QUOTE(yklooi @ Feb 4 2021, 07:15 PM)

i got this from.....

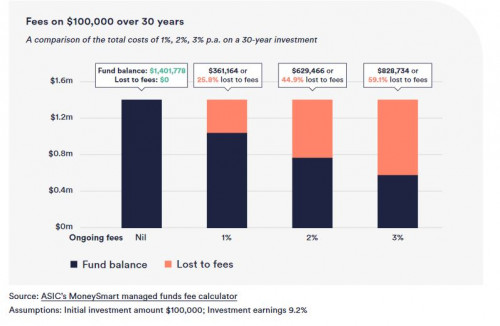

Managed funds fee calculator

How fees and costs will affect your investment

https://moneysmart.gov.au/managed-funds-and...-fee-calculatorjust not sure if my assumption are correct....

If you are only taking into account the one time contribution/sales charge then the calculation is correct.

Haven't taken into account the yearly management fee and once that is taken into account the numbers match.

QUOTE(ChAOoz @ Feb 4 2021, 07:38 PM)

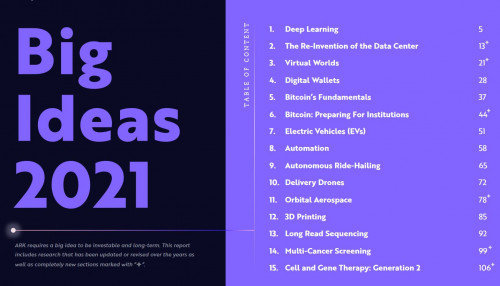

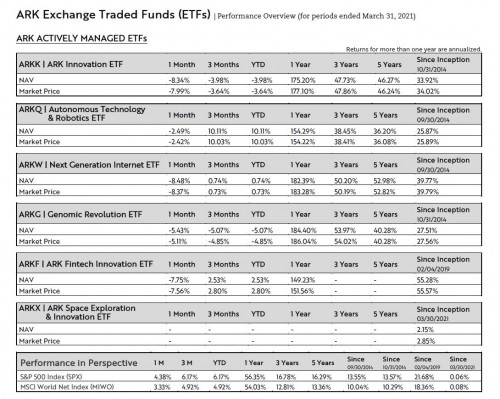

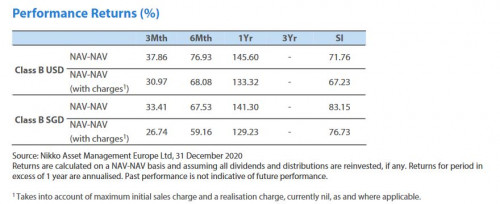

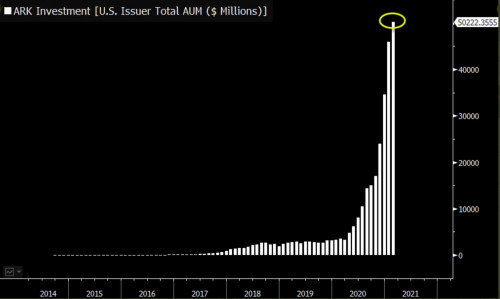

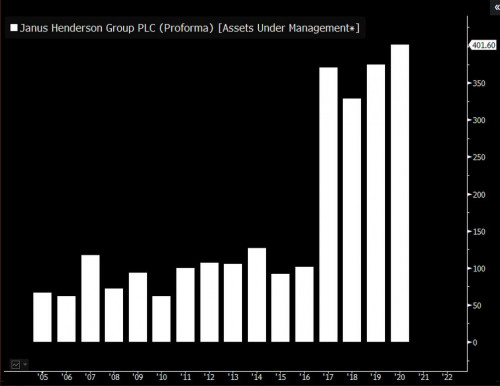

When you compare Janus twenty and ARKK side by side, you will realized it is in a pretty dangerous valuation now. Past performance may not equate to future results. If Ark doesn't regress to mean, maybe she will achieve legend status.

Also just goes to show us how awesome buffet really is.

It would be hypocritical for me to say anything about her strategies or the valuations because I employ the same strategies. She is a great investment manager for the current climate but only time will tell if she can compete with the other greats.

As long as you know the risk and know how to hedge then I personally don't see an issue with these strategies.

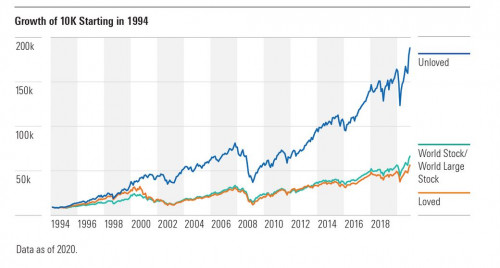

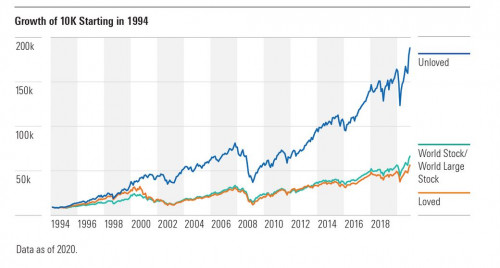

There is always a strategy for everyone out there like below for those who don't want to employ chasing high flying funds.

https://www.morningstar.com/articles/101986...1-funds-edition

QUOTE

Conclusion

Buy the Unloved isn't a total portfolio investing strategy, and it does not work 100% of the time. While outflows do not directly affect or indicate valuations, the data can point us toward areas of the market that have been beaten down or are unpopular and that may be ripe for recovery. It's also important to consider the contrary case at a time when our own biases may push us toward high-flying funds that may be reaching a tipping point.

Feb 3 2021, 10:05 PM, updated 5y ago

Feb 3 2021, 10:05 PM, updated 5y ago

Quote

Quote

0.0283sec

0.0283sec

0.57

0.57

6 queries

6 queries

GZIP Disabled

GZIP Disabled