QUOTE(victorian @ Jun 11 2024, 05:38 PM)

I have no time to study the PDS for MY and SG policy, but here's some things to consider:

1. Based on previous posting, its already debunked that its not an apple to apple comparison. Even if you do not care about the cash value, the fact is it is there- even if you don't need it (the world does not revolve around you, remember?

)

Get two similar policies to compare then we will talk.

2. Assuming you did find another similar term policy without cash value, the plan will definitely be cheaper than 14k (say 10k vs 7k). Any margin that you have to play with previously is now getting slimmer.

3. Why did you assume that SG CI policies will be similar to MY CI policies? Have you considered the Claims procedure? You are residing in Malaysia, and if there are any Claims do you have to go down to SG frequently to make the claim/diagnosis?

4. Don't forget that you are a foreigner in SG eyes. If I am the insurer I would have scrutinized you when you submit your claim. Its a red flag that you came all the way to SG to purchase an insurance policy.

There are so many other stuff to point out, but I believe the four points above is enough to invalidate your claims. Don't be penny wise, pound foolish.

1. I only care about protection. Like I said insurance is money burned. I am sure such policy exist. I don't care about cash value cause it's more of marketing and make you pay more. I only want to pay for insurance. Nothing else.

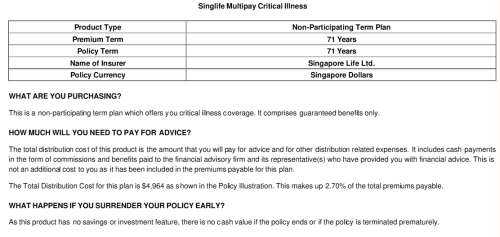

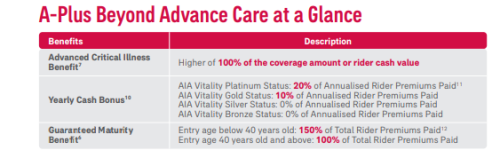

2. I don't look at cheapness of premium alone. I look at coverage it provided. The Singapore part covers for relapses and multiple payout up to 6x. The AIA part doesn't. That is already good enough for me. Assuming both same price 14k, I would pick the Singapore one. Why? Better coverage for same price. I went in with open minded and was let see how expensive it was. I was shocked to be honest when I found out that their insurance is cheaper.

3. Actually the policy is more or less the same. Word for word. Even their definition of critical illness is word for word like our Malaysian critical illness. I was surprised at this. I did. That was one of my main priority. Had to be claimable as a Malaysian staying in Malaysia. I was presented with 2 policy. One accept Singapore hospital diagnosis only. 2nd one anyone around the world as long as report is in English and certified by notary/lawyer. Think I only look at cheapness and coverage only? No way. Like I said so many times. Insurance is something that burns money, you wish you never need it but you are glad you get it. So if I get insurance which don't want to pay me, for what I get the insurance right? I need insurance to be able to payout. There is no need to go down. Just mail it down to Singapore. If you know critical illness, you might just claim max 2-3x in your life.

3 thing I look for critical illness:

1. Coverage amount and how many times can claim

2. Can payout as Malaysian staying in Malaysia, being treated in Malaysia hospital.

3. Lastly the premium.

4. Why they allow? Here are the reasons I gathered

a) lots of expats buy insurance, then leave Singapore and claim it for in their home country.

b) stable currency Vs their home currency.

c) true you are a foreigner but as long as you are treated in a Malaysian hospital, it's accepted.

d) their central bank (MAS)allows it. Like I said. You only need to go there once to sign the documents. Singapore govt not stupid. Other country hate consert, nevermind we bring in Taylor swift. Pay Taylor swift so she can bring money to Singapore. By allowing other people to buy insurance, they get money from external sources.

This post has been edited by Ramjade: Jun 11 2024, 07:12 PM

Jun 7 2024, 10:41 AM

Jun 7 2024, 10:41 AM

Quote

Quote

0.2802sec

0.2802sec

0.25

0.25

7 queries

7 queries

GZIP Disabled

GZIP Disabled