have the issue of their aggressive hedging... in 2009 kena 640 million in hedges... and now 2020, will total hedging losses runs over a billion?

and then in future? How? Can we be assured that in the future, AirAsia would not be hit with another multi million dollar hedging losses once more?

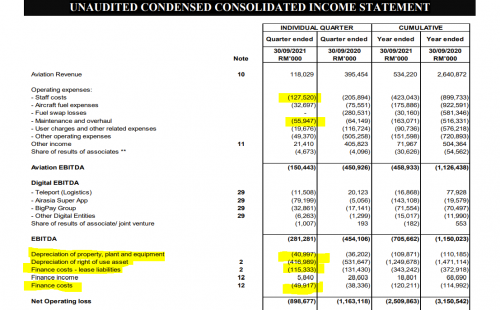

Remember the recent interview... "Right now, we’re trading cash flow positive if you take out the leasing and

some fuel hedging that we thought we did a good hedge." where he stubbornly reckons he did a good job!

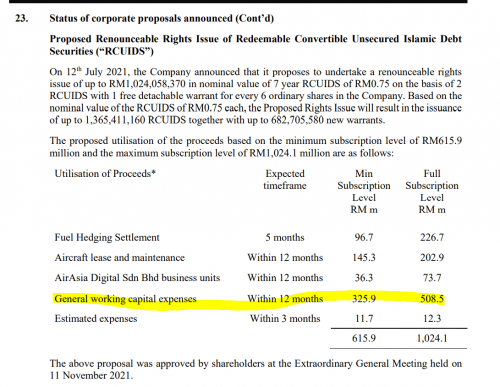

And the thing about the rights issue.... if AirAsia refuses to do one... clearly it means the boss 1 and boss 2 is refusing to put in own money when the company is in dire straits...

Dec 1 2021, 11:13 AM, updated 5y ago

Dec 1 2021, 11:13 AM, updated 5y ago

Quote

Quote

0.0665sec

0.0665sec

0.40

0.40

6 queries

6 queries

GZIP Disabled

GZIP Disabled