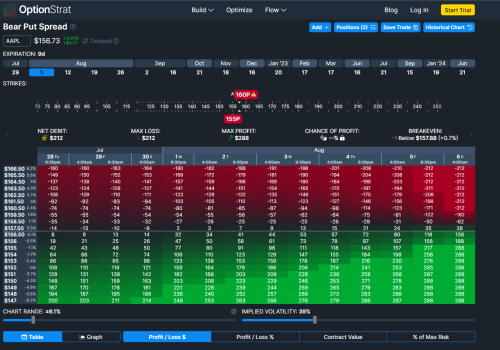

From the video. He mentioned that Bear Put Spreads > Naked Puts. Where he explained that Spreads has more advantage ( Lesser cost, less impact from IV crush, and less impact from Time Decay) while you lose your maximum profit (Max Profit got capped). I see how he use Option Strat to estimate what is the max profit he can made using Spreads.

But since you're not owning a 100 shares nor you have enough $$ to buy 100 shares (Naked Puts), I wonder if IBKR will recognize this type of "synthetic spreads"? And usually for spreads, you need to close both legs before expiry?

Jul 26 2022, 10:39 PM

Jul 26 2022, 10:39 PM

Quote

Quote

0.5098sec

0.5098sec

1.02

1.02

6 queries

6 queries

GZIP Disabled

GZIP Disabled