Outline ·

[ Standard ] ·

Linear+

Moomoo trading platform review

|

Medufsaid

|

Jul 14 2024, 08:43 PM Jul 14 2024, 08:43 PM

|

|

QUOTE(markedestiny @ Jul 14 2024, 08:26 PM) quickly fund your SG account for the Welcome Reward which has been extended until 23/7/24. yes... good rewards https://www.moomoo.com/sg/support/topic5_128 QUOTE - Reward 2

(i) Receive 1 x Stock Bundle#: AAPL,NVDA, TSLA, SE, NIO (worth S$70) - Reward 3

(i) Receive 3 x Stock Bundle#: AAPL, NVDA, TSLA, SE, NIO (worth S$210)

QUOTE - 70/S$3,000x12 wait 30d

28% pa - 210/S$10,000x4 wait 90d

8.4% pa

haven't even factor in moomoo SGD cash fund of 3.5%pa This post has been edited by Medufsaid: Jul 14 2024, 08:45 PM |

|

|

|

|

|

Medufsaid

|

Jul 16 2024, 01:06 PM Jul 16 2024, 01:06 PM

|

|

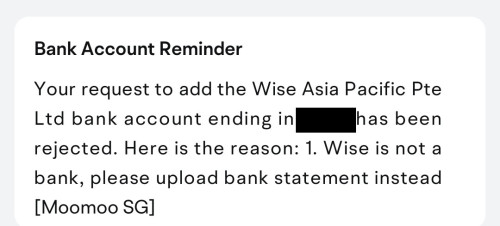

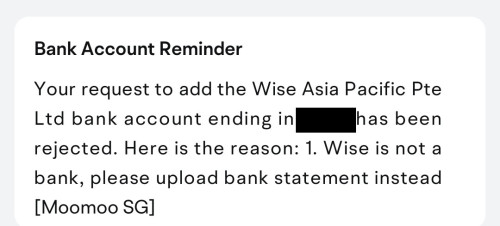

apowerfulskill deposit - wise

- singapore bank account

withdrawal - singapore bank acct only available

|

|

|

|

|

|

Medufsaid

|

Jul 16 2024, 02:34 PM Jul 16 2024, 02:34 PM

|

|

ssiapf if already cash-settled/or just deposited, is near instant.

bottleneck is waiting for it to settle after selling stock

This post has been edited by Medufsaid: Jul 16 2024, 02:35 PM

|

|

|

|

|

|

Medufsaid

|

Jul 17 2024, 06:25 PM Jul 17 2024, 06:25 PM

|

|

QUOTE(ssiapf @ Jul 17 2024, 05:26 PM) Why did I get a deduct rm16 I am new user? malaysian stamp duty of RM1 per RM1 to RM1,000 invested. So if you invest RM9000.01-RM10,000 you have RM10 stamp duty. So u find out the rate for clearing fee. Commission by moomoo is fixed |

|

|

|

|

|

Medufsaid

|

Jul 17 2024, 09:37 PM Jul 17 2024, 09:37 PM

|

|

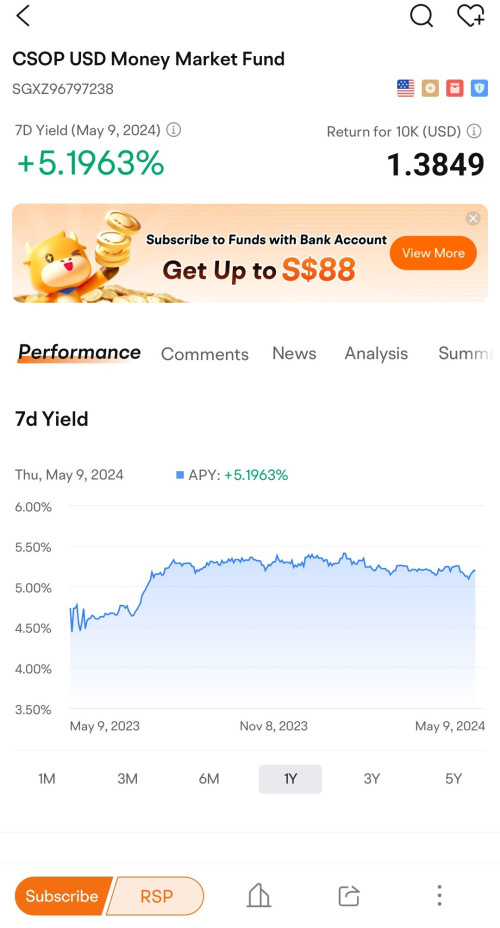

not as good as the moomoo SG one QUOTE(Medufsaid @ May 9 2024, 08:36 PM) |

|

|

|

|

|

Medufsaid

|

Jul 20 2024, 04:02 PM Jul 20 2024, 04:02 PM

|

|

probably an issue with the Maybank MMF. i tried the other MYR MMF no issues withdrawing |

|

|

|

|

|

Medufsaid

|

Jul 21 2024, 10:02 AM Jul 21 2024, 10:02 AM

|

|

spf referring to Moomoo SG withdrawal?

|

|

|

|

|

|

Medufsaid

|

Jul 21 2024, 11:20 AM Jul 21 2024, 11:20 AM

|

|

cweng93 very simple to decide, if your $1 is used to buy and hold an ETF for 10 years, deposit it to Moomoo MY if you are using that $1 to do multiple short term trades, best put into SG QUOTE(cweng93 @ Jul 21 2024, 11:16 AM) cuz the rate is better but then its kinda hassle since u have to convert to SGD moomoo sg's SGD->USD conversion is not cheap. No IBKR miracle here This post has been edited by Medufsaid: Jul 21 2024, 12:31 PM

|

|

|

|

|

|

Medufsaid

|

Jul 22 2024, 11:47 PM Jul 22 2024, 11:47 PM

|

|

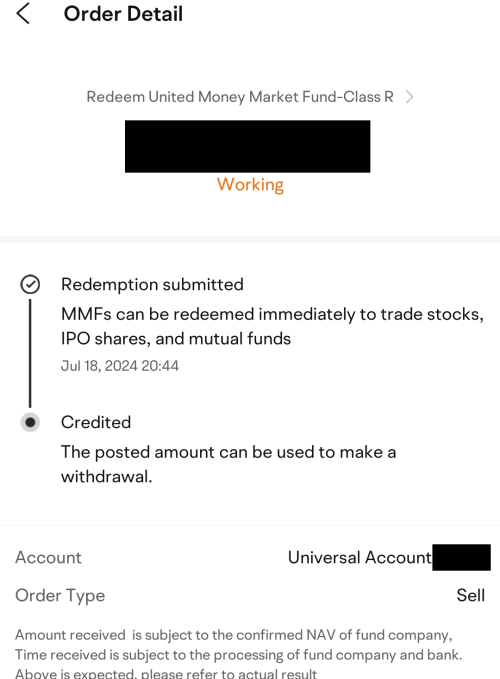

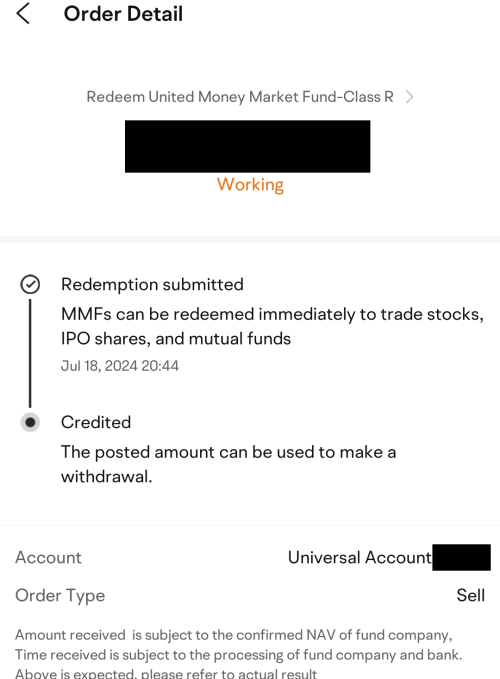

ericlaiys T+1 confirmed, as long as before cutoff time (as opposed to KDI save T+0)

note: this is not the Maybank MMF one

This post has been edited by Medufsaid: Jul 22 2024, 11:49 PM

|

|

|

|

|

|

Medufsaid

|

Jul 23 2024, 12:32 PM Jul 23 2024, 12:32 PM

|

|

QUOTE(togekiss @ Jul 23 2024, 09:41 AM) after depositing RM30k, it seems like you're already buying for the nvidia share. lol different risk exposure you buy shares, shares can go to zero. RM30k put aside buy 1 share (assume 1 NVDA is RM500), worst case scenario becomes $0 so RM29.5k RM30k put aside wait for rewards, worst case scenario unchanged at RM30k |

|

|

|

|

|

Medufsaid

|

Jul 30 2024, 02:26 PM Jul 30 2024, 02:26 PM

|

|

well you forgot all about the platform fee and commission fee in moomoo (against ibkr)

This post has been edited by Medufsaid: Jul 30 2024, 02:30 PM

|

|

|

|

|

|

Medufsaid

|

Jul 30 2024, 02:58 PM Jul 30 2024, 02:58 PM

|

|

no LSE etfs on moomoo, if u actually did trade in moomoo you've known that. and to reduce LSE costs follow my strategy here QUOTE(Medufsaid @ May 31 2024, 08:23 AM) » Click to show Spoiler - click again to hide... « my strategy is to buy USA etfs using recurring investment, then once a year, liquidate that ETF and buy CSPX | Month | Action | Fees | | Jan | buy USA etf | $0.35 | | Feb | buy USA etf | $0.35 | | Mar | buy USA etf | $0.35 + $0.34 (34 cents because your money in USA etf so additional 15% deduction) | | Apr | buy USA etf | $0.35 | | May | buy USA etf | $0.35 | | Jun | buy USA etf | $0.35 + $0.68 (you have twice as much money now) | | Jul | buy USA etf | $0.35 | | Aug | buy USA etf | $0.35 | | Sep | buy USA etf | $0.35 + $1.02 | | Oct | buy USA etf | $0.35 | | Nov | buy USA etf | $0.35 | | Dec | - buy USA etf

- sell USA etf & buy LSE etf (we'll do double work to utilise the free conversion fees of recurring investment)

| | | | Total fees | $8.50 |

buying purely LSE will cost you $20.40 yearly. the difference is only $11.90 or RM55.93 |

|

|

|

|

|

Medufsaid

|

Jul 31 2024, 12:10 PM Jul 31 2024, 12:10 PM

|

|

If you transfer <RM2,500 other methods like duitnow will win moneymatch. It's above that till RM30k or so where you see the savings on moneymatch

|

|

|

|

|

|

Medufsaid

|

Aug 6 2024, 11:06 PM Aug 6 2024, 11:06 PM

|

|

QUOTE(ericlaiys @ Aug 6 2024, 10:50 PM) they just cancel your buy/sell. u still got stock if u sell or money (if buy) it's messy if you buy something during overnight, then sell off in pre-market/normal hours. end up you have a naked short bcos the initial purchase is cancelled. so, popcorn time |

|

|

|

|

|

Medufsaid

|

Aug 7 2024, 01:22 PM Aug 7 2024, 01:22 PM

|

|

CommodoreAmiga no, Barricade is saying that malaysians can trade SGX from Moomoo Malaysia itself

|

|

|

|

|

|

Medufsaid

|

Aug 10 2024, 01:29 PM Aug 10 2024, 01:29 PM

|

|

I think can manually redeem and buy stocks immediately. That or someone need to ask helpdesk if there's any discrepancy QUOTE 2.1 Quick Redemption

Put your uninvested cash to work by investing in MMF, which can be redeemed immediately at any time for trading stocks, IPOs, and mutual funds. https://www.moomoo.com/my/support/topic9_25...%20loan%20limit. This post has been edited by Medufsaid: Aug 10 2024, 01:32 PM |

|

|

|

|

|

Medufsaid

|

Aug 16 2024, 10:24 AM Aug 16 2024, 10:24 AM

|

|

tropik you can only sell them 9:30pm-4am

IBKR also same limitation

|

|

|

|

|

|

Medufsaid

|

Aug 18 2024, 05:37 PM Aug 18 2024, 05:37 PM

|

|

QUOTE(poooky @ Aug 18 2024, 12:49 PM) Anyone calculate fees for buying us stocks. How much RM per transaction. Want to compare if worth it to buy rm500 per month through moomoo vs lump-sum ibkr every few months. Moomoo MY = $0.99+$0.42 IBKR $0.35 |

|

|

|

|

|

Medufsaid

|

Aug 23 2024, 09:04 PM Aug 23 2024, 09:04 PM

|

|

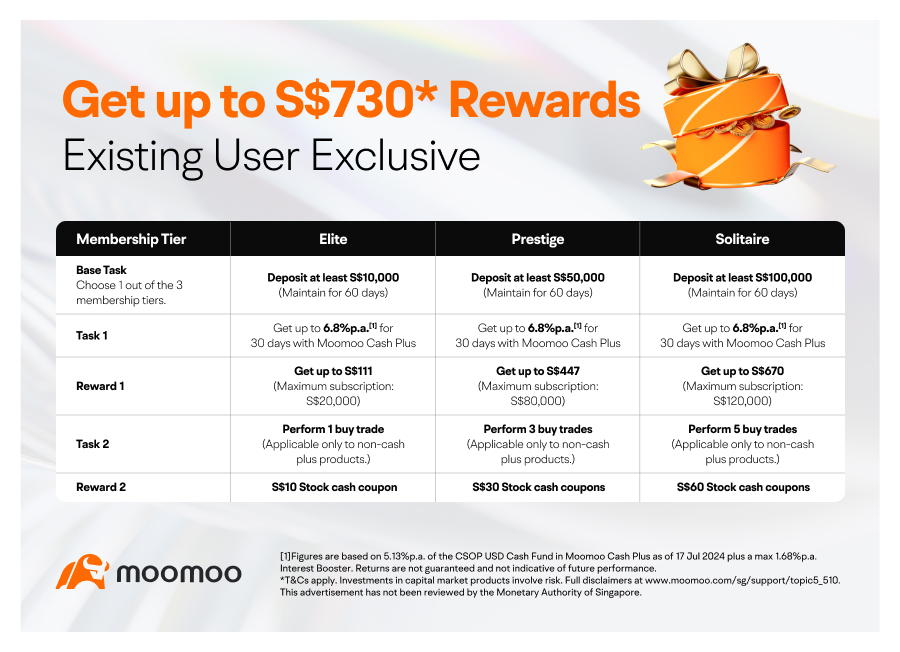

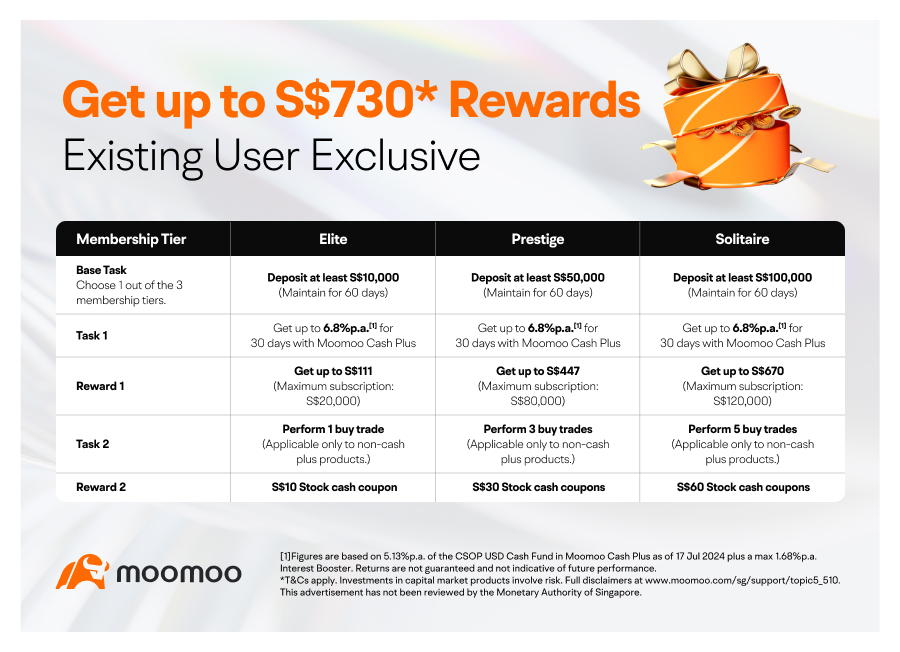

exclusive for existing moomoo SG users  QUOTE This event is only available to the existing clients of Moomoo Financial Singapore Pte. Ltd.

(Existing users who have previously made deposit of fresh fund of any amount into their Moomoo SG Universal account before 10:00PM SGT on 23/7/2024)

Each existing client is entitled to participate in this event once.

Moomoo Financial Singapore Pte. Ltd. reserves the right to change the eligibility criteria (eligible clients) for the event.

Existing users who have previously participated in the past existing user promotions are still eligible to participate in this promotion. This post has been edited by Medufsaid: Aug 23 2024, 09:05 PM |

|

|

|

|

|

Medufsaid

|

Sep 1 2024, 09:33 PM Sep 1 2024, 09:33 PM

|

|

adam1190 yup QUOTE(Medufsaid @ Apr 28 2024, 05:55 PM) rejected  actually the same thing for IBKR also. you can deposit from Wise to IBKR. you cannot directly withdraw from IBKR to Wise. it needs to go through local USA bank

|

|

|

|

|

Jul 14 2024, 08:43 PM

Jul 14 2024, 08:43 PM

Quote

Quote

0.0235sec

0.0235sec

0.72

0.72

7 queries

7 queries

GZIP Disabled

GZIP Disabled