QUOTE(1tanmee @ Jul 30 2021, 08:34 PM)

I have an ILP with GE, but the policy holder/owner is my spouse. How do I get the policy to be transferred fully to me?

Absolute assignmentInsurance Talk V7!, Your one stop Insurance Discussion

|

|

Jul 30 2021, 08:38 PM Jul 30 2021, 08:38 PM

Return to original view | Post

#261

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

|

|

|

Jul 31 2021, 02:15 PM Jul 31 2021, 02:15 PM

Return to original view | Post

#262

|

All Stars

10,162 posts Joined: Nov 2014 |

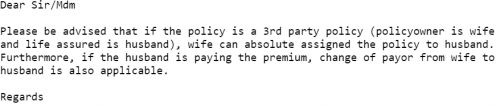

QUOTE(1tanmee @ Jul 31 2021, 12:14 PM) Called up my agent (Great Eastern), and she said cannot do! because my policy is 3rd party, not 1st party. I was like, what?? She say like forever the policy will be under my wife's name, and in case of her demise, the policy shall lapsed. I don't see issue with performing the absolute assignment with your wife signing it off.Question is, is there any other way? If your agent can't do it, then deal direct with Great Eastern Helpline 1tanmee liked this post

|

|

|

Aug 2 2021, 08:23 PM Aug 2 2021, 08:23 PM

Return to original view | Post

#263

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(1tanmee @ Aug 2 2021, 05:07 PM) Thanks for the number! Got my wife to call, and the response is the same Interesting.My wife has call the customer service, and the person say cannot, coz 3rd party We bought the policy under her name because she can claim tax, like i cannot coz i work in gig economy (and salary below requirement for tax) Well, not the case with mine- tried but say cannot I'll wait for Great Eastern to reply me then 1tanmee liked this post

|

|

|

Aug 3 2021, 04:02 PM Aug 3 2021, 04:02 PM

Return to original view | Post

#264

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Aug 4 2021, 07:46 PM Aug 4 2021, 07:46 PM

Return to original view | Post

#265

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(B u B u @ Aug 4 2021, 07:45 PM) My personal medical card has deductible 5k, however I have a company given medical card with 0 deductible but annual limit only 100k CanIf my hospital bill is 200k, can I use my company card to pay first 100k and remaining 100k with personal card without incurring 5k deductible ?tq |

|

|

Aug 4 2021, 08:57 PM Aug 4 2021, 08:57 PM

Return to original view | Post

#266

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(ckdenion @ Aug 4 2021, 08:20 PM) hi B u B u, you can either You sure ah?A) use company card to pay the first 100k, remaining 100k you pay and then claim from your personal card (without incurring 5k deductible) OR B) use personal card to pay the 195k hospital bill, pay the 5k deductible and then claim this 5k deductible from your company card. better to go for Option B) |

|

|

|

|

|

Aug 4 2021, 09:23 PM Aug 4 2021, 09:23 PM

Return to original view | Post

#267

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(ckdenion @ Aug 4 2021, 08:59 PM) yeap, i did this claim before. GL with prudential with deductible card and deductible claim from employer's medical card by Allianz with no deductible This post has been edited by lifebalance: Aug 4 2021, 09:24 PM |

|

|

Aug 5 2021, 11:07 AM Aug 5 2021, 11:07 AM

Return to original view | Post

#268

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Aug 5 2021, 11:37 AM Aug 5 2021, 11:37 AM

Return to original view | Post

#269

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Aug 5 2021, 12:05 PM Aug 5 2021, 12:05 PM

Return to original view | Post

#270

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(lifebalance @ Aug 5 2021, 11:07 AM) QUOTE(zzzxtreme @ Aug 5 2021, 11:46 AM) I asked two agents, both quoted similar amounts rm260x12 Not sure if you're intentionally ignoring what I just wrote, the easiest solution is to attach both proposal sent to you here so we know what is provided within the policy.For prubsn, they added CI of rm10K, disability 20K, accidental death 30K (which I dont need), normal death 10K. Small amounts, but made the contribution become double of GE. Is that expected? Otherwise, as mini_orchard said, you will be getting answers that is based on a figure plucked from the sky. Anyways, good luck. |

|

|

Aug 6 2021, 12:02 AM Aug 6 2021, 12:02 AM

Return to original view | Post

#271

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(1tanmee @ Aug 2 2021, 05:07 PM) Thanks for the number! Got my wife to call, and the response is the same yklooiMy wife has call the customer service, and the person say cannot, coz 3rd party We bought the policy under her name because she can claim tax, like i cannot coz i work in gig economy (and salary below requirement for tax) Well, not the case with mine- tried but say cannot  Here is your black and white. With the above evidence, whatever the Great Eastern agent mentioned below is wrong/incorrect. QUOTE(Ewa Wa @ Aug 2 2021, 07:45 PM) Yes, the information given by the customer service is right. Your wife can't transfer the ownership back to you and she can't absolute assign the policy back to u as well If it’s a Takaful plan. Do find out what type of plan u r having now. Sekian.No worries, I have done a case like your situation. Policy owner passes on and inform company by submitting the necessary documents e.g: death certificate, sign a Statutory Declaration with CTC from commission of oath then successfully transfer back to life assured. yklooi liked this post

|

|

|

Aug 6 2021, 11:12 AM Aug 6 2021, 11:12 AM

Return to original view | Post

#272

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Aug 6 2021, 11:20 AM Aug 6 2021, 11:20 AM

Return to original view | Post

#273

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

|

|

|

Aug 6 2021, 11:54 AM Aug 6 2021, 11:54 AM

Return to original view | Post

#274

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Aug 6 2021, 12:00 PM Aug 6 2021, 12:00 PM

Return to original view | Post

#275

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Aug 6 2021, 12:06 PM Aug 6 2021, 12:06 PM

Return to original view | Post

#276

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Aug 6 2021, 12:13 PM Aug 6 2021, 12:13 PM

Return to original view | Post

#277

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(yklooi @ Aug 6 2021, 12:10 PM) Thanks Any idea "must" be from what stage of covid19 then can qualify for claims of hospitalisation? Btw, just to confirm,... It is hospitalizations cost not just some amount of beneficial monetary compensation or support like RM10k QUOTE Any idea "must" be from what stage of covid19 then can qualify for claims of hospitalisation? As long as it's deemed Medically Necessary. QUOTE Btw, just to confirm,... It is hospitalizations cost not just some amount of beneficial monetary compensation or support like RM10k Up to your plan's benefit. yklooi liked this post

|

|

|

Aug 6 2021, 02:20 PM Aug 6 2021, 02:20 PM

Return to original view | Post

#278

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(MUM @ Aug 6 2021, 02:03 PM) If diarrhea or headache, prolonged incidences cannot be admitted? Covid19 stage 1 or 2 is "minor", cannot lead to complication to other stages? QUOTE(mini orchard @ Aug 6 2021, 02:08 PM) stop making your own theories.It's clearly stated that it must be medically necessary. |

|

|

Aug 7 2021, 11:56 PM Aug 7 2021, 11:56 PM

Return to original view | Post

#279

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(mini orchard @ Aug 7 2021, 09:46 PM) Does a payor rider kicks in upon a diagnosed of a CI ? The purpose for the waiver of premium rider is to reduce the burden on your finances while you've succumbed to Total Permanent Disability (TPD) or Critical Illness (CI) where the insurance company continues to pay for your premium until the end of the rider's term.The purpose of a CI policy is to obtain a lump sum payment and is there a reason why would an insured add a payor rider to continue the policy? Isnt a payor rider kicks in only upon TPD or death to protect the dependents. It's applicable on 1. Insurance policies with hospital & surgical benefits 2. Life insurance 3. Endowment & Annuities What are it's benefits on the above? 1. You get to maintain your insurance policy with the medical plan while you're recovering from TPD/CI 2. a. If the policy does not cover for CI, having the waiver will help to maintain your life policy until the event of Death/TPD. 2. b. if the policy covers CI (depending if it accelerates the CI or not), the policy will continue to maintain it's benefits until Death/TPD/Multi CI 3. Your retirement plans is uninterrupted as the insurance company pays for you. QUOTE Isnt a payor rider kicks in only upon TPD or death to protect the dependents. This is only applicable if the parent bought the policy for their child or husband/wife buying the policy for their spouse. |

|

|

Aug 10 2021, 07:46 PM Aug 10 2021, 07:46 PM

Return to original view | Post

#280

|

All Stars

10,162 posts Joined: Nov 2014 |

|

| Change to: |  0.0389sec 0.0389sec

0.90 0.90

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 03:37 PM |