QUOTE(chiayi91 @ Jul 28 2021, 12:13 PM)

What are the fixed interest deposits you mentioned? so far I see FD highest also 2.5% only.

it's not Fixed Deposit that I was referring to. Unfortunately I'm not allowed to promote it here.

QUOTE(ping325 @ Jul 28 2021, 12:38 PM)

hi chiayi , maybe put it this way / in lay man terms

FD you set an amount like RM5000 and FD term for 1 year

1.during this one year you can still withdraw 5000 out in case of emergency but all interest gone

2.keep this money for 1 year and you get the interest + your initial 5000 capital

Life insurance savings plan [ regardless of insurance company ]1. you set an amount to save every month...for example RM50

2. you set a term that you need to commit .... normally 20-30 years , you need to commit with the duration terms at first

3. as long as you continue to save , you can get guaranteed / non guaranteed bonus or interest [whatever that insurance company written in black & white]

Difference here is : 1. if we are diagnose with CI / disabled , savings plan still go on and born by insurance company

*subject to different insurance company terms & condition on covered waiver

2. you can get bonus / interest in between where you can partially withdraw or just keep inside the saving account ,

normally principle money is locked until end of contract only can take out.

3. most of the cases , after you commit the savings plan and in between if you want to withdraw

principle money is not allow,

if you

fail to save / surrender halfway, your principle $$ / portion of it will gone depend on insurer T&C written.

Same goes with EPF , PRS , SSPN and so on ... all got their different function and terms ,

Most importantly is you understand each of it in details and choose those that suits you the most.

why not paint the full picture on Pru's saving plan and not just the good part?

QUOTE

1. if we are diagnose with CI / disabled , savings plan still go on and born by insurance company

- Would you rather have an insurance payout or continue to "save" money while you're in a condition that needs you to utilize money for treatment?

QUOTE

2. you can get bonus / interest in between where you can partially withdraw or just keep inside the saving account ,

normally principle money is locked until end of contract only can take out.

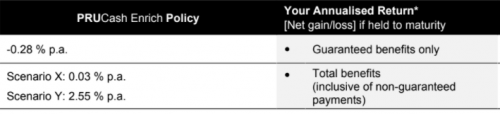

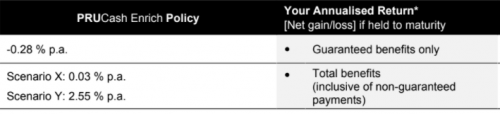

- Sounds pretty nice by the description till you show them

QUOTE

Same goes with EPF , PRS , SSPN and so on ... all got their different function and terms

All these above you've mentioned are retirement funds which are locked away till you're Age 50 - 55. It's not as accessible compared to a Saving Plan where you allow a person to make withdrawal / loan which defeats the purpose of saving for retirement. Moreover, a chunk of money is paid upfront to the agent's commission which affects the long term return of the policy holder.

Jul 13 2021, 11:58 AM

Jul 13 2021, 11:58 AM

Quote

Quote

0.0307sec

0.0307sec

0.72

0.72

7 queries

7 queries

GZIP Disabled

GZIP Disabled