Outline ·

[ Standard ] ·

Linear+

Insurance Talk V7!, Your one stop Insurance Discussion

|

MUM

|

Aug 8 2023, 05:00 PM Aug 8 2023, 05:00 PM

|

|

QUOTE(Ramjade @ Aug 8 2023, 04:10 PM) On the contrary, it's 50% cheaper than what I found in Malaysia. eg. RM500k coverage. AIA charges me RM14k/year fixed for the entire term of insurance. Sg insurance charges me only RM7k/year. No other charges. No increases. The payout coverage is RM500k but if you factor in multiplier, it's 2x more and they cover for relapses of diseases (more coverage and cheaper). Basically a better deal. Oh, ...so it is a Spore policy instead of Malaysia one. Hope you can sustain the premium if when you did not earn SGD or will not be impacted by the ever increasing SGD if you are earning MYR Hope that SG insurance policy had some mature payout. This post has been edited by MUM: Aug 8 2023, 05:12 PM |

|

|

|

|

|

SUSTOS

|

Aug 8 2023, 05:03 PM Aug 8 2023, 05:03 PM

|

|

QUOTE(Ramjade @ Aug 8 2023, 04:10 PM) On the contrary, it's 50% cheaper than what I found in Malaysia. eg. RM500k coverage. AIA charges me RM14k/year fixed for the entire term of insurance. Sg insurance charges me only RM7k/year. No other charges. No increases. The payout coverage is RM500k but if you factor in multiplier, it's 2x more and they cover for relapses of diseases (more coverage and cheaper). Basically a better deal. You pay premium in MYR or in SGD? |

|

|

|

|

|

hksgmy

|

Aug 8 2023, 05:32 PM Aug 8 2023, 05:32 PM

|

|

QUOTE(Ramjade @ Aug 8 2023, 03:43 PM) Yes. You cannot run away from premium increase. Medical insurance premium will also go up with time. Plan for it. ILP premium increases because 1. not enough money left in the pool (too many people claim) -this also happen for standalone -this you cannot avoid 2. Fund not performing - this one you can avoid. How? Do your own investment, avoid ILP. If you don't know how to invest, just dump it into EPF. You will beat majority of the ILP returns over time. Medical premium will increase with age. You cannot run away from it. Is whether you get additional increase vs the projected returns. In theory you are not supposed to get additional increase when you buy ILP, but that's not the truth. Some people get it as early as 2 years of buying. Some get it like 2 yearly  Also depending on insurance company. Some standalone medical insurance follow the projected increase to the dot. Some standalone do not. You need to research before buying. Yes, this is absolutely true - as we grow older, the chances of hospitalization and illnesses go up. It's a fact of life. Thanks for highlighting that. |

|

|

|

|

|

hksgmy

|

Aug 8 2023, 05:34 PM Aug 8 2023, 05:34 PM

|

|

QUOTE(MUM @ Aug 8 2023, 05:00 PM) Oh, ...so it is a Spore policy instead of Malaysia one. Hope you can sustain the premium if when you did not earn SGD or will not be impacted by the ever increasing SGD if you are earning MYR Hope that SG insurance policy had some mature payout. It's an interesting reversal. When I decided to stay in Singapore and grow my career here, I actually cancelled and surrendered all the legacy insurance policies that were bought for me in Malaysia. The agent was livid. But, I'm glad I did, as the shrinking ringgit would have rendered the payouts laughable. |

|

|

|

|

|

Ramjade

|

Aug 8 2023, 05:58 PM Aug 8 2023, 05:58 PM

|

|

QUOTE(MUM @ Aug 8 2023, 05:00 PM) Oh, ...so it is a Spore policy instead of Malaysia one. Hope you can sustain the premium if when you did not earn SGD or will not be impacted by the ever increasing SGD if you are earning MYR Hope that SG insurance policy had some mature payout. Even if RM is depreciating, RM7k is still cheaper than RM14k. Mature payout from GE and AIA is a joke. Pay you at 80 years old all your premium paid without any interest provided you never claimed. QUOTE(TOS @ Aug 8 2023, 05:03 PM) You pay premium in MYR or in SGD? SGD This post has been edited by Ramjade: Aug 8 2023, 06:07 PM |

