Outline ·

[ Standard ] ·

Linear+

Investment Raiz Malaysia, https://raiz.com.my/

|

extinct_83

|

Jul 27 2020, 09:31 AM Jul 27 2020, 09:31 AM

|

|

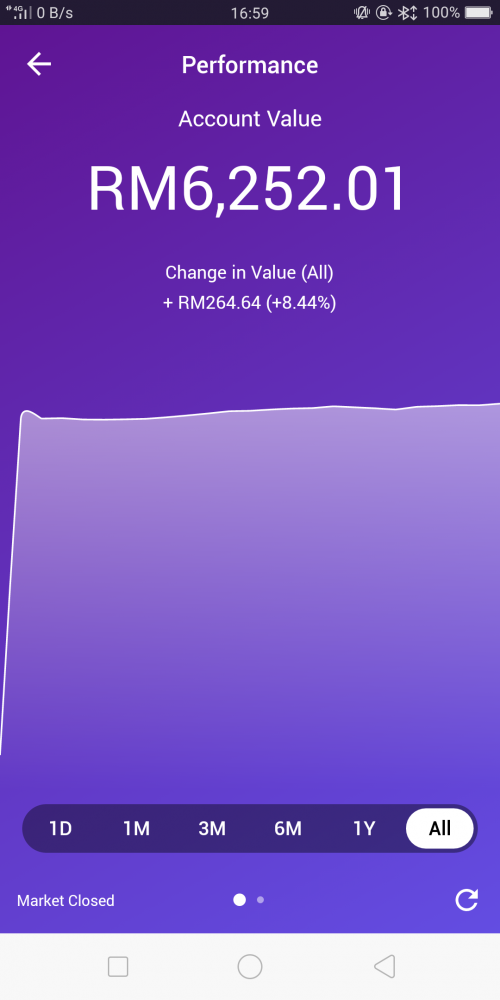

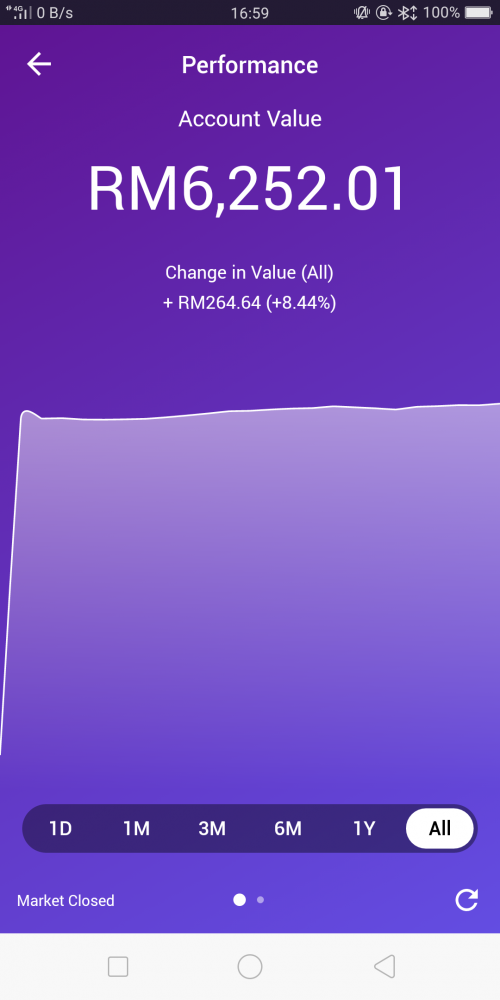

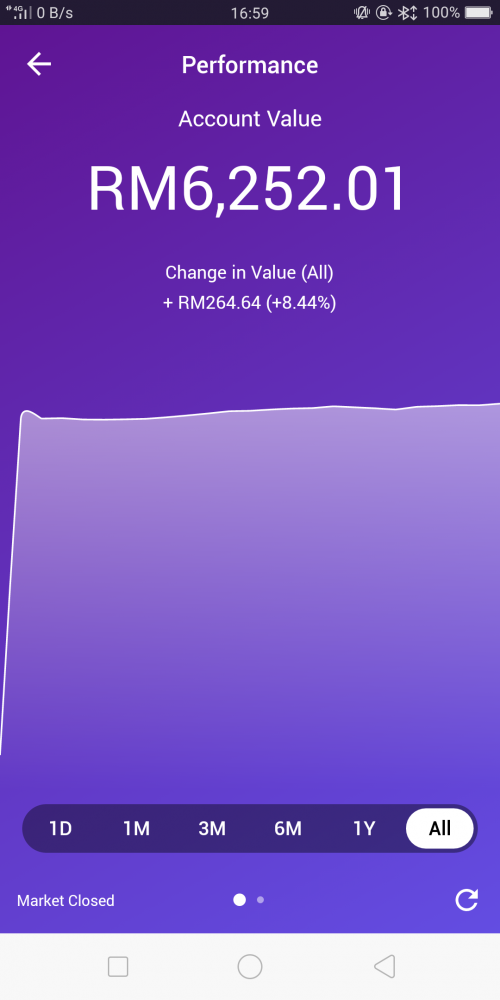

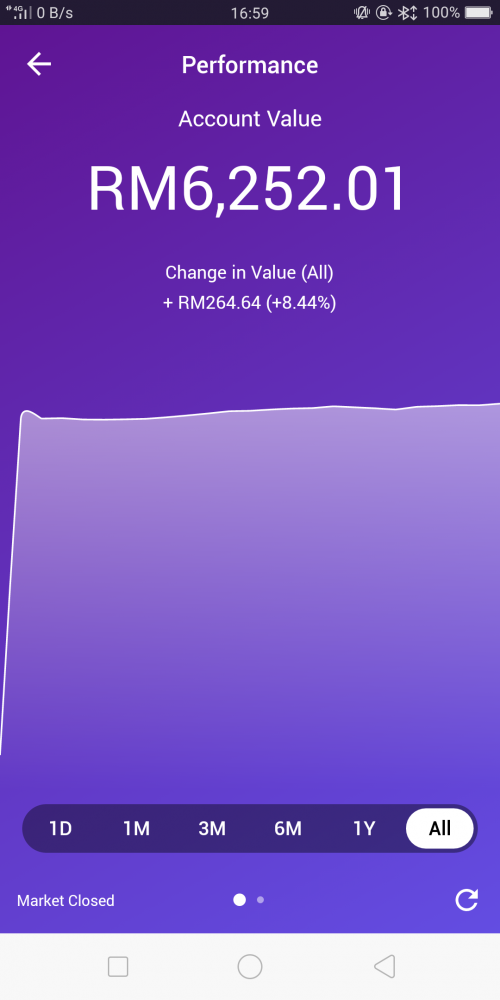

QUOTE(Eurobeater @ Jul 26 2020, 06:01 PM) Its been a month since I plopped down RM6k into the app in a Conservative portfolio. So far have made RM264 within the month itself. Most probably is because of the surge in the KLCI due to people buying glove lol  Wow.. A month earn about 8% - do you top up in the middle or just left 6K until now? |

|

|

|

|

|

Eurobeater

|

Jul 27 2020, 09:35 AM Jul 27 2020, 09:35 AM

|

|

QUOTE(extinct_83 @ Jul 27 2020, 09:31 AM) Wow.. A month earn about 8% - do you top up in the middle or just left 6K until now? Didn't top up. Placed 6k back in June and left it at that |

|

|

|

|

|

GrumpyNooby

|

Jul 27 2020, 09:35 AM Jul 27 2020, 09:35 AM

|

|

QUOTE(Eurobeater @ Jul 27 2020, 09:35 AM) Didn't top up. Placed 6k back in June and left it at that So this is 2nd SAMY which can potentially generate double digit return? |

|

|

|

|

|

Eurobeater

|

Jul 27 2020, 09:37 AM Jul 27 2020, 09:37 AM

|

|

QUOTE(GrumpyNooby @ Jul 27 2020, 09:35 AM) So this is 2nd SAMY which can potentially generate double digit return? Maybe. But 1 month might still be too short to judge |

|

|

|

|

|

SUSyklooi

|

Jul 27 2020, 09:41 AM Jul 27 2020, 09:41 AM

|

|

QUOTE(extinct_83 @ Jul 27 2020, 09:31 AM) Wow.. A month earn about 8% - do you top up in the middle or just left 6K until now?  was mentioned "Its been a month since I plopped down RM6k into the app in a Conservative portfolio. So far have made RM264 within the month itself" been a month since topped 6k made 264 within a month thus could it be 264/6000 x100 = 4.4% and the displayed 8.44% was cumulation from previous gains ? |

|

|

|

|

|

moiskyrie

|

Jul 27 2020, 09:44 AM Jul 27 2020, 09:44 AM

|

|

Deposit usually take how long...

Until now still no reflect into my acccount...

|

|

|

|

|

|

majorarmstrong

|

Jul 27 2020, 10:25 AM Jul 27 2020, 10:25 AM

|

|

i think those who lumpsum make good money

i DCA starting with 1k in middle june till now got 7k

every monday 1k

return just so so saja

RM105 ringgit

|

|

|

|

|

|

XHunTerx123

|

Jul 27 2020, 02:36 PM Jul 27 2020, 02:36 PM

|

Getting Started

|

QUOTE(victorian @ Jul 26 2020, 11:10 AM) As much as I welcome the concept of investing pocket change, I can’t help but to think that all these features comes with a cost. Investing should be a habit and not an afterthought coming from the spare change of your meal How much can you save from your spare change monthly? Rm50-100? Not to forget Raiz is charging minimum RM1.50 per MONTH for amount less than RM6,000. You will be paying 1.5% monthly fee if you are investing RM100 in Raiz. That is equivalent to 18% annual fee; in contrast Stashaway has no minimum fee charge and they are charging 0.8% annual fee. If you ask me, Raiz is definitely not suitable for “spare change” investing. The fee charge will eat up your funds before you know it. I can foresee many youngster who is not serious in investing but wanting to dip their feet into the pool get mediocre return over the years. If you want to invest, get serious and set up a regular saving plan and not just invest your spare change. This statement, I would like to know the 18% annual fee is based on which calculation? QUOTE Not to forget Raiz is charging minimum RM1.50 per MONTH for amount less than RM6,000. You will be paying 1.5% monthly fee if you are investing RM100 in Raiz. That is equivalent to 18% annual fee |

|

|

|

|

|

victorian

|

Jul 27 2020, 02:38 PM Jul 27 2020, 02:38 PM

|

|

QUOTE(XHunTerx123 @ Jul 27 2020, 02:36 PM) This statement, I would like to know the 18% annual fee is based on which calculation? 1.5% monthly * 12 months = 18% |

|

|

|

|

|

imin

|

Jul 27 2020, 02:43 PM Jul 27 2020, 02:43 PM

|

|

Just wondering, anyone here tried/used https://wahedinvest.com/ before? If yes, how does it compare to Raiz? |

|

|

|

|

|

GrumpyNooby

|

Jul 27 2020, 02:44 PM Jul 27 2020, 02:44 PM

|

|

QUOTE(imin @ Jul 27 2020, 02:43 PM) Just wondering, anyone here tried/used https://wahedinvest.com/ before? If yes, how does it compare to Raiz? Here's the existing dedicated thread for discussion: https://forum.lowyat.net/topic/4858234/+1840#entry97591251 |

|

|

|

|

|

SUSyklooi

|

Jul 27 2020, 02:46 PM Jul 27 2020, 02:46 PM

|

|

QUOTE(imin @ Jul 27 2020, 02:43 PM) Just wondering, anyone here tried/used https://wahedinvest.com/ before? If yes, how does it compare to Raiz? there was an existing thread on Wahed. https://forum.lowyat.net/topic/4858234/+1840 |

|

|

|

|

|

XHunTerx123

|

Jul 27 2020, 02:59 PM Jul 27 2020, 02:59 PM

|

Getting Started

|

QUOTE(victorian @ Jul 27 2020, 03:38 PM) 1.5% monthly * 12 months = 18% Hurmm.... I have some opinion for this calculation. RM1.50 per months=1.5% for RM100 each months RM1.50 * 12 months = RM18 for RM1200 (12 months) RM18 = 1.5% for 12 months / per annum Does this more accurate? Since it charge as RM1.50 not 1.5% |

|

|

|

|

|

victorian

|

Jul 27 2020, 03:09 PM Jul 27 2020, 03:09 PM

|

|

QUOTE(XHunTerx123 @ Jul 27 2020, 02:59 PM) Hurmm.... I have some opinion for this calculation. RM1.50 per months=1.5% for RM100 each months RM1.50 * 12 months = RM18 for RM1200 (12 months) RM18 = 1.5% for 12 months / per annum Does this more accurate? Since it charge as RM1.50 not 1.5%My calculation is based on rm100 in your portfolio, of course as you DCA more you will get lower and lower % until you hit 0.30% annually at RM6k. My point is, since it is fixed RM1.50, the annualized fee can be very high if you are not investing a lot. |

|

|

|

|

|

XHunTerx123

|

Jul 27 2020, 03:20 PM Jul 27 2020, 03:20 PM

|

Getting Started

|

QUOTE(victorian @ Jul 27 2020, 04:09 PM) My calculation is based on rm100 in your portfolio, of course as you DCA more you will get lower and lower % until you hit 0.30% annually at RM6k. My point is, since it is fixed RM1.50, the annualized fee can be very high if you are not investing a lot. I see, than it is correct, if this better prefer FD or ASNB |

|

|

|

|

|

GrumpyNooby

|

Jul 27 2020, 03:21 PM Jul 27 2020, 03:21 PM

|

|

QUOTE(XHunTerx123 @ Jul 27 2020, 03:20 PM) I see, than it is correct, if this better prefer FD or ASNB Do you know where's the end product goes into? |

|

|

|

|

|

victorian

|

Jul 27 2020, 03:32 PM Jul 27 2020, 03:32 PM

|

|

QUOTE(XHunTerx123 @ Jul 27 2020, 03:20 PM) I see, than it is correct, if this better prefer FD or ASNB But if you are investing more than 6k, 0.30% fee is very attractive |

|

|

|

|

|

XHunTerx123

|

Jul 28 2020, 02:29 PM Jul 28 2020, 02:29 PM

|

Getting Started

|

QUOTE(victorian @ Jul 27 2020, 04:32 PM) But if you are investing more than 6k, 0.30% fee is very attractive In which means the higher your investment the lower been charged in % |

|

|

|

|

|

majorarmstrong

|

Jul 28 2020, 03:47 PM Jul 28 2020, 03:47 PM

|

|

QUOTE(XHunTerx123 @ Jul 28 2020, 02:29 PM) In which means the higher your investment the lower been charged in % not a true statement the crossing point is 6k after 6k it make no difference at all i start with 1k weekly and slowly move up to now 8k this week should reach 9k as 1 more k pending buy |

|

|

|

|

|

chichabom

|

Jul 28 2020, 08:35 PM Jul 28 2020, 08:35 PM

|

Getting Started

|

QUOTE(Eurobeater @ Jul 26 2020, 05:01 PM) Its been a month since I plopped down RM6k into the app in a Conservative portfolio. So far have made RM264 within the month itself. Most probably is because of the surge in the KLCI due to people buying glove lol  But presume conservative portfolio will allocate more towards bonds than equity right? Not surprising as i see many bond funds doing quite well in recent months |

|

|

|

|

Jul 27 2020, 09:31 AM

Jul 27 2020, 09:31 AM

Quote

Quote 0.2664sec

0.2664sec

0.54

0.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled