QUOTE(hafizmamak85 @ May 1 2025, 05:49 PM)

Please be careful when buying 'cheap products', especially when they are long term - e.g. 20, 30 years.

The problem with the big insurers and takaful operators (ITOs) is that they have huge margins and fees. That is how policyholders get screwed.

The problem with mid to small ITOs is that they have another way of shortchanging consumers, and that is through designing or pricing the products as lapse supported. Not to say big ITOs don't do this, but I think the smaller guys will feel the urge to do this more often than not.

I used to think this problem wouldn't plague takaful operators as there was usually this split, where any remainder premium amount (contribution amount) - after deduction of wakalah (management) fees - would flow to something called the savings account first, before monthly drips or deductions from the savings account to the tabarru fund (risk fund) are made.

So, if you die, your beneficiaries will receive any remaining amount retained within the savings account, and the sum assured will be separately paid to your beneficiaries from the risk fund. If you surrender your policy, you will receive the savings account amount.

The savings account amount can also be thought of as the 'Asset Share' of the policy.

The Kaotim Legasi death benefit 'more than 1 year term' products by STMB (Syarikat Takaful Malaysia Berhad) are suspiciously cheap and not designed and priced fairly, as there is no separation between the savings accounts and risk fund, and there is no surrender value. Kaotim also, very strangely, reserves the right to reprice the tabarru charges at any time during the policy's term. Again, this should only be exercised if the ITO faces going concern risks.

I suspect that these products may also be benefiting from

STMB's Estate. Yes, Great Embarrassment is not the only ITO with an Estate.

This 'no surrender value, lapse supported design' means that the proper management of the Kaotim Legasi product requires either a part, or the entirety, of the Asset Shares of policyholders who leave the fund during the middle of the contract term, to sustain future benefit payouts of remaining policyholders.

Why should you, the leaving policyholder, fork out any amount belonging to you, for the benefit of the other remaining policyholders???? You have no stake in the pool anymore, you're not being afforded any protection. So, why should you and your funds be bothered???

And what happens if all policyholders decide to simultaneously leave the fund??? That money will then languish within the tabarru fund, which would then allow the takaful operator to further underprice the products and claw as much management fees from future policyholders.

And when the tabarru fund closes, the government gets the money. What a sham and a scam. Boycott STMB!!!!!.

Again, this is a very unfair contact term and the way the products are designed and managed, without any proper separation between the risk fund and savings account, is also unfair.

Stay Away from it.

SAY NO to lapse supported products.

Also, demand that Great Embarrassment calculates the Asset Shares of participating policies within closed funds properly by accounting for the Estate, which is technically not really an Estate, within its computation. Demand that Great Eastern pays out the entirety of the Asset Share and Estate, to participating policyholders within their closed funds, by the time the last policyholder leaves the fund and in line with the 90/10 rule.

I'm truly surprised that STMB is doing this.

I think you are jumping to the wrong conclusions here. Yes, the product is lapse supportable because it contains no surrender value.

But insurers CAN design such products.

If too many policyholders buy long-term cover and the lapse just 2 or 3 years into the policy, the insurers make bank. Why is this wrong though?

Cause on the flip side, by buying such a product, you pay significantly lesser.

In pricing the product, the insurer will make certain lapse assumptions, possibly by drawing from the experience of similar products.

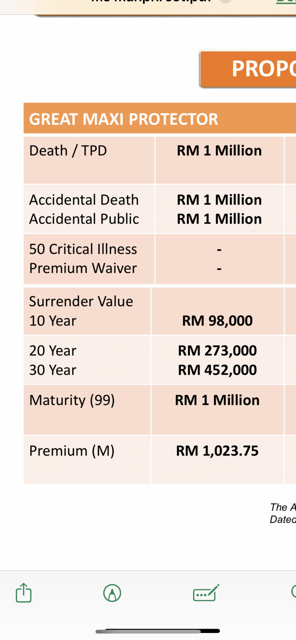

By pricing the product such that there is no surrender value, we customers get to buy "cheaper" term cover. This is proven by the fact that Kaotim Legasi is cheaper than almost every other term insurance covering death and TPD.

There is nothing shady here. It is written clearly in the PDS and policy contract that there is no surrender value.

As a customer looking for the absolute cheapest insurance coverage, I am OKAY with this. I don't need any surrender value from my pure protection policies.

Regarding the company's ability to reprice, I believe it is a standard wording for "non-guaranteed" products. Most term cover products have this clause. Those with guaranteed rates, are generally more expensive. However, given the trend of Malaysians living longer, this should not be a concern. It is fairly unlikely, probably unheard of, for an insurer to reprice pure death+TPD products, and if they do, they will come under significant scrutiny from BNM. If they intentionally underpriced the product, they will not get the approval from BNM to reprice the product. BNM has access to all the assumptions used in pricing the product.

As to the question of the use of estate, I am not sure if STMB has any estate, and if they do, is it even significant? Do takaful operators even have an estate? Is a estate even applicable to non-participating policies such as this? In any case, that's not an issue and BNM has got stringent policies on the management of estates and not a relevant consideration as to whether one should buy this product or not.

Edit: My man, you do know that for pure protection non-participating product from conventional insurance, the customer gets nothing as well right, if ultimately the fund has excess monies due to high lapses, or better-than-expected claims experience.

Edit 2: You may check out the FWD Takaful Protect Direct plan. It is also similarly "cheap", but not as cheap as Kaotim Legasi plan. No surrender value here either. But the drawback is, it does not have TPD protection.

This post has been edited by contestchris: May 1 2025, 09:04 PM

Apr 21 2025, 01:45 PM

Apr 21 2025, 01:45 PM

Quote

Quote

0.0255sec

0.0255sec

0.33

0.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled