QUOTE(ryan@chua @ Sep 25 2020, 12:20 PM)

Are u mean if can't afford then just simply go for a affordable but not investable high rise.... Maybe I understand wrongly😂

First of all, this forum topic is about a high rise project called Trion2 located in Chan Sow Lin.

We are here to share the good, the bad about this project and specific criteria that can affect this project in a way before making decision to buy for own stay, invest or speculate.

If you want to talk about investment, of course there a lot different types of investment out there in the world, u can buy stock, u can buy land, and even invest in start up. But here is not the place to go so far into those.

Of course buying landed also have good , but if u want to relate to this project,

please share which landed is better or related to this project at least? Otherwise u might as well go to every single topic in lowyat and post "landed is better" if u got notjing better to do in life.

This project range is 450k to 800k, are you going to tell that buying landed 800k in rawang is better in apprreciation? Maybe, but i have people who buy rawang but end up cant rent out. Slowly wait for appreciation only and pay installment without income?

Which has a better ROI then? Everything has good and bad, but to compare every single one? Maybe 10 years also u wont buy a property.

Stick to the topic, no need to stray so far

Its like going to McDonalds and tell them vegeterian is healthier

But if misunderstood your point, and u saying that high rise takes 10 years to appreciate. I may disagree with you. Lets take a look at V residence since its near by. During launch its about 1000 to 1100 /sqft

https://forum.lowyat.net/topic/3014020 post#7

Now its already Rm1200 to 1500 sqft.. why? Cause new project Velo2 leasehold is already 900/sqft+. It only took 5 years for appreciation once the mall ready.

https://www.iproperty.com.my/sale/apartment...nway%20Velocity(You van verify, i maybe wrong)

End of day we buy property base on speculation. If h buy high rise in middle of nowhere of course wont appreciate in 20 years even.

Thats why we are here to TALK about Trion2 where the BOOM FACTOR is TRX and Bandar Malaysia.

Another misconception about Capital Appreciation is that, property now alot rebates, the published rate is not the Nett price. Actually some projects upon completion is selling subsale at published rate, u already profit from the rebates

Also to add on TRX tower is already open for leasing. In my opinion i think its good especially now MCO, not much people will lease it, but in 5 years time when HSBC, Affin and others ready, occupancy should be better.

https://youtu.be/kJmIV2ClmqYThe influx of workers, where will they stay? Take a look at this and decide.

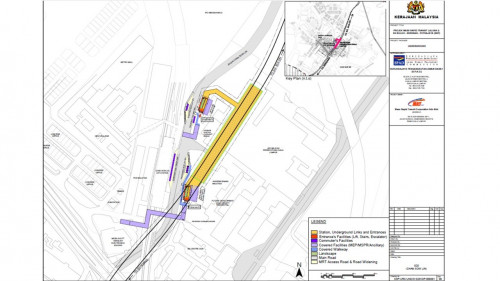

*map by MRT corp

This post has been edited by halofujima: Sep 25 2020, 03:07 PM

Sep 24 2020, 10:21 PM

Sep 24 2020, 10:21 PM

Quote

Quote

0.0309sec

0.0309sec

0.46

0.46

6 queries

6 queries

GZIP Disabled

GZIP Disabled