QUOTE(zacknistelrooy @ Feb 10 2021, 11:40 PM)

ARK is great at marketing but there are other active ETF's that are in the same range of performance.

YOLO ETF which has returned around 150% in a year or even the SoFi Gig Economy ETF which has returned around 120% in a year.

https://advisorshares.com/etfs/yolo/

https://www.sofi.com/invest/etfs/gige/

These all are still short term returns and if you are concerned about tail risk then there is an ETF that caters to that:

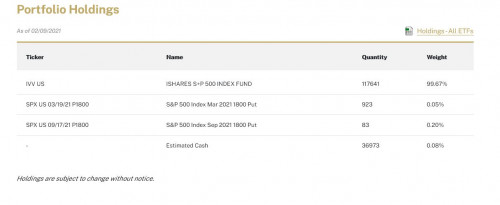

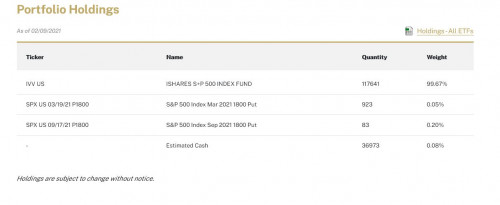

https://www.simplify.us/etfs/spd-simplify-u...e-convexity-etf

This SPD fund does not seem to perform as expected (at least did not work during the pre-Nov 2020 draw down before election, and the GME drawdown last month)...or is it only performing during more extreme drawdowns...? YOLO ETF which has returned around 150% in a year or even the SoFi Gig Economy ETF which has returned around 120% in a year.

https://advisorshares.com/etfs/yolo/

https://www.sofi.com/invest/etfs/gige/

These all are still short term returns and if you are concerned about tail risk then there is an ETF that caters to that:

https://www.simplify.us/etfs/spd-simplify-u...e-convexity-etf

Generally, we are all attracted to the ARK(K,W,etc) due to the impressive returns. Are you expecting this fund to continue outperforming the market or not?

I really like your balanced viewpoint regarding Cathie / ARK.

Personally my viewpoint is nothing good lasts forever, everybody is right once in a while. So, I am only invested in medium to short term with ARKK and with limited exposure.

Feb 16 2021, 02:39 PM

Feb 16 2021, 02:39 PM

Quote

Quote

0.0171sec

0.0171sec

0.13

0.13

7 queries

7 queries

GZIP Disabled

GZIP Disabled