QUOTE(tsutsugami86 @ Mar 29 2021, 11:45 AM)

I feel sad to TNG, launch new product also get scold

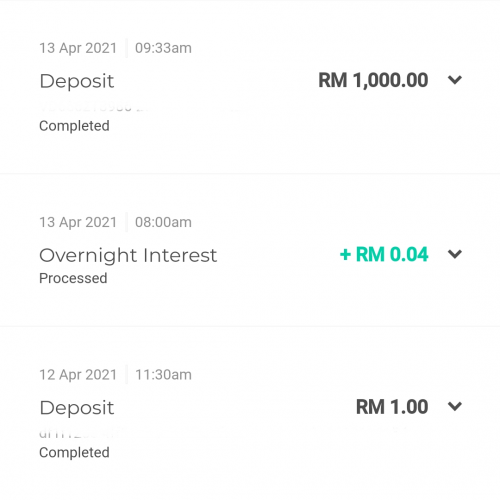

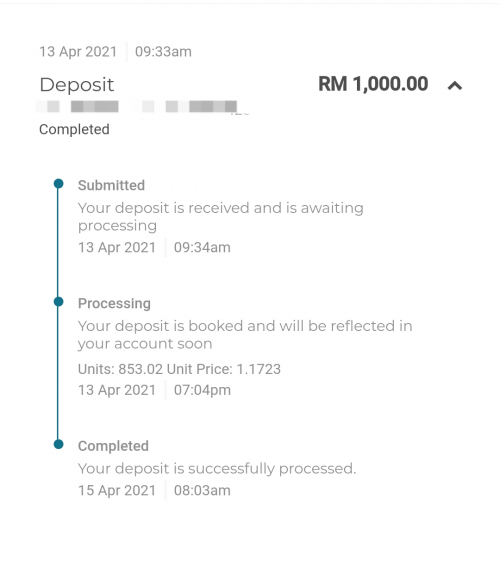

They didn't cheat us, they already mention the return rate around 1.47 pa, still got many ppl complain the interest is low.

The main purpose for this Go+ is for you to generate interest when you got money in e-wallet. Few sen better than nothing

Basic rubbish product as it will fluctuate daily hence for gain of rm0.01 to rm250 deposit basically useless to the point to There too many suckers in the platform to be sucked into itThey didn't cheat us, they already mention the return rate around 1.47 pa, still got many ppl complain the interest is low.

The main purpose for this Go+ is for you to generate interest when you got money in e-wallet. Few sen better than nothing

The key is to demand that they should return at 1.8% at OPR rates otherwise suckers who are into it basically just robbed of the returns of 0.33% for doing basically nothing and just making CIMB richer

Mar 29 2021, 12:42 PM

Mar 29 2021, 12:42 PM

Quote

Quote

0.0542sec

0.0542sec

1.06

1.06

7 queries

7 queries

GZIP Disabled

GZIP Disabled