|

|

|

|

|

SUSTOS

|

Aug 8 2023, 06:01 PM Aug 8 2023, 06:01 PM

|

|

QUOTE(Ramjade @ Aug 8 2023, 05:58 PM) Oh Do note that if your income is in MYR, buying SGD products will expose yourself to FX risk. |

|

|

|

|

|

Ramjade

|

Aug 8 2023, 06:10 PM Aug 8 2023, 06:10 PM

|

|

QUOTE(TOS @ Aug 8 2023, 06:01 PM) Oh Do note that if your income is in MYR, buying SGD products will expose yourself to FX risk. Don't look at oh FX risk. Why? Payout will be in SGD. You are getting double payout Vs what you get in Malaysia. And at current price it's RM7k Vs RM14k. RM7k and RM14k is big difference. Yes I know ringgit will weaken with time, but it is still a very good deal. |

|

|

|

|

|

SUSTOS

|

Aug 8 2023, 07:05 PM Aug 8 2023, 07:05 PM

|

|

QUOTE(Ramjade @ Aug 8 2023, 06:10 PM) Don't look at oh FX risk. Why? Payout will be in SGD. You are getting double payout Vs what you get in Malaysia. And at current price it's RM7k Vs RM14k. RM7k and RM14k is big difference. Yes I know ringgit will weaken with time, but it is still a very good deal. Can share the product name and insurance company name? Singlife? Aviva? |

|

|

|

|

|

Ramjade

|

Aug 8 2023, 07:30 PM Aug 8 2023, 07:30 PM

|

|

QUOTE(TOS @ Aug 8 2023, 07:05 PM) Can share the product name and insurance company name? Singlife? Aviva? Go get it via moneyowl. They are not agent. Also you get 30% or 50% of first year commission back. They even have disability insurance (something Malaysia don't have). Eg if you use your hand to work, you fall down and break your hand, you are unable to work, you can claim the disability insurance until your hand heals. It's nice to have I feel. |

|

|

|

|

|

SUSTOS

|

Aug 8 2023, 07:46 PM Aug 8 2023, 07:46 PM

|

|

QUOTE(Ramjade @ Aug 8 2023, 07:30 PM) Go get it via moneyowl. They are not agent. Also you get 30% or 50% of first year commission back. They even have disability insurance (something Malaysia don't have). Eg if you use your hand to work, you fall down and break your hand, you are unable to work, you can claim the disability insurance until your hand heals. It's nice to have I feel. Oh you mean this one? https://www.moneyowl.com.sg/critical-illness/Moneyowl is an NTUC service mah Cheng hu cannot simply charge expensively like private sector  |

|

|

|

|

|

MUM

|

Aug 11 2023, 06:23 AM Aug 11 2023, 06:23 AM

|

|

Just asking, ...

Are all medical reports & billings details required for insurance claims provided by both the private and Govt hospitals in Malaysia written in English?

This post has been edited by MUM: Aug 11 2023, 06:23 AM

|

|

|

|

|

|

lifebalance

|

Aug 11 2023, 09:59 AM Aug 11 2023, 09:59 AM

|

|

QUOTE(MUM @ Aug 11 2023, 06:23 AM) Just asking, ... Are all medical reports & billings details required for insurance claims provided by both the private and Govt hospitals in Malaysia written in English? You should be more specific on why are you asking this ? |

|

|

|

|

|

MUM

|

Aug 11 2023, 10:47 AM Aug 11 2023, 10:47 AM

|

|

QUOTE(lifebalance @ Aug 11 2023, 09:59 AM) You should be more specific on why are you asking this ? Nothing specific, just curious and asking. May or may not uv use later |

|

|

|

|

|

dwks

|

Aug 12 2023, 02:26 PM Aug 12 2023, 02:26 PM

|

|

Hi, is there any individual insurance with OP coverage?

|

|

|

|

|

|

totoro2018

|

Aug 12 2023, 02:36 PM Aug 12 2023, 02:36 PM

|

Getting Started

|

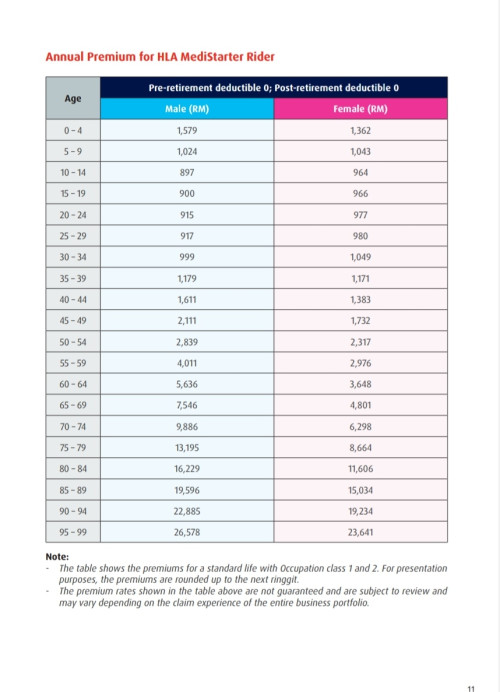

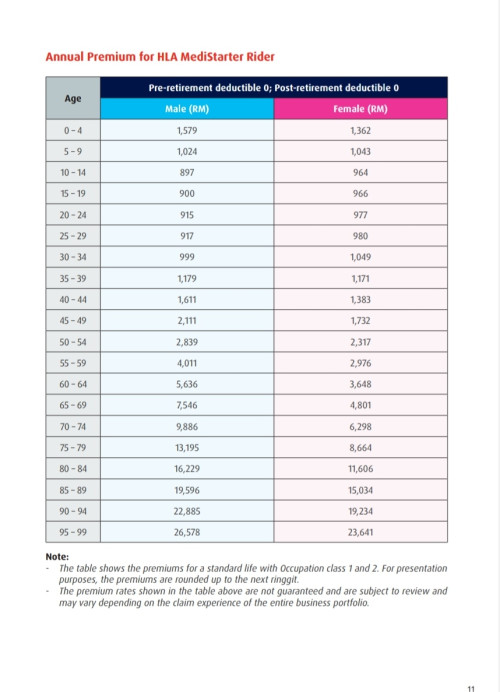

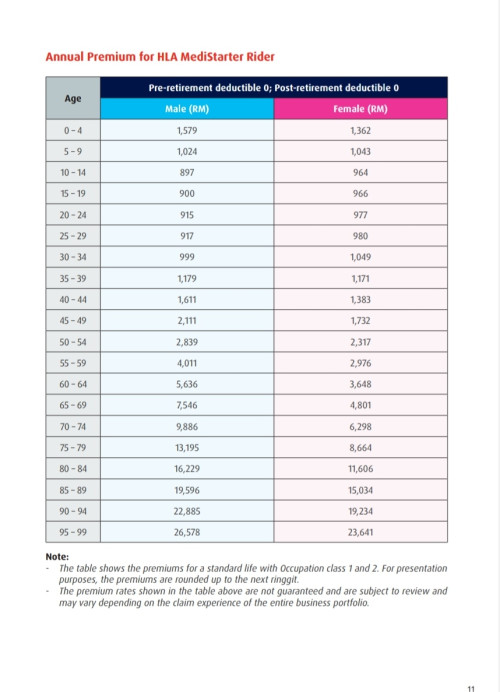

I am looking for HLA Medistarter medical card (stand-alone medical card). I found not many people commenting on HLA insurance in this forum. Benefit of HLA Medistarter attractive me : 15% for no claim TCM treatment claim What I want to know is will the HLA insurance claim be difficult? Especially when you are admitted to the hospital, will you be delayed in applying for GL? @Ramjade please help me to see if the HLA medistarter is reliable? https://www.hla.com.my/CMS/Product-Services...Starter%20RiderThis post has been edited by totoro2018: Aug 12 2023, 03:36 PM |

|

|

|

|

|

adele123

|

Aug 12 2023, 04:17 PM Aug 12 2023, 04:17 PM

|

|

QUOTE(totoro2018 @ Aug 12 2023, 02:36 PM) I am looking for HLA Medistarter medical card (stand-alone medical card). I found not many people commenting on HLA insurance in this forum. Benefit of HLA Medistarter attractive me : 15% for no claim TCM treatment claim What I want to know is will the HLA insurance claim be difficult? Especially when you are admitted to the hospital, will you be delayed in applying for GL? [email=@Ramjade]@Ramjade[/email] please help me to see if the HLA medistarter is reliable? https://www.hla.com.my/CMS/Product-Services...Starter%20RiderAfter awhile all the medical plan kinda looks the same. You have pointed out 2 somewhat unique benefit. Aside from that, annual limit is 1mil, no lifetime limit, but room &board 180 is kinda low for Klang valley but outside Klang valley is not bad actually, just not sure inflation might eat it or not after 20years. The plan seems cheap for zero deductible but would suggest to get a plan with deductible, 1000 will be a nice spot or something with coinsurance 10% or 20% with some cap to lower down the premium you have to pay. |

|

|

|

|

|

Ramjade

|

Aug 12 2023, 04:41 PM Aug 12 2023, 04:41 PM

|

|

QUOTE(dwks @ Aug 12 2023, 02:26 PM) Hi, is there any individual insurance with OP coverage? Here you go. https://www.generali.com.my/medical-health/...medi-outpatientQUOTE(totoro2018 @ Aug 12 2023, 02:36 PM) I am looking for HLA Medistarter medical card (stand-alone medical card). I found not many people commenting on HLA insurance in this forum. Benefit of HLA Medistarter attractive me : 15% for no claim TCM treatment claim What I want to know is will the HLA insurance claim be difficult? Especially when you are admitted to the hospital, will you be delayed in applying for GL? [email=@Ramjade]@Ramjade[/email] please help me to see if the HLA medistarter is reliable? https://www.hla.com.my/CMS/Product-Services...Starter%20RiderA rider plan. Likely it's an ILP. I think it's pretty clear how I feel about ILP. Only good thing is TCM la. I only know GE GL is the one problematic (based off conversation with friends). They ask all kind of questions. Sorry not much help. For me if I see ILP, I run far away. |

|

|

|

|

|

totoro2018

|

Aug 12 2023, 05:53 PM Aug 12 2023, 05:53 PM

|

Getting Started

|

QUOTE(adele123 @ Aug 12 2023, 04:17 PM) After awhile all the medical plan kinda looks the same. You have pointed out 2 somewhat unique benefit. Aside from that, annual limit is 1mil, no lifetime limit, but room &board 180 is kinda low for Klang valley but outside Klang valley is not bad actually, just not sure inflation might eat it or not after 20years. The plan seems cheap for zero deductible but would suggest to get a plan with deductible, 1000 will be a nice spot or something with coinsurance 10% or 20% with some cap to lower down the premium you have to pay. Yes, the room rate is a bit low. FYI, the room rate will be increased RM50 for every 10years up to RM330.  This post has been edited by totoro2018: Aug 12 2023, 05:59 PM This post has been edited by totoro2018: Aug 12 2023, 05:59 PM |

|

|

|

|

|

totoro2018

|

Aug 12 2023, 05:55 PM Aug 12 2023, 05:55 PM

|

Getting Started

|

QUOTE(Ramjade @ Aug 12 2023, 04:41 PM) Here you go. https://www.generali.com.my/medical-health/...medi-outpatientA rider plan. Likely it's an ILP. I think it's pretty clear how I feel about ILP. Only good thing is TCM la. I only know GE GL is the one problematic (based off conversation with friends). They ask all kind of questions. Sorry not much help. For me if I see ILP, I run far away. HLA claimed this is traditional plan medical card (like standalone card) which is the premium is refer to the age range and not a investment plan medical card. You can refer to the brochure in this link: https://www.hla.com.my/CMS/Product-Services...Starter%20Rider This post has been edited by totoro2018: Aug 12 2023, 06:16 PM This post has been edited by totoro2018: Aug 12 2023, 06:16 PM |

|

|

|

|

|

Ramjade

|

Aug 12 2023, 06:41 PM Aug 12 2023, 06:41 PM

|

|

QUOTE(totoro2018 @ Aug 12 2023, 05:55 PM) HLA claimed this is traditional plan medical card (like standalone card) which is the premium is refer to the age range and not a investment plan medical card. You can refer to the brochure in this link: https://www.hla.com.my/CMS/Product-Services...Starter%20Rider If it's rider then it's must be attach to something right? Is it attached to life/critical illness? If you look at standalone cards there are no rider. So the word rider already imply it is not a standalone. I don't have any HLA experience do cannot comment much. But I know the word rider means it is attached to something. If you want cashback for no claim, take a look at Generali (It's an ILP). https://www.generali.com.my/medical-health/onemedic-elite |

|

|

|

|

Aug 8 2023, 05:00 PM

Aug 8 2023, 05:00 PM

Quote

Quote

0.0207sec

0.0207sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled