QUOTE(xander83 @ Feb 26 2021, 11:34 PM)

They start distribution process today Money market fund

Money market fund

|

|

Feb 27 2021, 12:15 AM Feb 27 2021, 12:15 AM

Return to original view | Post

#21

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

|

|

|

Mar 24 2021, 11:48 AM Mar 24 2021, 11:48 AM

Return to original view | IPv6 | Post

#22

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Hoshiyuu @ Mar 24 2021, 11:41 AM) Seems periodical rebates is needed to achieve 2.4% p.a. Yeah, quite normal for MMF, since dividends are actually paid out of the unit NAV (it's same for dividend paying stocks, stock price will drop when dividends paid out).Also, given their explanation, seems like I don't need to concern myself too much with deposit date and withdrawal date missing dividend date as it would be reflected in unit price. Generally MMF will perform better than average fixed deposit rates, so if you look at fixed deposits on offer in the market it's a rough benchmark for what the projected % p.a. rate will be. For both Versa and SA Simple they apparently get rebates from their respective fund houses so they can give a higher projected rate than the fund's projected performance. This post has been edited by DragonReine: Mar 24 2021, 11:50 AM blackchides and Hoshiyuu liked this post

|

|

|

Mar 27 2021, 08:22 PM Mar 27 2021, 08:22 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(blackchides @ Mar 27 2021, 07:01 PM) General question - do we expect MMF returns to increase when BNM eventually raises the interest rates? MMF and FD's both affected by raised interest rates so they'll likely move up at similar pace.Basically, will there come a point in time when FD returns will be higher than Versa/Simple? My understanding is that MMFs have holdings in FDs anyway, so I would expect the returns to also move up in step with any interest rate hike? blackchides liked this post

|

|

|

Mar 27 2021, 08:24 PM Mar 27 2021, 08:24 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(thecurious @ Mar 27 2021, 08:13 PM) Havent seen a MMF that has a higher return than FD, if there is, please share as well. Versa and StashAway Simple both give higher projected returns than current non-promotional-rate FD, at least for the moment, because both have rebates from their respective fund houses that they pass on down to users.MMF returns depend on interest rates so it should go up in theory if BNM raise the base rate. This post has been edited by DragonReine: Mar 27 2021, 08:25 PM |

|

|

Mar 28 2021, 09:23 AM Mar 28 2021, 09:23 AM

Return to original view | IPv6 | Post

#25

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(thecurious @ Mar 27 2021, 11:21 PM) Thanks Dragon and Xander, should have mentioned promo FD rates. I see the returns for SA simple and versa are higher than non-promo FD rates tho but not higher than promo rates. Promo FDs usually only for certain tenure and require a fairly big sum of investment of at least several thousand "fresh funds" (aka money that wasn't initially deposited with that bank). Some only give that promo rate if you buy investment/insurance products which means you need even bigger starting capital. Even regular FD certificate needs at least RM1k usually. Versa/Simple etc. are designed for people who Mind sharing what is Pecef? never heard of it. 1) don't have much capital (since minimum deposit is RM1 haha) 2) want liquidity and don't want to get locked in FD tenures So target audience is different. Both have their uses but obviously if you have the financial capability and don't mind that lock in period, please invest in promo FDs 🤣 thecurious and yklooi liked this post

|

|

|

Mar 28 2021, 01:04 PM Mar 28 2021, 01:04 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(thecurious @ Mar 28 2021, 10:24 AM) Thanks all for the input. If its for liquidity with some earnings, why not high interest savings accounts? Is it because MMF has no requirements to fulfil? Even the lowest requirement one on market (OCBC 360) needs minimum RM500 spend + RM500 deposit + 3 bills to pay. If low income earner/gig worker/student/those who rely on allowance like stay at home spouses it's difficult to hit those requirements. Most other HYCASA requires thousand ringgit spending and deposits. Or if like UOB Stash needs very high balance (several thousand). |

|

|

|

|

|

Mar 29 2021, 05:00 PM Mar 29 2021, 05:00 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

2,610 posts Joined: Aug 2011 |

IMO there's nothing wrong with ths GO+ feature per se, it's nice to earn a few sen with TnG balance especially heavy user. But IMO it's also mostly something to combat the people who complain about how TnG has no cash out and any money put in is wasted 🤣 it's a way to one-up the other major ewallet competitors who have similar problems and to compete against wider DuitNow implementation. So it's not an ideal investment vehicle, but it does it's job at helping retain existing TnG users la yayai liked this post

|

|

|

Mar 31 2021, 10:46 AM Mar 31 2021, 10:46 AM

Return to original view | IPv6 | Post

#28

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(ken_zen @ Mar 31 2021, 10:27 AM) hi, i deposited Versa on 28/3 and today the status still showing awaiting processing. Is this normal? Normal. For deposits they take around 2 to 3 biz days to complete from receiving the FPX deposit to invest in MMF. 28/3 Sunday non biz day, so should finish later today once money is invested into MMF and they'll reflect in Versa.If not then better call customer service and check This post has been edited by DragonReine: Mar 31 2021, 10:47 AM |

|

|

Apr 1 2021, 02:37 PM Apr 1 2021, 02:37 PM

Return to original view | IPv6 | Post

#29

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Icon01 @ Apr 1 2021, 02:27 PM) Newbie here. I am starting to notice there are many players now for MMF. So far which are the better choice below; in your opinion. Also, are there more options available besides the 3 I've named? IMO Versa best because fastest relative to gains (StashAway slow withdrawal at least 3 biz days to arrive back in bank account, TnG GO+ fast transaction but gains bad)1. StashAway Simple 2. Versa 3. TnG GO+ You can invest in MMFs through conventional investment platforms like Public Mutual, Affin Hwang, HLAM, FSMOne etc. Just that compared to the 3 you listed, starting capital + minimum deposit is quite high. The three options you listed because they essentially "pool" users money together and invest on behalf, you can deposit as low as RM1. Also I recall FSMOne go their own MMF called Cash Solutions, but I never used so I'm not familiar. This post has been edited by DragonReine: Apr 1 2021, 02:40 PM ktek liked this post

|

|

|

Apr 1 2021, 04:04 PM Apr 1 2021, 04:04 PM

Return to original view | IPv6 | Post

#30

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(ChessRook @ Apr 1 2021, 03:47 PM) "projected" isn't really useful indicator of how much funds will returnMMFs fluctuates like any other unit trust, just that fluctuation isn't very high. If you want to guess at MMF returns, you need to study the past distribution, YTD, 3-months and 1 year returns. Versa's partner fund HWAEDEP at the moment is leading ahead of StashAway Simple's PRUISIN very slightly. |

|

|

Apr 2 2021, 01:04 PM Apr 2 2021, 01:04 PM

Return to original view | IPv6 | Post

#31

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Icon01 @ Apr 2 2021, 12:31 PM) Just wondering how does it work and how Versa gains better than StashAway. From what I read on their respective website. Don't read Versa and StashAway's projected rates. They're predictions that look nice to attract customers. The real tracking is following the underlying funds HWAEDEP and PRUISIN, you can follow on sites like MorningStar. Study the 1M, 3M, YTD and 1Y returns, look at the portfolio, and you can make a more educated guess on the actual returns.Versa's interest is 2.46% minus 0.30% Management Fee and 0.05% Trustee Fee = 2.11% Whereas, StashAway interest is 2.4% minus 0.165% Management Fee = 2.23% PRUISIN (StashAway Simple): https://my.morningstar.com/my/report/fund/p...px?t=0P0000GEZP HWAEDEP (Versa): https://my.morningstar.com/my/report/fund/p...px?t=0P00008ME1 PRUISIN's heavier weight in deposits is most likely going to bite the fund's earnings unless low interest environment improves abruptly in later half of the year |

|

|

Apr 2 2021, 05:13 PM Apr 2 2021, 05:13 PM

Return to original view | IPv6 | Post

#32

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Apr 2 2021, 05:20 PM Apr 2 2021, 05:20 PM

Return to original view | IPv6 | Post

#33

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(blackchides @ Apr 2 2021, 04:43 PM) Agreed with the above. I'm only using Simple for simplicity in transferring into their main Stashaway ETF portfolios. Park lump sum into Simple to DCA and forget. Could do it manually but too lazy for that small diff in %. To think that in those days for those who don't like conditional high yield accounts the best we could do was FD laddering trick to get this level of % earnings without sacrificing liquidity too much But otherwise, Versa is main MMF for me. Where were all these low-barrier money management/investment platforms all those years ago? All the youngsters coming in now have it good lol. This post has been edited by DragonReine: Apr 2 2021, 05:21 PM |

|

|

|

|

|

Apr 7 2021, 02:25 PM Apr 7 2021, 02:25 PM

Return to original view | IPv6 | Post

#34

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(DragonReine @ Feb 22 2021, 03:01 PM) Currently using both. Have put in roughly equal amount of money to track their individual performance. Update almost 2 months later: Initially started at RM2k first with Versa and RM2000.25 in SASimple Been depositing same amount on same day (every Monday morning) on both currently Versa has managed to go past SASimple and has higher balance now Will continue my experiment for next few months to see if the gap will widen between Versa and Simple, or if there won't be much difference in long run Hoshiyuu, bokbokchai, and 4 others liked this post

|

|

|

Apr 7 2021, 05:28 PM Apr 7 2021, 05:28 PM

Return to original view | IPv6 | Post

#35

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Apr 7 2021, 06:02 PM Apr 7 2021, 06:02 PM

Return to original view | IPv6 | Post

#36

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Apr 7 2021, 07:25 PM Apr 7 2021, 07:25 PM

Return to original view | IPv6 | Post

#37

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Apr 8 2021, 08:05 PM Apr 8 2021, 08:05 PM

Return to original view | IPv6 | Post

#38

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(TOS @ Apr 8 2021, 07:50 PM) FSM's RHB CMF2 only saw passing mention in first page of this thread. So it's worse than the 3 mentioned above? I am using RHB CMF2 for now, but thinking of switching if there are other better options. CMF2 a teeny bit better than Simple and GO+ but I don't think can beat Versa's HWAEDEP base This post has been edited by DragonReine: Apr 8 2021, 08:06 PM TOS liked this post

|

|

|

Apr 9 2021, 12:49 AM Apr 9 2021, 12:49 AM

Return to original view | IPv6 | Post

#39

|

Senior Member

2,610 posts Joined: Aug 2011 |

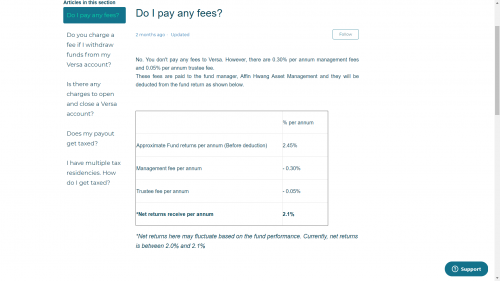

QUOTE(TOS @ Apr 8 2021, 08:37 PM) Before further comments. Just to double confirm. After fees the projected rate 2021 is something like 2.15 to 2.2%, based on my speculation and the 1M/3M/YTD performance. 2.45% is 2020's final rate after feeshttps://support.versa.com.my/hc/en-us/artic...I-pay-any-fees-  So, 2.45% p.a. is the fund's actual return (for illustration purpose of course, return fluctuates all the time), management fee and trustee fee are the fund's fee right? (So far I check with the fund's interim and annual report, the 2 fees tally in number). https://nadiablob.blob.core.windows.net/fun...2FIR_EDFHCF.pdf So Versa does not take any upfront cost? (except that they take trailer fee back-end) If this is the case, Versa actually beats RHB CMF2 by dozens or scores of basis points. https://my.morningstar.com/my/screener/fund...&sortOrder=desc Consistent performance for past 10 years, always in top quartile. It seem RHB failed to hire good fund managers even for their safest fund and yep, Versa takes no upfront cost or fees This post has been edited by DragonReine: Apr 9 2021, 08:33 AM TOS liked this post

|

|

|

Apr 9 2021, 01:02 AM Apr 9 2021, 01:02 AM

Return to original view | IPv6 | Post

#40

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(ziiriium @ Apr 8 2021, 10:05 PM) In my opinion: Versa ask few private and confidential questions during new account opening. To avoid money laundering, I think deposit only from bank account with same name is enough. Versa ask the name of the company we work, job title and salary. Due to this few questions, I decided NOT to migrate my money market fund from FSM to Versa. FSM does this too. It's part of country's measures to prevent money laundering and opening of mule accounts. Registered fintech and financial entities all have to do this. |

| Change to: |  0.0463sec 0.0463sec

0.33 0.33

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 09:24 PM |