QUOTE(shawnme @ Apr 14 2021, 07:58 PM)

HI, thanks... I want to know the minimal amount of days needed for deposit to get 1 day interest prior to withdrawal.

I was just wondering which are the days that interest will be accrued, but now I'm a little confused. A few post earlier, I understand that 'processing' status does not accrue interest. Hence, in the scenario below, no interest will be accrued.

However, based your explanation, in this new example below, there will be 1 day (Tuesday) interest accrued.

Mon - deposit 9am (processing)

Tue - processing

Wed - balance shown -> withdraw 9am

Thu - received in bank

Total earnings = 1 day interest

*besides, since it's payout every fortnight, I can't experiment like I do with Go+

If based strictly on Versa's declared policy, Xander's words are incorrect because Versa calculates only based on days it's reflected in balance

In fact the way you're going about by doing withdrawal before dividend payout, you cannot pakai the idea of "interest"

How MMF works:

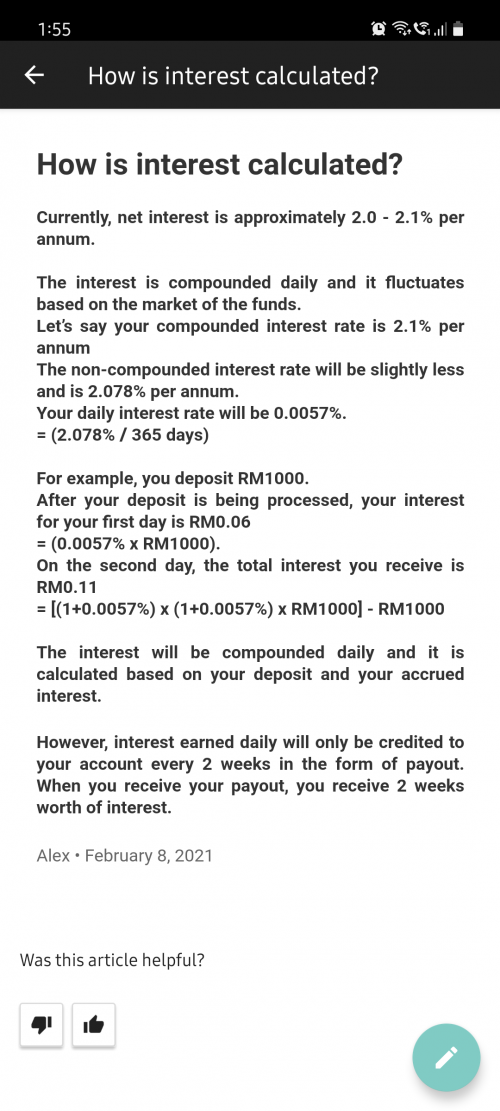

1) When you "deposit" money into Versa, you buy units at the net asset value (NAV) for the day the units are booked for you

2) As you hold into those units, profits slowly increase, which will reflect in

NAV of each unit which will increase as profits are calculated into the NAV 3) On the day of distribution, the fund will

deduct the profits accrued from NAV and pay out in the form of cash (dividend) which Versa auto reinvests as units. The amount they pay is depending on the number of units you hold on dividend calculation day (example: if you hold 10000 units on distribution calculation date, and distribution is 0.0009 sen per unit, you get 0.0009 x 10000 = 9 sen). So your NAV per unit goes down, but the number of units go up, so you've profited in terms of number of units (and why your balance won't exactly change).

4) If, however, you deposit and then withdraw shortly after you buy units BEFORE dividend payout date, what happens is that usually you actually

sell your units off at a higher NAV, so you effectively "earn interest" because you bought lower and sell higher. If you want to know if you've earned interest, you can look at the NAV price booked during your deposit processing vs the NAV price when your withdrawal is processed.

5) The every two week dividend will only pay based on number of units you have on dividend day, but if you withdraw in the case of #4 you essentially got your dividend/profit early.

Hope that makes sense to you.

This post has been edited by DragonReine: Apr 14 2021, 09:19 PM

Apr 13 2021, 12:42 AM

Apr 13 2021, 12:42 AM

Quote

Quote

0.0508sec

0.0508sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled