ARK Invest

|

|

Feb 7 2021, 12:27 AM Feb 7 2021, 12:27 AM

|

Junior Member

91 posts Joined: Jul 2015 |

Please watch this and give your opinion.

|

|

|

|

|

|

Feb 8 2021, 09:56 PM Feb 8 2021, 09:56 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

For those interested, Cathie Wood did an interview with Yahoo Finance:

https://finance.yahoo.com/video/ark-invests...-224355767.html |

|

|

Feb 9 2021, 09:52 AM Feb 9 2021, 09:52 AM

|

Senior Member

3,904 posts Joined: Jul 2007 |

anyone keen on getting ARK merchandise?

lets group buy to share the shopping cost? https://ark-invest.store/collections/full-catalog |

|

|

Feb 9 2021, 10:11 AM Feb 9 2021, 10:11 AM

|

Junior Member

531 posts Joined: Mar 2012 |

Not going to comment too much. I'm invested in the fund as well.

But the biggest argument against ARK is: If you compare the porfolios of Cathie Wood and a novice investor just starting, you wouldn't find a difference. TLDR: She lucked out. |

|

|

Feb 10 2021, 11:40 PM Feb 10 2021, 11:40 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

ARK is great at marketing but there are other active ETF's that are in the same range of performance.

YOLO ETF which has returned around 150% in a year or even the SoFi Gig Economy ETF which has returned around 120% in a year. https://advisorshares.com/etfs/yolo/ https://www.sofi.com/invest/etfs/gige/ These all are still short term returns and if you are concerned about tail risk then there is an ETF that caters to that: https://www.simplify.us/etfs/spd-simplify-u...e-convexity-etf  |

|

|

Feb 10 2021, 11:48 PM Feb 10 2021, 11:48 PM

Show posts by this member only | IPv6 | Post

#26

|

Senior Member

1,019 posts Joined: Sep 2018 |

QUOTE(toiletwater @ Feb 9 2021, 10:11 AM) Not going to comment too much. I'm invested in the fund as well. She bought TSMC just b4 the surge. Could b lucky but she must have her methods to see things that normal ppl dontBut the biggest argument against ARK is: If you compare the porfolios of Cathie Wood and a novice investor just starting, you wouldn't find a difference. TLDR: She lucked out. |

|

|

|

|

|

Feb 11 2021, 02:23 AM Feb 11 2021, 02:23 AM

|

Senior Member

2,379 posts Joined: Sep 2017 |

QUOTE(zacknistelrooy @ Feb 10 2021, 11:40 PM) ARK is great at marketing but there are other active ETF's that are in the same range of performance. ThanksYOLO ETF which has returned around 150% in a year or even the SoFi Gig Economy ETF which has returned around 120% in a year. https://advisorshares.com/etfs/yolo/ https://www.sofi.com/invest/etfs/gige/ These all are still short term returns and if you are concerned about tail risk then there is an ETF that caters to that: https://www.simplify.us/etfs/spd-simplify-u...e-convexity-etf  |

|

|

Feb 12 2021, 10:22 PM Feb 12 2021, 10:22 PM

Show posts by this member only | IPv6 | Post

#28

|

Junior Member

370 posts Joined: Jan 2017 |

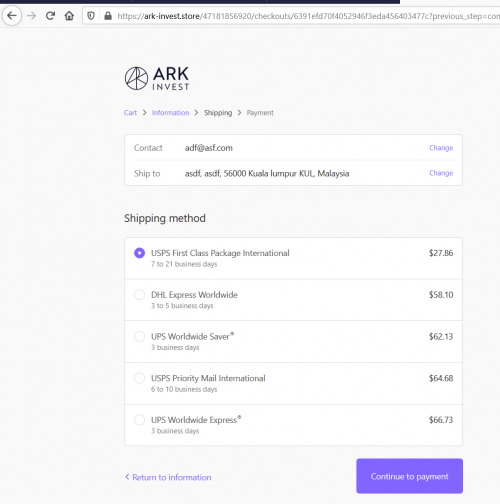

QUOTE(lamode @ Feb 9 2021, 09:52 AM) anyone keen on getting ARK merchandise? Can you tell us how much is the shipping cost and how long approximately it would take to ship? I'm interested. lets group buy to share the shopping cost? https://ark-invest.store/collections/full-catalog |

|

|

Feb 13 2021, 12:35 AM Feb 13 2021, 12:35 AM

|

Senior Member

3,904 posts Joined: Jul 2007 |

|

|

|

Feb 15 2021, 11:18 PM Feb 15 2021, 11:18 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

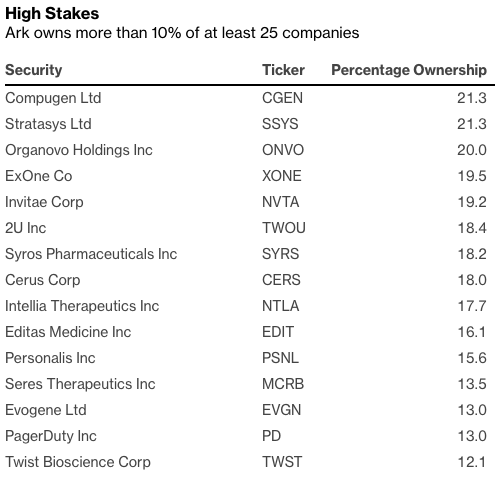

https://www.bloomberg.com/news/articles/202...t-enough-stocks

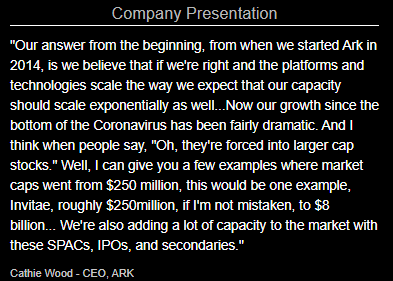

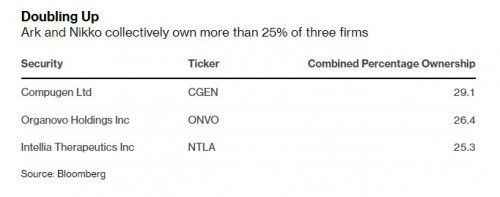

QUOTE As the cash continues to pour in, Ark already owns 10% or more of at least 24 companies, according to data compiled by Bloomberg. They include Invitae Corp., Cerus Corp., and CRISPR Therapeutics AG. High Stakes Ark owns more than 10% of at least 25 companies “There is risk with so much money flowing into so few,” said James Pillow, managing director at Moors & Cabot Inc. “When the flows stop, or worse yet reverse, one should expect a day of reckoning.” Two kinds of threats are looming, Peter Garnry of Saxo Bank wrote in a research note this week. The first is Ark’s potential impact on the market. The firm’s huge inflows over the past year have helped fuel a biotech boom, for instance. If assets start to flow out, it could undercut the sector. The second threat is from the market to Ark. A slide in the companies it is heavily exposed to could force the firm to sell in turn, starting a feedback loop, according to Garnry, Saxo’s head of equity strategy.  Ark's response to this issue:  |

|

|

Feb 16 2021, 02:39 PM Feb 16 2021, 02:39 PM

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(zacknistelrooy @ Feb 10 2021, 11:40 PM) ARK is great at marketing but there are other active ETF's that are in the same range of performance. This SPD fund does not seem to perform as expected (at least did not work during the pre-Nov 2020 draw down before election, and the GME drawdown last month)...or is it only performing during more extreme drawdowns...? YOLO ETF which has returned around 150% in a year or even the SoFi Gig Economy ETF which has returned around 120% in a year. https://advisorshares.com/etfs/yolo/ https://www.sofi.com/invest/etfs/gige/ These all are still short term returns and if you are concerned about tail risk then there is an ETF that caters to that: https://www.simplify.us/etfs/spd-simplify-u...e-convexity-etf  Generally, we are all attracted to the ARK(K,W,etc) due to the impressive returns. Are you expecting this fund to continue outperforming the market or not? I really like your balanced viewpoint regarding Cathie / ARK. Personally my viewpoint is nothing good lasts forever, everybody is right once in a while. So, I am only invested in medium to short term with ARKK and with limited exposure. |

|

|

Feb 21 2021, 12:57 AM Feb 21 2021, 12:57 AM

|

Senior Member

1,033 posts Joined: Dec 2009 |

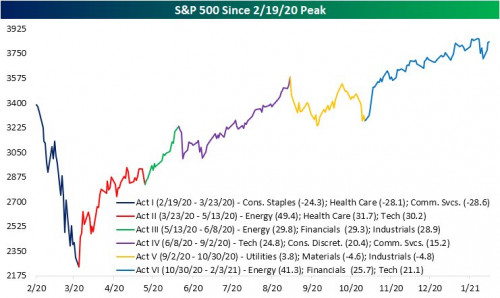

QUOTE(lee82gx @ Feb 16 2021, 02:39 PM) This SPD fund does not seem to perform as expected (at least did not work during the pre-Nov 2020 draw down before election, and the GME drawdown last month)...or is it only performing during more extreme drawdowns...? Meant to protect against extreme drawadowns and not garden variety 10% drawdowns.Generally, we are all attracted to the ARK(K,W,etc) due to the impressive returns. Are you expecting this fund to continue outperforming the market or not? I really like your balanced viewpoint regarding Cathie / ARK. Personally my viewpoint is nothing good lasts forever, everybody is right once in a while. So, I am only invested in medium to short term with ARKK and with limited exposure. Far out of the money put like below only worked during the March drawadown last year.  For Ark, it will last as long as current market dynamics last. For one, their AUM is ballooning quite rapidly and as Buffet says easier to compound with 1 million than 10 billion. On the market dynamics, lets take a look at Uber and Palantir. During Uber's IPO demand wasn't there and not many wanted it above 40 but fast forward two years on, people's minds have changed. Similar story for Palantir where they were struggling in the secondary market and now it is the talk of the town. Can't complain since I own Palantir but important to understand and plan ahead for changes in market dynamics. lee82gx liked this post

|

|

|

Feb 21 2021, 10:44 AM Feb 21 2021, 10:44 AM

Show posts by this member only | IPv6 | Post

#33

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(zacknistelrooy @ Feb 21 2021, 12:57 AM) Meant to protect against extreme drawadowns and not garden variety 10% drawdowns. What are your indicators for a change in market dynamics? A shift towards more stable valuations, ie lower demand for tech like uber / palantir? Or a weird unexplained black Swan? Far out of the money put like below only worked during the March drawadown last year.  For Ark, it will last as long as current market dynamics last. For one, their AUM is ballooning quite rapidly and as Buffet says easier to compound with 1 million than 10 billion. On the market dynamics, lets take a look at Uber and Palantir. During Uber's IPO demand wasn't there and not many wanted it above 40 but fast forward two years on, people's minds have changed. Similar story for Palantir where they were struggling in the secondary market and now it is the talk of the town. Can't complain since I own Palantir but important to understand and plan ahead for changes in market dynamics. What will your response be, importantly? I suppose I'm asking you to Crystal ball haha. |

|

|

|

|

|

Feb 26 2021, 12:26 AM Feb 26 2021, 12:26 AM

|

Senior Member

1,033 posts Joined: Dec 2009 |

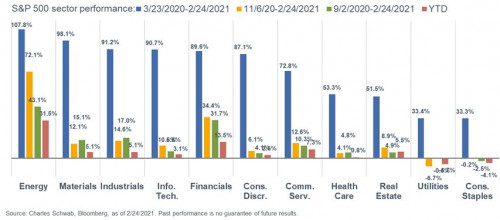

QUOTE(lee82gx @ Feb 21 2021, 10:44 AM) What are your indicators for a change in market dynamics? A shift towards more stable valuations, ie lower demand for tech like uber / palantir? Or a weird unexplained black Swan? Will leave valuations to a side for now because is a subjective thing and I am a believer of what Jim Grant once said.What will your response be, importantly? I suppose I'm asking you to Crystal ball haha. QUOTE To suppose that the value of a common stock is determined by a corporation's earnings discounted by the relevant interest rate and adjusted for the marginal tax rate is to forget that people have burned witches, gone to war on a whim, risen to the defense of Joseph Stalin, and believed Orson Welles when he told them over the radio that the Martians had landed. Will touch on overall sectors instead of individual stocks because when I mention FCX which is one of the largest copper producers in the world up 500% from March bottom then someone else will tell me Pintrest is also up that amount. Stock picking still works.... Overall the tech index has actually performed in line with the materials sector from March last year and for all the buzz for me at least, it isn't good enough when large cap tech is underperforming.  So what am I monitoring right now. First the rotation has to keep continuing like below:  Second, bond yields around the world need to calm down. Third and lastly something to be cautious about is the reflation trade which has actually been building since November but only now the media is pushing it. Don't want to see those sectors climb at a steep rate of change but rather slowly. Marriott close to an all time high even before things fully come back makes me cautious for now. This post has been edited by zacknistelrooy: Feb 26 2021, 12:28 AM ChAOoz liked this post

|

|

|

Feb 27 2021, 08:30 PM Feb 27 2021, 08:30 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

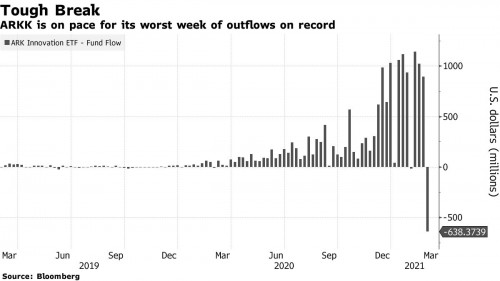

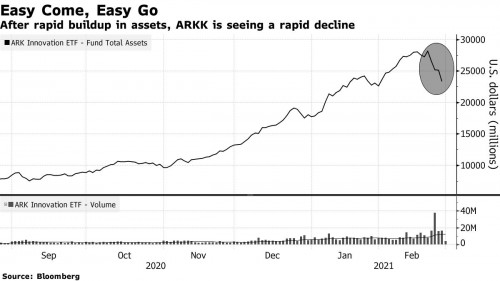

https://www.bloomberg.com/news/articles/202...lion-asset-drop

QUOTE Assets in the ETF have slumped by $4.9 billion this week to $23.3 billion, according to data compiled by Bloomberg. The figure doesn’t include flows from Thursday, when ARKK dropped 6.4% for its worst day in almost six months. Investors pulled about $200 million from the fund in Wednesday trading. That brings total weekly outflows to $638 million, on pace to be the worst on record. “Money that is ‘easy come’ tends to be money that is ‘easy go’,” said Ben Johnson, Morningstar’s global director of ETF research. “You’re going to see similar, if not potentially greater, market impact on the way down, especially given that this is an actively managed ETF and a fully transparent one. The market is hanging on their every move, they’re watching their every move.” What's moving markets Start your day with the 5 Things newsletter. By submitting my information, I agree to the Privacy Policy and Terms of Service and to receive offers and promotions from Bloomberg. Bearish bets against the ETF continue to grow, with short interest now accounting for more than 4% of available shares, according to data from IHS Markit Ltd.   |

|

|

Mar 5 2021, 08:08 PM Mar 5 2021, 08:08 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

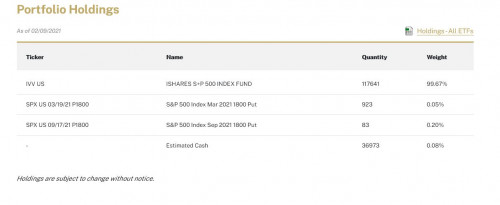

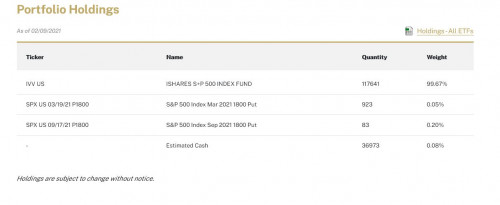

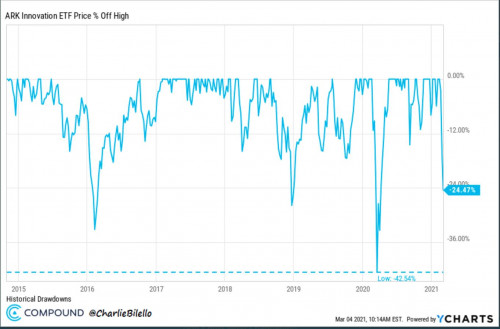

Have to give ARK credit that they are actually following through with their idea of selling highly liquid large cap assets to buy small cap assets. Sold Facebook, Amazon, Paypal and TSM among others. Don't agree with this move since valuations are much move down to earth in those names compared to the small and mid cap names but lets see if this experiment works out. Price of entry into the ARK universe  yklooi liked this post

|

|

|

Mar 6 2021, 12:12 AM Mar 6 2021, 12:12 AM

|

Senior Member

1,042 posts Joined: Jan 2003 |

Topped up ikan bilis amount... time to go hibernate again for me

|

|

|

Mar 6 2021, 01:28 AM Mar 6 2021, 01:28 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Mar 6 2021, 01:30 AM Mar 6 2021, 01:30 AM

Show posts by this member only | IPv6 | Post

#39

|

Junior Member

826 posts Joined: Mar 2008 |

QUOTE(zacknistelrooy @ Mar 5 2021, 08:08 PM) Have to give ARK credit that they are actually following through with their idea of selling highly liquid large cap assets to buy small cap assets. This strategy is something new especially for hedge fund. Really interesting to watch.Sold Facebook, Amazon, Paypal and TSM among others. Don't agree with this move since valuations are much move down to earth in those names compared to the small and mid cap names but lets see if this experiment works out. Price of entry into the ARK universe  |

|

|

Mar 7 2021, 08:44 PM Mar 7 2021, 08:44 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

QUOTE(Raymond_ACCA @ Mar 6 2021, 01:30 AM) It wouldn't surprise me that there are those that employ a similar strategy but it is something that shouldn't be publicly announced because it puts a target on your back especially with low liquidity stocks. Those who have traded low liquidity stocks know the slippage issues among the many issues that come with that territory.Sure that she doesn't handle buys and sells and only focuses on allocation but she is a really an experienced PM and has tons of experience through different cycles and this doesn't seem like prudent risk management. Either way, it is either going to be a spectacular success or the other way around. Don't see just ending quietly/sideways.  Another issue is the increase likelihood of dispersion trading with ARK ETF's. They are all moving in lockstep and even with another ETF from Sofi. Wasn't really a big issue previously when the AUM increases weren't that aggressive but has picked up quite considerably since November.  This post has been edited by zacknistelrooy: Mar 7 2021, 08:47 PM |

| Change to: |  0.0293sec 0.0293sec

0.91 0.91

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 10:56 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote