QUOTE(shahrul09 @ Mar 27 2021, 10:19 PM)

is there a differences in premium term that I need to pay for those 2 type?

afaik investment link premium term should be shorter right like 10-20y and the investment acc will cover up after that?

but not so sure about the non investment linked, do I need to keep paying the premium for the whole policy tenure?

and also is there increasement in premium for both product or only one type will increase every 5-10y?

in your opinion which product much better actually.

(yeah I need only life insurance coverage/income replacement etc, not much on investment but if the investment acc can sustain on its own after I retire and I don't have to pay anymore, that would be good also.)

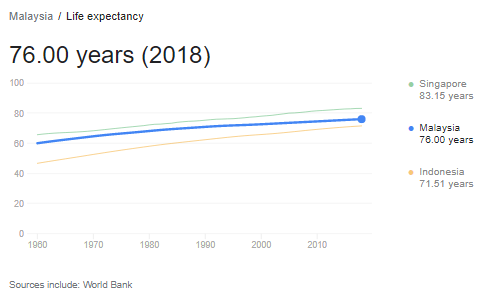

Investment linked policies do provide coverage up to the age of 100. However, you have the flexibility to decide when to terminate the life policy if you deem it's no longer beneficial for you.afaik investment link premium term should be shorter right like 10-20y and the investment acc will cover up after that?

but not so sure about the non investment linked, do I need to keep paying the premium for the whole policy tenure?

and also is there increasement in premium for both product or only one type will increase every 5-10y?

in your opinion which product much better actually.

(yeah I need only life insurance coverage/income replacement etc, not much on investment but if the investment acc can sustain on its own after I retire and I don't have to pay anymore, that would be good also.)

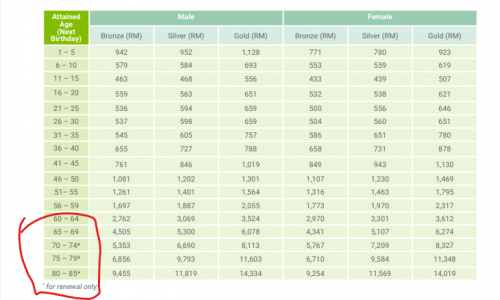

As for term insurance, they are renewable yearly, if you forget to make payment for it, it'll be terminated. Yes, the premium payable will be incremental as you grow older every year.

Sorry, there is really no such thing as "much better" product, the plan should be customized to your current/future need.

I normally consult and understand my clients first before any proposal is made.

This post has been edited by lifebalance: Mar 27 2021, 11:08 PM

Mar 27 2021, 10:31 PM

Mar 27 2021, 10:31 PM

Quote

Quote

0.2204sec

0.2204sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled