QUOTE(Lon3Rang3r00 @ Jun 4 2022, 10:58 PM)

I have a few questions For PMCC

PMCC = which you are Buying a LONG deep ITM Call with around 180 DTE. Then selling a SHORT OTM Call with DTE <60 or whichever DTE you feel good about it.

Let's take AMD for example, Reference: AMD inc Yahoo Options Chart

- Buy Long Calls with the strike price $90 expiry on 16-December with the premium of $26.16.

- Sell Short Calls against it with the strike price of $120 expiry on 19-August with the premium of $5.75.

Questions:-

1) The total amount that I need to pay for the Buying the Long Call is $2616. Can i assume the breakeven price for this options excluded the Selling Calls is $116.16? (26.16+90.00). Meaning if AMD rises above $130, I'll be making profit if i exercised the call options anytime before Expiry and sell it immediately? (Provided i have the upfront cash to buy the entire share at $9000)

2) After i sell the calls for $575, my total cost for this PMCC is $2051. Next is to wait till 19-August, if it expired worthless then only i can sell another calls?

2a) What if the Short Call got exercised? Since I'm using IBKR, does the initial Long Call exercised automatically? or IBKR will treated as "Naked Calls" and ask me to cough out 100 AMD shares?

2b) If the short call got exercised, how much did i lost in total?

3) If i don't have enough cash to exercise the long call (buying the 100 shares before the long call expired), I'll have to sell a short calls to ensure it got called away before the expiry date?

Still a toddler here

Still a toddler here

enter it in ibkr, and it will show a p/l chart for you... you can also use many other options calculators on the web to visualize the tradePMCC = which you are Buying a LONG deep ITM Call with around 180 DTE. Then selling a SHORT OTM Call with DTE <60 or whichever DTE you feel good about it.

Let's take AMD for example, Reference: AMD inc Yahoo Options Chart

- Buy Long Calls with the strike price $90 expiry on 16-December with the premium of $26.16.

- Sell Short Calls against it with the strike price of $120 expiry on 19-August with the premium of $5.75.

Questions:-

1) The total amount that I need to pay for the Buying the Long Call is $2616. Can i assume the breakeven price for this options excluded the Selling Calls is $116.16? (26.16+90.00). Meaning if AMD rises above $130, I'll be making profit if i exercised the call options anytime before Expiry and sell it immediately? (Provided i have the upfront cash to buy the entire share at $9000)

2) After i sell the calls for $575, my total cost for this PMCC is $2051. Next is to wait till 19-August, if it expired worthless then only i can sell another calls?

2a) What if the Short Call got exercised? Since I'm using IBKR, does the initial Long Call exercised automatically? or IBKR will treated as "Naked Calls" and ask me to cough out 100 AMD shares?

2b) If the short call got exercised, how much did i lost in total?

3) If i don't have enough cash to exercise the long call (buying the 100 shares before the long call expired), I'll have to sell a short calls to ensure it got called away before the expiry date?

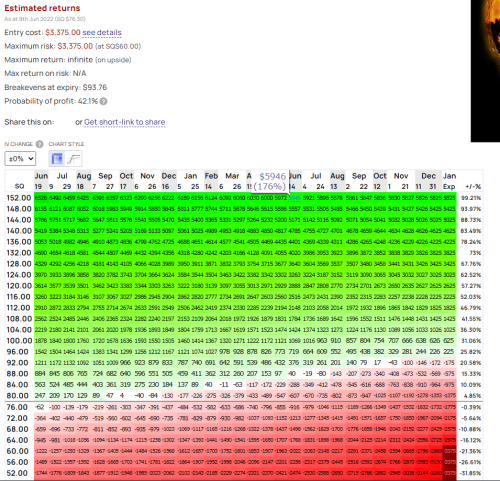

your bull call diagonal debit spread... is most profitable at 120 strike at expiry... and you want prices around here for both legs... lol... manage your trade based on this p/l chart... don't simply trade without proper understanding, your short calls shouldn't be naked unless it's deeply otm... but you'll need to manage your long call too...

practice paper trading first lah... anyways have fun...

This post has been edited by dwRK: Jun 5 2022, 10:31 AM

Jun 5 2022, 08:57 AM

Jun 5 2022, 08:57 AM

Quote

Quote

0.0374sec

0.0374sec

0.94

0.94

7 queries

7 queries

GZIP Disabled

GZIP Disabled