Outline ·

[ Standard ] ·

Linear+

Money market fund

|

GrumpyNooby

|

Aug 14 2020, 09:17 PM Aug 14 2020, 09:17 PM

|

|

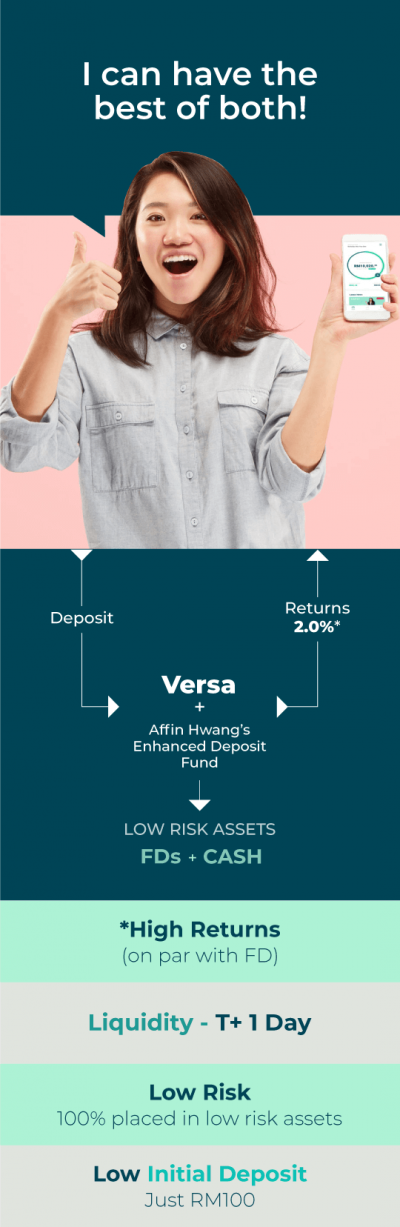

Here is the FFS for Affin Hwang Enhanced Deposit Fund (target fund for Versa). https://nadiablob.blob.core.windows.net/fun...FFFS_EDFHCF.pdfIf you want to buy directly from Affin Hwang, the min II is RM 10k. Interestingly to find out this fund is also EPF-MIS approved. |

|

|

|

|

|

GrumpyNooby

|

Aug 24 2020, 08:08 AM Aug 24 2020, 08:08 AM

|

|

QUOTE(MUM @ Aug 23 2020, 10:49 PM) for monthly distribution data... try this https://www.publicmutual.com.my/LinkClick.a...8%3D&portalid=0for latest purchase price try this for latest NAV https://www.publicmutual.com.my/Our-Products/UT-Fund-Pricesi would see the fund performance for that year instead of distribution per unit PM doesn't have monthly fund factsheet (FFS) like other fund managers?  |

|

|

|

|

|

GrumpyNooby

|

Sep 1 2020, 12:28 PM Sep 1 2020, 12:28 PM

|

|

PMMMF rate as of 31/08/2020 is 2.05% pa This post has been edited by GrumpyNooby: Sep 1 2020, 12:29 PM This post has been edited by GrumpyNooby: Sep 1 2020, 12:29 PM |

|

|

|

|

|

GrumpyNooby

|

Oct 31 2020, 06:40 PM Oct 31 2020, 06:40 PM

|

|

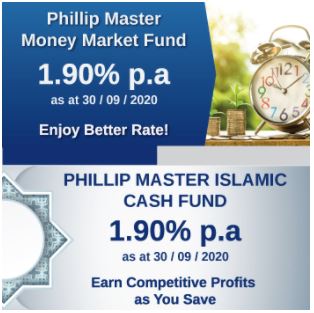

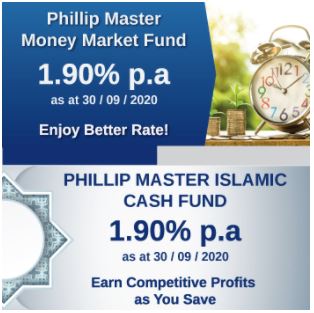

QUOTE(abcn1n @ Oct 31 2020, 06:38 PM) Is the return better than Opus money market fund? This is the latest rate for PMMMF: QUOTE(GrumpyNooby @ Oct 5 2020, 09:15 AM) PMMMF return as of September 2020  |

|

|

|

|

|

GrumpyNooby

|

Oct 31 2020, 07:33 PM Oct 31 2020, 07:33 PM

|

|

QUOTE(abcn1n @ Oct 31 2020, 07:23 PM) If base on opus fund factsheet https://www.opusasset.com/wp-content/upload...v=1604143129848, it would seem Opus slightly better (2.05% vs 1.9%) at least for this YTD. YTD may not be accurate as OPR has been in the downward trend. Try use 1-week or 1-month figure for rough estimattion: 1-week: 0.03% or 1.56% pa 1-month: 0.18% or 2.16% pa |

|

|

|

|

|

GrumpyNooby

|

Nov 4 2020, 11:39 AM Nov 4 2020, 11:39 AM

|

|

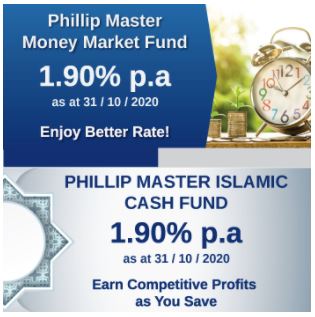

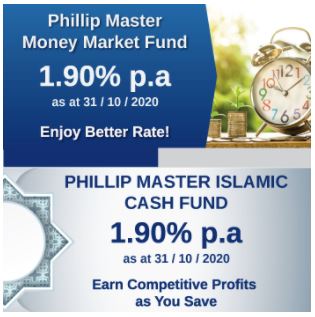

PMMMF return as of October 2020:  |

|

|

|

|

|

GrumpyNooby

|

Dec 2 2020, 01:40 PM Dec 2 2020, 01:40 PM

|

|

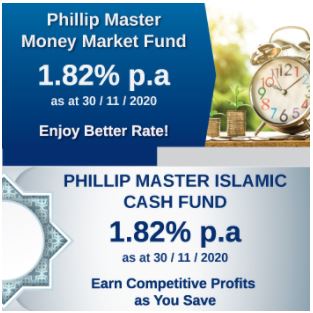

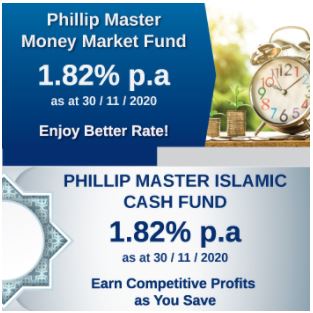

PMMMF return as of November 2020:  |

|

|

|

|

|

GrumpyNooby

|

Dec 2 2020, 05:01 PM Dec 2 2020, 05:01 PM

|

|

QUOTE(Ramjade @ Dec 2 2020, 04:44 PM) Damn it's pathetic now. I have switched to stashaway simple for the mean time. Cant wait for versa. Instant withdrawal. Some said SAMY is subsidizing the projected return of Simple™. Real return from its underlying MMF is just 1.9% pa. |

|

|

|

|

|

GrumpyNooby

|

Jan 28 2021, 05:50 PM Jan 28 2021, 05:50 PM

|

|

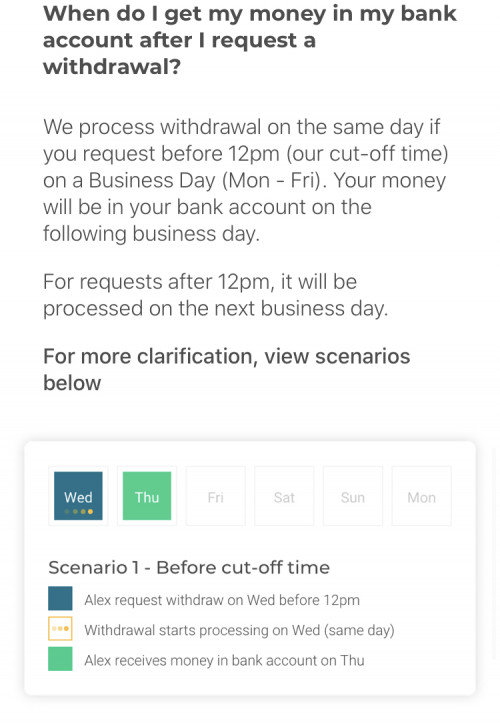

QUOTE(JJ93 @ Jan 28 2021, 03:28 PM) QUOTE(CSW1990 @ Jan 28 2021, 05:49 PM) Had just registered and pending for personal account verification, wanna try how is this Versa doing Looks like can only buy 1 MMF.. No other available funds to see there. For me the important is the redemption processing time The MMF rate is the the extra bonus PHillip Master mmf still have the fastest redemption time T+0 This is what I captured from Versa apps,  Can fund using credit card? |

|

|

|

|

|

GrumpyNooby

|

Jan 28 2021, 06:57 PM Jan 28 2021, 06:57 PM

|

|

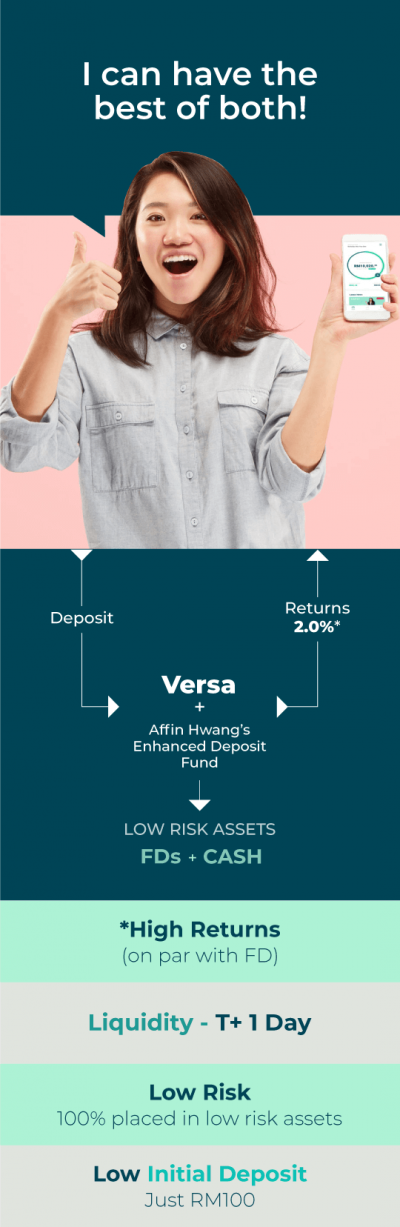

QUOTE(ironman16 @ Jan 28 2021, 06:52 PM) do update ur review here..... if link with affin hwang, i just wait my Allocate Plus settle la.....  It is only restricted to cash management funds. QUOTE KUALA LUMPUR, Jan 28 — A new mobile application called Versa launched its platform today, offering Malaysians an alternative to fixed deposits that allows them to grow any idle cash on hand.

The company said it is the first recognised digital cash management platform to obtain approval and licence from the Securities Commission Malaysia. |

|

|

|

|

|

GrumpyNooby

|

Jan 28 2021, 09:17 PM Jan 28 2021, 09:17 PM

|

|

QUOTE(!@#$%^ @ Jan 28 2021, 09:16 PM) ROI seems like better than PMMMF. |

|

|

|

|

|

GrumpyNooby

|

Jan 29 2021, 07:14 AM Jan 29 2021, 07:14 AM

|

|

QUOTE(xander83 @ Jan 29 2021, 01:46 AM) Mostly to short term bonds on 18 months tenure Banks already approaching retail investors which to me load of bulls because they just wanna earn 2.5% commissions Just park Versa for small liquidity  For large liquidity park where? |

|

|

|

|

|

GrumpyNooby

|

Jan 29 2021, 06:34 PM Jan 29 2021, 06:34 PM

|

|

QUOTE(!@#$%^ @ Jan 29 2021, 06:33 PM) cant verify as i have already invested before via fsm. and those who didn't invest directly cannot use i-access. waiting support. This one sure cannot unless you buy directly from Affin Hwang.  This post has been edited by GrumpyNooby: Jan 29 2021, 06:35 PM This post has been edited by GrumpyNooby: Jan 29 2021, 06:35 PM |

|

|

|

|

|

GrumpyNooby

|

Jan 29 2021, 06:59 PM Jan 29 2021, 06:59 PM

|

|

QUOTE(!@#$%^ @ Jan 29 2021, 06:57 PM) i aim to buy directly via allocate plus but apparently cannot verify cus my IC already in system. I called Affin CS that day, even I got holdings for Affin funds under PRS and FSM, she said that I don't have access to i-Access. She said they need to create a profile for me. |

|

|

|

|

|

GrumpyNooby

|

Jan 29 2021, 07:01 PM Jan 29 2021, 07:01 PM

|

|

QUOTE(!@#$%^ @ Jan 29 2021, 07:00 PM) yup. i guess so. but as long can be done. otherwise i try versa. also same i guess Versa is not under Affin right? I believe your account creation should be successful. |

|

|

|

|

|

GrumpyNooby

|

Jan 29 2021, 07:04 PM Jan 29 2021, 07:04 PM

|

|

QUOTE(!@#$%^ @ Jan 29 2021, 07:02 PM) haha sorry. i mean also investing into the same fund via versa. though i wonder if got any extra charges incorporated MMF shouldn't have charge as the fund return is razor thin only. |

|

|

|

|

|

GrumpyNooby

|

Jan 29 2021, 07:39 PM Jan 29 2021, 07:39 PM

|

|

QUOTE(ironman16 @ Jan 29 2021, 07:26 PM) versa got management fee , i thinks is 0.3% annually gonna find ppl that haven't invest through fsm baru dpt.....we all got the same problem  How much is SAMY charges for Simple™? |

|

|

|

|

|

GrumpyNooby

|

Jan 30 2021, 10:26 AM Jan 30 2021, 10:26 AM

|

|

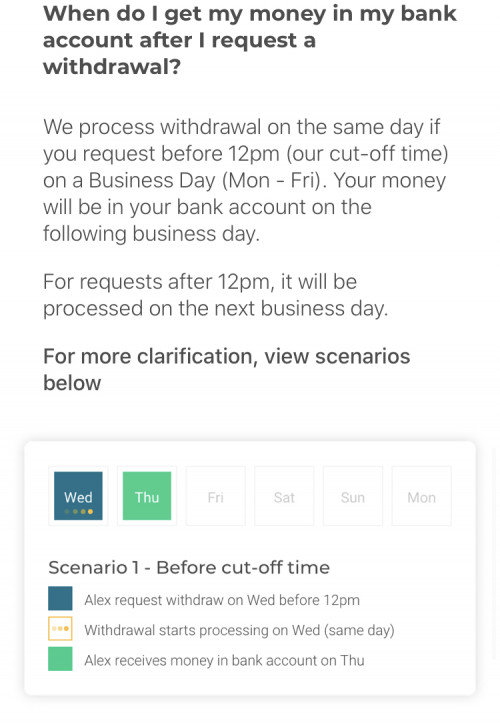

QUOTE(AnasM @ Jan 30 2021, 10:23 AM) how quite is the withdrawal time for versa? faster than opus?  |

|

|

|

|

|

GrumpyNooby

|

Jan 30 2021, 12:22 PM Jan 30 2021, 12:22 PM

|

|

QUOTE(ironman16 @ Jan 30 2021, 12:10 PM) I just wait Allocate Plus, just let IT figure out how to settle but too slow 😩😩😩 3 week oledi I think you're all over two concurrent threads specially Allocate+ |

|

|

|

|

|

GrumpyNooby

|

Jan 30 2021, 12:52 PM Jan 30 2021, 12:52 PM

|

|

QUOTE(!@#$%^ @ Jan 30 2021, 12:46 PM) in that case, how will the 0.3% management fee come in? it will eventually show diff amounts in both apps. I think there's on management fee levied to customer: QUOTE The annual management fee of 0.32% will be split in half between Versa and AHAM, he says, adding that “Versa will be in charge of customer acquisition and the continuous development of its mobile app while AHAM will focus on managing the money of the investors”. https://www.theedgemarkets.com/article/fint...est-both-worlds |

|

|

|

|

Aug 14 2020, 09:17 PM

Aug 14 2020, 09:17 PM

Quote

Quote

0.0493sec

0.0493sec

0.65

0.65

7 queries

7 queries

GZIP Disabled

GZIP Disabled