QUOTE(Medufsaid @ Oct 25 2023, 02:05 PM)

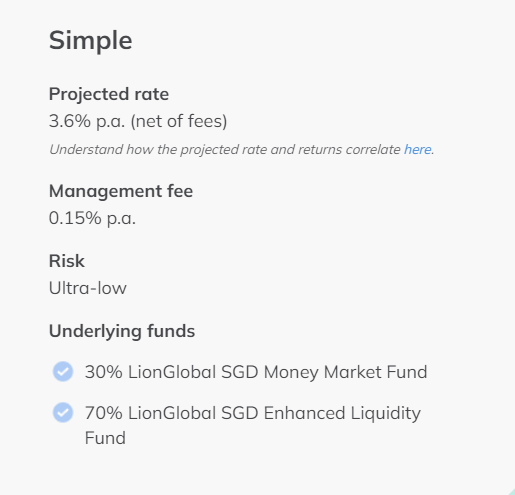

2 things:1. No SDIC guarantee. Technically those funds' underlying are only partially MAS Bills/T-bills, there are short-term commercial papers, MTNs/EMTNs etc.

2. Withdrawal is not as flexible as from within CIMB SG itself. CIMB's by itself a bank account, direct FAST to anywhere else in SG instantly. whereas SA Simple needs at least 2 business days for withdrawal.

SA Simple "Guaranteed" might be a bit more tempting, especially on the shorter-end tenure of 1-3 months.

Oct 25 2023, 02:14 PM

Oct 25 2023, 02:14 PM

Quote

Quote

0.0468sec

0.0468sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled