|

abcn1n

|

Feb 4 2021, 08:47 PM Feb 4 2021, 08:47 PM

|

|

QUOTE(yklooi @ Feb 4 2021, 07:15 PM) i got this from..... Managed funds fee calculator How fees and costs will affect your investment https://moneysmart.gov.au/managed-funds-and...-fee-calculatorjust not sure if my assumption are correct.... Investment earnings of 9.2%. I guess that's the fund p.a return before minusing the contribution fee right? |

|

|

|

|

|

abcn1n

|

Feb 5 2021, 12:32 AM Feb 5 2021, 12:32 AM

|

|

QUOTE(yklooi @ Feb 4 2021, 09:04 PM) investment sum 100 000 duration 30 yrs ROI 9.2% sales charge 1%, 2%, 3% are all from earlier postings....just that the impact of the sales charges on the total sum are not that great a percentage as per the earlier postings also, the sales charges amount if amortized it over a 30 yrs periods will be very significant (or just very little) Thanks |

|

|

|

|

|

abcn1n

|

Feb 11 2021, 02:23 AM Feb 11 2021, 02:23 AM

|

|

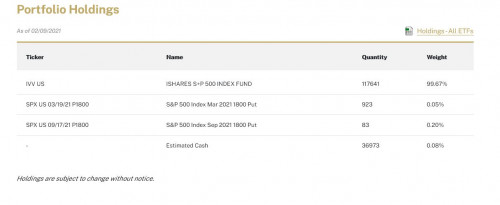

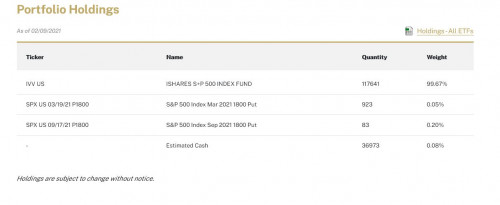

QUOTE(zacknistelrooy @ Feb 10 2021, 11:40 PM) ARK is great at marketing but there are other active ETF's that are in the same range of performance. YOLO ETF which has returned around 150% in a year or even the SoFi Gig Economy ETF which has returned around 120% in a year. https://advisorshares.com/etfs/yolo/https://www.sofi.com/invest/etfs/gige/These all are still short term returns and if you are concerned about tail risk then there is an ETF that caters to that: https://www.simplify.us/etfs/spd-simplify-u...e-convexity-etf Thanks |

|

|

|

|

Feb 4 2021, 08:47 PM

Feb 4 2021, 08:47 PM

Quote

Quote

0.0172sec

0.0172sec

1.56

1.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled