Any comments ? Low entry .. i am thinking of it ...

Ubb Trustfund covid19 6.5%

|

|

May 5 2020, 01:54 AM, updated 6y ago May 5 2020, 01:54 AM, updated 6y ago

Show posts by this member only | IPv6 | Post

#1

|

Junior Member

52 posts Joined: Jan 2012 |

spleong liked this post

|

|

|

|

|

|

May 5 2020, 03:04 AM May 5 2020, 03:04 AM

Show posts by this member only | IPv6 | Post

#2

|

Junior Member

316 posts Joined: May 2015 |

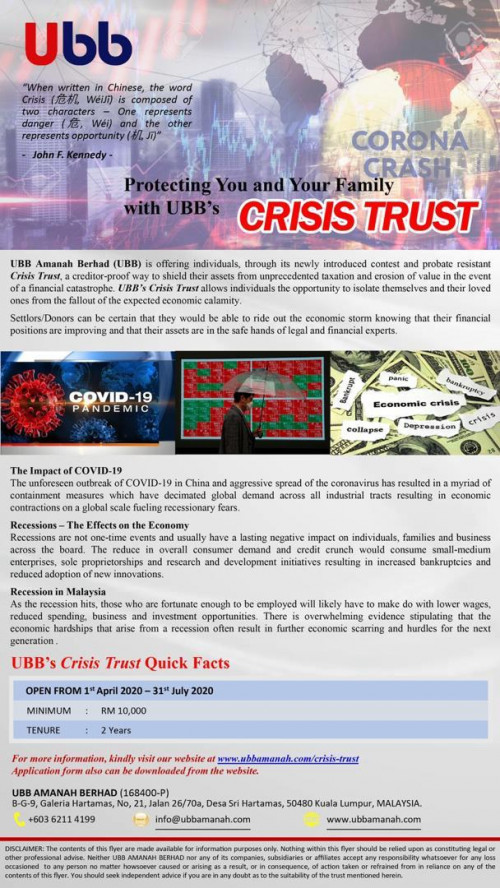

What's this? On one hand this looks like a family trust structured product + unit trust? Or it is just family trust setup?

|

|

|

May 5 2020, 06:45 AM May 5 2020, 06:45 AM

Show posts by this member only | Post

#3

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(curmbox @ May 5 2020, 01:54 AM) even thought is has lower entry amount,......do check out the annual fees to be charged per annumhttps://www.ubbamanah.com/crisis-trust https://www.ubbamanah.com/cash-trust and do take note of the word "Projected" as in Projected Profit share"...thus is just a projected number This post has been edited by MUM: Jul 24 2020, 01:03 AM Attached thumbnail(s)

|

|

|

May 5 2020, 06:55 AM May 5 2020, 06:55 AM

Show posts by this member only | IPv6 | Post

#4

|

Senior Member

623 posts Joined: Dec 2006 |

6.5? Where does it say and how they forecast?

|

|

|

May 5 2020, 10:08 AM May 5 2020, 10:08 AM

Show posts by this member only | IPv6 | Post

#5

|

Senior Member

2,337 posts Joined: Oct 2014 |

QUOTE(MUM @ May 5 2020, 06:45 AM) even thought is has lower entry amount,......do check out the annual fees to be charged per annum Wow, thanks for the headsup, I almost called them.https://www.ubbamanah.com/crisis-trust https://www.ubbamanah.com/cash-trust |

|

|

May 5 2020, 05:23 PM May 5 2020, 05:23 PM

Show posts by this member only | IPv6 | Post

#6

|

Junior Member

52 posts Joined: Jan 2012 |

QUOTE(MUM @ May 5 2020, 06:45 AM) even thought is has lower entry amount,......do check out the annual fees to be charged per annum Wow thank you for pointing that out, really appreciated. I will check about this too and share for any updatehttps://www.ubbamanah.com/crisis-trust https://www.ubbamanah.com/cash-trust |

|

|

|

|

|

May 6 2020, 07:44 AM May 6 2020, 07:44 AM

Show posts by this member only | IPv6 | Post

#7

|

Junior Member

52 posts Joined: Jan 2012 |

Sorry guys the there was a ss here before but i want to take it down . my fren dont need the conflict.

This what the agent said.. what do you guys think ? legit or not ? This post has been edited by curmbox: May 7 2020, 11:23 AM |

|

|

May 6 2020, 09:17 AM May 6 2020, 09:17 AM

Show posts by this member only | Post

#8

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(curmbox @ May 6 2020, 07:44 AM) ask why it is not stated in the website?will this 6.5% be in the agreement? whp will be responsible if the 6.5% is not being given? how to seek justice if this 6.5% is not being given? btw, how much is theannual feees per year? ( they can gives 20% pa,...but charges you 19% pa annual fees too) ha-ha. |

|

|

May 6 2020, 09:53 AM May 6 2020, 09:53 AM

Show posts by this member only | IPv6 | Post

#9

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

|

|

|

May 6 2020, 02:17 PM May 6 2020, 02:17 PM

|

Senior Member

2,113 posts Joined: Jul 2013 |

QUOTE(yklooi @ May 6 2020, 09:17 AM) ask why it is not stated in the website? Everything need to be B&W, only can be trusted.will this 6.5% be in the agreement? whp will be responsible if the 6.5% is not being given? how to seek justice if this 6.5% is not being given? btw, how much is theannual feees per year? ( they can gives 20% pa,...but charges you 19% pa annual fees too) ha-ha. |

|

|

May 7 2020, 11:21 AM May 7 2020, 11:21 AM

Show posts by this member only | IPv6 | Post

#11

|

Junior Member

52 posts Joined: Jan 2012 |

QUOTE(yklooi @ May 6 2020, 09:17 AM) ask why it is not stated in the website? I didn't get a straight answer.will this 6.5% be in the agreement? whp will be responsible if the 6.5% is not being given? how to seek justice if this 6.5% is not being given? btw, how much is theannual feees per year? ( they can gives 20% pa,...but charges you 19% pa annual fees too) ha-ha. anyways after my due diligence i have decided to not pursue this. I have talked to a few financial advisers who share the same sentiment as alot of you bros here Thank you for sharing . Please dont pursue this based on my posting. I need to take down this ss as the agent is someone my fren know personally and dont want to conflict . This post has been edited by curmbox: May 7 2020, 11:24 AM |

|

|

May 7 2020, 11:25 AM May 7 2020, 11:25 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(curmbox @ May 7 2020, 11:21 AM) I didn't get a straight answer. then would it be better for you to "close" this thread?anyways after my due diligence i have decided to not pursue this. I have talked to a few financial advisers who share the same sentiment as alot of you bros here Thank you for sharing . Please dont pursue this based on my posting. I need to take down this ss as the agent is someone i know personally and dont want to conflict . |

|

|

May 7 2020, 11:34 AM May 7 2020, 11:34 AM

|

Junior Member

261 posts Joined: Apr 2020 |

I'd rather stick to government controlled banks during the era of CCP and world oil price crisis.

|

|

|

|

|

|

Jun 15 2020, 12:37 PM Jun 15 2020, 12:37 PM

|

Newbie

37 posts Joined: Feb 2019 |

places cash trust in 2017 now expiring on september, for 2 years receive what they promised me. kalau tak dpat duit aku balik memang aku bising lah. now thinking of renew but now cash trust rate drop d.

This crisis trust not sure yet. cukup duit nak try cuz 2 years only and 10k onli mah. cash trust 60k. |

|

|

Jun 15 2020, 12:39 PM Jun 15 2020, 12:39 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(cloudy_eye @ Jun 15 2020, 12:37 PM) places cash trust in 2017 now expiring on september, for 2 years receive what they promised me. kalau tak dpat duit aku balik memang aku bising lah. now thinking of renew but now cash trust rate drop d. you have been 2 yrs with them....what is the actual return per annum?This crisis trust not sure yet. cukup duit nak try cuz 2 years only and 10k onli mah. cash trust 60k. the rate is MINUS all other fees? This post has been edited by T231H: Jun 15 2020, 12:41 PM |

|

|

Jun 15 2020, 02:48 PM Jun 15 2020, 02:48 PM

|

Newbie

37 posts Joined: Feb 2019 |

QUOTE(T231H @ Jun 15 2020, 12:39 PM) you have been 2 yrs with them....what is the actual return per annum? cash trust 1st year 7% 2 year 7% and final year i receive my capital plus final year 7%, so far so good la. the rate is MINUS all other fees? only crisis trust havent tried cus MCO NO MONEY ALL SPEND D. now waiting september to receive my capital. i read the agreement the penalty quite mahal about 10% from capital. btw the 7% they gave me said to be nett off all fees. i dont complain much as they held up their promise toughout the years w them. will give an update when i receive my capital back in sept This post has been edited by cloudy_eye: Jun 15 2020, 02:49 PM |

|

|

Jun 15 2020, 02:53 PM Jun 15 2020, 02:53 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(cloudy_eye @ Jun 15 2020, 02:48 PM) cash trust 1st year 7% 2 year 7% and final year i receive my capital plus final year 7%, so far so good la. only crisis trust havent tried cus MCO NO MONEY ALL SPEND D. now waiting september to receive my capital. i read the agreement the penalty quite mahal about 10% from capital. btw the 7% they gave me said to be nett off all fees. i dont complain much as they held up their promise toughout the years w them. will give an update when i receive my capital back in sept |

|

|

Jun 15 2020, 06:01 PM Jun 15 2020, 06:01 PM

|

Newbie

37 posts Joined: Feb 2019 |

QUOTE(T231H @ Jun 15 2020, 02:53 PM) altough the penalty damn high. i think its okay since the trustee fee is not affecting me if i complete the whole tenure. only early termination will cut my throat.. for what its worth, talking from experience. i think they are doing good throughout the years.. only now people started to notice them. |

|

|

Jun 15 2020, 06:04 PM Jun 15 2020, 06:04 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(cloudy_eye @ Jun 15 2020, 06:01 PM) True, for my cash trust account i want to continue, just let it sit as emergency funds there. Use that to store emergency fund?... You mentioned high premature penalty....altough the penalty damn high. i think its okay since the trustee fee is not affecting me if i complete the whole tenure. only early termination will cut my throat.. for what its worth, talking from experience. i think they are doing good throughout the years.. only now people started to notice them. I think more will turn to that if they are more open in publishing the real return n any hidden fees... Currently they mostly mention abt %of yield.... Then it display the annual charges.... Did not mention abt whether the displayed yield is before or after the mgmt fees. This post has been edited by T231H: Jun 15 2020, 06:08 PM |

|

|

Jun 17 2020, 10:06 AM Jun 17 2020, 10:06 AM

|

Newbie

37 posts Joined: Feb 2019 |

QUOTE(T231H @ Jun 15 2020, 06:04 PM) Use that to store emergency fund?... You mentioned high premature penalty.... memang emergency fund, but not for me, for my family if i mati katak. I think more will turn to that if they are more open in publishing the real return n any hidden fees... Currently they mostly mention abt %of yield.... Then it display the annual charges.... Did not mention abt whether the displayed yield is before or after the mgmt fees. rather than wait for my wasiat which might cause dispute later among siblings. also to give my family also no need to hire a lawyer. sometimes wasiat process can take superduper long. for my own use of emergency fund i put in bank la senang nak keluarkan. This post has been edited by cloudy_eye: Jun 17 2020, 10:06 AM |

|

|

Jun 17 2020, 10:10 AM Jun 17 2020, 10:10 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(cloudy_eye @ Jun 17 2020, 10:06 AM) memang emergency fund, but not for me, for my family if i mati katak. rather than wait for my wasiat which might cause dispute later among siblings. also to give my family also no need to hire a lawyer. sometimes wasiat process can take superduper long. for my own use of emergency fund i put in bank la senang nak keluarkan. also, do update us on the status of your money in Sept, (upon maturity)....will you?? like example, how long it takes to get the money back, any other charges incured and the total returns for this 2 yrs tenure trust fund deposits. |

|

|

Jun 17 2020, 01:02 PM Jun 17 2020, 01:02 PM

|

Newbie

37 posts Joined: Feb 2019 |

QUOTE(T231H @ Jun 17 2020, 10:10 AM) also, do update us on the status of your money in Sept, (upon maturity)....will you?? like example, how long it takes to get the money back, any other charges incured and the total returns for this 2 yrs tenure trust fund deposits. |

|

|

Jul 11 2020, 08:01 PM Jul 11 2020, 08:01 PM

Show posts by this member only | IPv6 | Post

#23

|

Newbie

5 posts Joined: Oct 2009 |

How does one apply for this. Online or need to go to BIMB?

|

|

|

Aug 3 2020, 11:27 AM Aug 3 2020, 11:27 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

I was engaged by UBB as well. Can’t really say I would invest into it as there is no factsheet to proof how this 6.5% is given especially with a high initial charge 4.5%. Take it at your own risk. NB01 liked this post

|

|

|

Aug 3 2020, 11:35 AM Aug 3 2020, 11:35 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

just a note:

no response after emailing 2 times since 2 month ago there is no response from DCS private trust about this guaranteed returns and annual fees questions.... guess they does not want to go public with it..... guess have to go thru what the agent tells you and read the agreement/contract fine print after signing up. |

|

|

Aug 3 2020, 12:50 PM Aug 3 2020, 12:50 PM

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(HJK_93 @ Aug 3 2020, 12:40 PM) Hi, thank you for your interest and enquiry. thanks for providing the above inputs... 1) How much guaranteed returns per annum for this one? - This is a government bond investment, and no company regulated by BNM can give you a “guaranteed” return for this investment. However, based on the track record, investors had been honoured with returns averaging from 5% and above. Government bond investment is not as volatile as stock market so I cannot tell you the returns are “guaranteed” but it is stable and had shown that it’s going the right direction. 2) How much annual fees for this one? - There is no annual fee for this investment. The only charge applied is a one time 3.75% for administration and commission charges. There is absolutely no other hidden fee, .............. 3) Is there sales charges for this one? - As mentioned above, other than the one time 3.75% charges, there is absolutely no other charges. You will also get extra tax exemption of up to RM 1000 yearly. ................ Regards, Kong thus SC of 3.75% is about 0.75% pa over 5 yrs....(3.75/5=0.75) 5% pa - 0.75% = 4.25% pa of possible returns btw, what is the extra tax exemption of RM1000 yearly from/for/how? This post has been edited by MUM: Aug 3 2020, 12:51 PM |

|

|

Aug 3 2020, 01:26 PM Aug 3 2020, 01:26 PM

|

Probation

4 posts Joined: Aug 2020 |

QUOTE(MUM @ Aug 3 2020, 12:50 PM) thanks for providing the above inputs... You’re most welcome. The tax exemption is for you or anyone that is still paying income tax yearly. It works just like life insurance product, because you’re actually getting a product licensed by insurance company. And PIDM protection for investment is up to RM 500k, whereas life insurance product only up to RM 250k.thus SC of 3.75% is about 0.75% pa over 5 yrs....(3.75/5=0.75) 5% pa - 0.75% = 4.25% pa of possible returns btw, what is the extra tax exemption of RM1000 yearly from/for/how? Note: The 5% is only a projected return, because I’m not here to convince you or anyone that this is the best investment, we have honoured higher return but it’s always depending on the performance of the market. In this case, our government bond had shown really strong ability in competing, because of the fantastic job they did to contain the pandemic. I, myself is a very conservative investor, and I take every investors’ money very seriously because it’s all our blood and sweat money. 💪 |

|

|

Aug 3 2020, 01:31 PM Aug 3 2020, 01:31 PM

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(HJK_93 @ Aug 3 2020, 01:26 PM) You’re most welcome. The tax exemption is for you or anyone that is still paying income tax yearly. It works just like life insurance product, because you’re actually getting a product licensed by insurance company. And PIDM protection for investment is up to RM 500k, whereas life insurance product only up to RM 250k. thanks for clarifying again. Note: The 5% is only a projected return, because I’m not here to convince you or anyone that this is the best investment, we have honoured higher return but it’s always depending on the performance of the market. In this case, our government bond had shown really strong ability in competing, because of the fantastic job they did to contain the pandemic. I, myself is a very conservative investor, and I take every investors’ money very seriously because it’s all our blood and sweat money. 💪 wish to hear from you again, btw, i think you have reached your daily posts of 3 (for new forummer that is under probation) |

|

|

Aug 13 2020, 09:47 PM Aug 13 2020, 09:47 PM

Show posts by this member only | IPv6 | Post

#29

|

Senior Member

1,904 posts Joined: Jan 2003 From: Kelana Jaya , Petaling Jaya |

is just on projected return no guaranteed return. so are different terms over here.

|

|

|

Sep 25 2020, 04:09 PM Sep 25 2020, 04:09 PM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

I bought the cash trust 2 years ago and already had my return 7% for both years. This year they are giving 6% according to my agent as the worldwide economy had fallen. I would say pretty good compared with the FD interest rate at 1.5-1.8%

The annual fee can ignore as the return they give you is already net of all fees. So far the trust deed there already mentioned a minimum 6-8% return. I feel its pretty safe la. I had bought another education trust from them as well and renewed mine, also around 7% return annually. If anyone interested to know more, can PM me. I can recommend my service agent as he is pretty good. |

|

|

Sep 25 2020, 04:25 PM Sep 25 2020, 04:25 PM

Show posts by this member only | IPv6 | Post

#31

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(jonathanchee315 @ Sep 25 2020, 04:09 PM) I bought the cash trust 2 years ago and already had my return 7% for both years. This year they are giving 6% according to my agent as the worldwide economy had fallen. I would say pretty good compared with the FD interest rate at 1.5-1.8% The annual fee can ignore as the return they give you is already net of all fees. So far the trust deed there already mentioned a minimum 6-8% return. I feel its pretty safe la. I had bought another education trust from them as well and renewed mine, also around 7% return annually. If anyone interested to know more, can PM me. I can recommend my service agent as he is pretty good. you mentioned that the returns is net of annual fees ....how many % is the annual fees? how long is your UBB cash trust contracted terms of deposit duration? |

|

|

Sep 25 2020, 04:30 PM Sep 25 2020, 04:30 PM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

QUOTE(yklooi @ Sep 25 2020, 04:25 PM) you mentioned that the returns is net of annual fees ....how many % is the annual fees? how long is your UBB cash trust contracted terms of deposit duration? annual fee if not wrong is 3.5% , but my agent tell you can ignore that as the return you get is net of all fees meaning the 6-8% return they write inside the trust deed is already minus of the management fee or annual fee they call it. for the cash trust is 36 months which is 3 years. Going matured in October next month, which I intend to renew cause now the FD so low, can just treat this trust fund as an FD. My previous one education trust also from same agent and UBB already matured and got all my 3 years return and capital. But after that I put in again cause the dissapointing FD rate. Should have just renew then can save some admin cost and stamp duty fee haha. |

|

|

Sep 25 2020, 04:36 PM Sep 25 2020, 04:36 PM

Show posts by this member only | IPv6 | Post

#33

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(jonathanchee315 @ Sep 25 2020, 04:30 PM) Yeah , it is governed by trust act which are under Bank negara malaysia . Inside the trust deed there got mention about what kind of things or fund they can invest in which are needed to approve by MOF or BNM. annual fee if not wrong is 3.5% , but my agent tell you can ignore that as the return you get is net of all fees meaning the 6-8% return they write inside the trust deed is already minus of the management fee or annual fee they call it. for the cash trust is 36 months which is 3 years. Going matured in October next month, which I intend to renew cause now the FD so low, can just treat this trust fund as an FD. My previous one education trust also from same agent and UBB already matured and got all my 3 years return and capital. But after that I put in again cause the dissapointing FD rate. Should have just renew then can save some admin cost and stamp duty fee haha. 7%pa nett....when will FD go to 7% rate again... good for you. get your parents to withdraw their KWSP and put inside there? even KWSP will be lower than 7% nett pa for the near future.... This post has been edited by yklooi: Sep 25 2020, 04:55 PM |

|

|

Sep 26 2020, 11:30 AM Sep 26 2020, 11:30 AM

|

Junior Member

391 posts Joined: Feb 2020 |

This UBB trust fund is stable? Banks have PIDM. What about this?

|

|

|

Sep 27 2020, 06:34 AM Sep 27 2020, 06:34 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Sep 27 2020, 08:38 AM Sep 27 2020, 08:38 AM

Show posts by this member only | IPv6 | Post

#36

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(xander83 @ Sep 27 2020, 06:34 AM) Was mentioned in fd tread...Go for both Islamic and conventional one of the same bank if can... Then the pidm protection will be 250k x 2. Do that for other banks too... Then the pidm coverage will be alot of millions... |

|

|

Sep 27 2020, 03:57 PM Sep 27 2020, 03:57 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(T231H @ Sep 27 2020, 08:38 AM) Was mentioned in fd tread... Only stupid ppl would do that as it make that person even poorer Go for both Islamic and conventional one of the same bank if can... Then the pidm protection will be 250k x 2. Do that for other banks too... Then the pidm coverage will be alot of millions... This post has been edited by xander83: Sep 27 2020, 03:59 PM |

|

|

Sep 27 2020, 04:15 PM Sep 27 2020, 04:15 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(xander83 @ Sep 27 2020, 03:57 PM) Why would seeking pidm protection is stupid?Your earlier post mentioned pidm is for 250k only... One can increase pidm amount by doing that... What other way can increase pidm protection amount and not stupid? |

|

|

Sep 27 2020, 04:32 PM Sep 27 2020, 04:32 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(T231H @ Sep 27 2020, 04:15 PM) Why would seeking pidm protection is stupid? Basically if you study economics and finance PIDM is for stupid ppl to lose their money through inflation and make banks and insurance richer Your earlier post mentioned pidm is for 250k only... One can increase pidm amount by doing that... What other way can increase pidm protection amount and not stupid? There’s are so many to protect your wealth and yet make money at the same time which you need to learn and read more instead of just asking only |

|

|

Sep 27 2020, 04:42 PM Sep 27 2020, 04:42 PM

Show posts by this member only | IPv6 | Post

#40

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(xander83 @ Sep 27 2020, 04:32 PM) Basically if you study economics and finance PIDM is for stupid ppl to lose their money through inflation and make banks and insurance richer why do you answer coronaV with that below post?There’s are so many to protect your wealth and yet make money at the same time which you need to learn and read more instead of just asking only CoronaV asked about PIDM,...NOT about how to be NOT eaten by inflation.... btw, why 250k and not more? max 250k in FD will not be stupid and ppl will not lose their money through inflation and make banks and insurance richer? QUOTE(CoronaV @ Sep 26 2020, 11:30 AM) QUOTE(xander83 @ Sep 27 2020, 06:34 AM) This post has been edited by T231H: Sep 27 2020, 04:45 PM |

|

|

Sep 27 2020, 08:04 PM Sep 27 2020, 08:04 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(T231H @ Sep 27 2020, 04:42 PM) why do you answer coronaV with that below post? 250k was set by Central Bank of MalaysiaCoronaV asked about PIDM,...NOT about how to be NOT eaten by inflation.... btw, why 250k and not more? max 250k in FD will not be stupid and ppl will not lose their money through inflation and make banks and insurance richer? Go study from the best of the best and they will tell you a lesson to learn The banks and insurance will just take and never give back fairly which is why you will realise why the rich is getting richer Go read and learn more instead of asking questions as I believe you will still got a lot to learn instead asking and getting spoonfed as I myself still learning and growing everyday |

|

|

Sep 27 2020, 08:32 PM Sep 27 2020, 08:32 PM

Show posts by this member only | IPv6 | Post

#42

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(xander83 @ Sep 27 2020, 08:04 PM) 250k was set by Central Bank of Malaysia yes, go learn more from the FD thread...to know more as to why people put money in FD instead of calling people stupid for the things you don't understand fullyGo study from the best of the best and they will tell you a lesson to learn The banks and insurance will just take and never give back fairly which is why you will realise why the rich is getting richer Go read and learn more instead of asking questions as I believe you will still got a lot to learn instead asking and getting spoonfed as I myself still learning and growing everyday |

|

|

Sep 27 2020, 08:46 PM Sep 27 2020, 08:46 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Sep 27 2020, 08:50 PM Sep 27 2020, 08:50 PM

Show posts by this member only | IPv6 | Post

#44

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(T231H @ Sep 27 2020, 04:42 PM) why do you answer coronaV with that below post? kena kantoi liao CoronaV asked about PIDM,...NOT about how to be NOT eaten by inflation.... btw, why 250k and not more? max 250k in FD will not be stupid and ppl will not lose their money through inflation and make banks and insurance richer? |

|

|

Sep 27 2020, 08:56 PM Sep 27 2020, 08:56 PM

Show posts by this member only | IPv6 | Post

#45

|

All Stars

12,387 posts Joined: Feb 2020 |

So this trust fund is safe?

|

|

|

Sep 27 2020, 10:26 PM Sep 27 2020, 10:26 PM

|

Senior Member

2,361 posts Joined: Feb 2008 |

"confirm 6.5%".. wow. even we cannot confirm who is the prime minister.

|

|

|

Sep 28 2020, 09:53 AM Sep 28 2020, 09:53 AM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

|

|

|

Sep 28 2020, 09:59 AM Sep 28 2020, 09:59 AM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

|

|

|

Sep 28 2020, 10:03 AM Sep 28 2020, 10:03 AM

Show posts by this member only | IPv6 | Post

#49

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(jonathanchee315 @ Sep 28 2020, 09:59 AM) If it is written under the trust deed agreement then it is true. As its governed by the trust act 1949. the deed agreement mentioned "Projected" or "Guaranteed"?the deed agreement got mention that the "returns" will be nett of annual management fees? if it is not too troublesome,...can you PLEASE share with us the deed agreement ( on the returns and annual management fees things), so as to enable us to delete our fears and doubt ? Thanks This post has been edited by yklooi: Sep 28 2020, 10:08 AM |

|

|

Sep 28 2020, 10:24 AM Sep 28 2020, 10:24 AM

Show posts by this member only | IPv6 | Post

#50

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(yklooi @ Sep 28 2020, 10:03 AM) the deed agreement mentioned "Projected" or "Guaranteed"? while waiting for his response,the deed agreement got mention that the "returns" will be nett of annual management fees? if it is not too troublesome,...can you PLEASE share with us the deed agreement ( on the returns and annual management fees things), so as to enable us to delete our fears and doubt ? Thanks you can try read post 25 & 36 of this thread Ubb CASH TRUST 3 years nett 6-8% pa anyone?, UBB Amanah Bhd https://forum.lowyat.net/topic/4801818/+20 it most probably has the answers .... |

|

|

Sep 28 2020, 10:36 AM Sep 28 2020, 10:36 AM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

QUOTE(yklooi @ Sep 28 2020, 10:03 AM) the deed agreement mentioned "Projected" or "Guaranteed"? The deed mentioned it need to be invest on authorised investment and fund which give safeguard of the capital and comes with projected return of the percentage. Hence its very much safe that their investment need to give you 2 thing safeguard of your capital and return of the percentage as mentioned. the deed agreement got mention that the "returns" will be nett of annual management fees? if it is not too troublesome,...can you PLEASE share with us the deed agreement ( on the returns and annual management fees things), so as to enable us to delete our fears and doubt ? Thanks In my personal opinion la, if need to mentioned guarantee then might as well bank no need to do FD already. At the end of the day, it is still an investment. At least this is safe guarded capital and mentioned investment that which must give a projected return on the percentage mentioned and so far it did hold up to its promises. The original trust deed is in my safebox though , this is what I could share base on my own personal experience, cashing out once and the current one with 2 years 7% return in my pocket already. If I am right , it is the same as one of the forumer share here already on the picture he snapped. The annual management fee is 3.5% per annum , but then it is net of all fees for the annual return we get. So , you shoudnt worried on the management fees though. I would say the downside of this trust fund is that it lock you up for 2-3 years and the penalty if cashing out early which is 10-8% charges. |

|

|

Sep 28 2020, 10:47 AM Sep 28 2020, 10:47 AM

Show posts by this member only | IPv6 | Post

#52

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(jonathanchee315 @ Sep 28 2020, 10:36 AM) The deed mentioned it need to be invest on authorised investment and fund which give safeguard of the capital and comes with projected return of the percentage. Hence its very much safe that their investment need to give you 2 thing safeguard of your capital and return of the percentage as mentioned. thanks for responding...In my personal opinion la, if need to mentioned guarantee then might as well bank no need to do FD already. At the end of the day, it is still an investment. At least this is safe guarded capital and mentioned investment that which must give a projected return on the percentage mentioned and so far it did hold up to its promises. The original trust deed is in my safebox though , this is what I could share base on my own personal experience, cashing out once and the current one with 2 years 7% return in my pocket already. If I am right , it is the same as one of the forumer share here already on the picture he snapped. The annual management fee is 3.5% per annum , but then it is net of all fees for the annual return we get. So , you shoudnt worried on the management fees though. I would say the downside of this trust fund is that it lock you up for 2-3 years and the penalty if cashing out early which is 10-8% charges. wow... 7% + 3.5% annual fees = 10.5% pa (the ubb trust company must make per year on a yearly basis)(excluding the x% for agent that roped in the participant) This post has been edited by yklooi: Sep 28 2020, 10:57 AM |

|

|

Sep 28 2020, 11:08 AM Sep 28 2020, 11:08 AM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

QUOTE(yklooi @ Sep 28 2020, 10:47 AM) thanks for responding... It you refer back to the post https://forum.lowyat.net/topic/4801818/+20 shared by T231H, there is mentioned investment licensed by central bank malaysia and equity in licensed company under the governing act or property investment. So maybe they invested in top glove and achieve a record booming return? wow... 7% + 3.5% annual fees = 10.5% pa (the ubb trust company must make per year on a yearly basis)(excluding the x% for agent that roped in the participant) So I dunno whats your concern la bro haha. Consistenly kenanga or any fund house can generated 10% per annum actually if you notice but thats on the higher risk of investment side. I am not fund manager or what so I just leave it to the professional to do though. |

|

|

Sep 28 2020, 11:15 AM Sep 28 2020, 11:15 AM

Show posts by this member only | IPv6 | Post

#54

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(jonathanchee315 @ Sep 28 2020, 11:08 AM) It you refer back to the post https://forum.lowyat.net/topic/4801818/+20 shared by T231H, there is mentioned investment licensed by central bank malaysia and equity in licensed company under the governing act or property investment. So maybe they invested in top glove and achieve a record booming return? the UBB investment panel can invest our money (money placed as trust fund) in Equities like those of unit trusts?So I dunno whats your concern la bro haha. Consistenly kenanga or any fund house can generated 10% per annum actually if you notice but thats on the higher risk of investment side. I am not fund manager or what so I just leave it to the professional to do though. even those unit trust that invested fully in Malaysian Equities or 1/2 in Equities and 1/2 in Fixed income (balanced fund) cannot generate 10% annualised returns for a 10 yrs period wor.. This post has been edited by yklooi: Sep 28 2020, 11:29 AM |

|

|

Sep 28 2020, 12:26 PM Sep 28 2020, 12:26 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(yklooi @ Sep 28 2020, 11:15 AM) the UBB investment panel can invest our money (money placed as trust fund) in Equities like those of unit trusts? That's why I'm curious where they invest the "trust" money.even those unit trust that invested fully in Malaysian Equities or 1/2 in Equities and 1/2 in Fixed income (balanced fund) cannot generate 10% annualised returns for a 10 yrs period wor.. |

|

|

Sep 28 2020, 04:32 PM Sep 28 2020, 04:32 PM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

QUOTE(yklooi @ Sep 28 2020, 11:15 AM) the UBB investment panel can invest our money (money placed as trust fund) in Equities like those of unit trusts? Seriously bro, I dunno man. As long as I had my returns. Which I already fully matured once and get back my money and current one with 2 time interest return payout already. even those unit trust that invested fully in Malaysian Equities or 1/2 in Equities and 1/2 in Fixed income (balanced fund) cannot generate 10% annualised returns for a 10 yrs period wor.. At the end of the day, this company had been around 30 years + with trust license issued by BNM. If you suspicious maybe can go write in to BNM to clarify or investigate them. I just sharing my own experience with them only. I think there is another forumer had good experience with them as well. Maybe those interested can directly call up my service consultant and ask? Or UBB themselves haha. This post has been edited by jonathanchee315: Sep 28 2020, 04:33 PM |

|

|

Sep 28 2020, 04:38 PM Sep 28 2020, 04:38 PM

Show posts by this member only | IPv6 | Post

#57

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(jonathanchee315 @ Sep 28 2020, 04:32 PM) Seriously bro, I dunno man. As long as I had my returns. Which I already fully matured once and get back my money and current one with 2 time interest return payout already. At the end of the day, this company had been around 30 years + with trust license issued by BNM. If you suspicious maybe can go write in to BNM to clarify or investigate them. I just sharing my own experience with them only. I think there is another forumer had good experience with them as well. Maybe those interested can directly call up my service consultant and ask? Or UBB themselves haha. yes, thanks for sharing your experience just like the other forummer too. hopefully the experience you had gained would entice you and your family members to put in more to reap a bigger rewards. parents taking out EPF to put in there perhaps? btw, it is not that i don't trust that company, for that company is sure legal...it is the "returns and annual fees" of the product with the word "projected profit sharing" that made me hesitate. but since you and the other forummer had shared your personal experience of having 7%pa net of fees......i will just keep it on my radar. This post has been edited by yklooi: Sep 28 2020, 04:44 PM |

|

|

Sep 28 2020, 08:28 PM Sep 28 2020, 08:28 PM

|

Junior Member

569 posts Joined: Aug 2020 |

QUOTE(jonathanchee315 @ Sep 28 2020, 04:32 PM) Seriously bro, I dunno man. As long as I had my returns. Which I already fully matured once and get back my money and current one with 2 time interest return payout already. can u share the contact?At the end of the day, this company had been around 30 years + with trust license issued by BNM. If you suspicious maybe can go write in to BNM to clarify or investigate them. I just sharing my own experience with them only. I think there is another forumer had good experience with them as well. Maybe those interested can directly call up my service consultant and ask? Or UBB themselves haha. can share the comisen if sign up under ur referal? |

|

|

Sep 29 2020, 09:52 AM Sep 29 2020, 09:52 AM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

QUOTE(yklooi @ Sep 28 2020, 04:38 PM) yes, thanks for sharing your experience just like the other forummer too. hopefully the experience you had gained would entice you and your family members to put in more to reap a bigger rewards. parents taking out EPF to put in there perhaps? btw, it is not that i don't trust that company, for that company is sure legal...it is the "returns and annual fees" of the product with the word "projected profit sharing" that made me hesitate. but since you and the other forummer had shared your personal experience of having 7%pa net of fees......i will just keep it on my radar. No worries, not like life saving EPF and all la. My family just treat this like FD and put the amount we feel comfortable with. I am not encouraging u put all your money into it , but whatever one feels comfortable with and not going to use it in few years down the road. As I mentioned before, the penalty of early withdrawal is quite high 10% first year and 8% for subsequence year. So just exercise own cautions and invest wisely. QUOTE(AnasM @ Sep 28 2020, 08:28 PM) Yeah sure bro, I am not the agent but i can share you the contact. I dun have any refferal fees from these perhaps you can directly ask my consultant. Cause I feel his service quite good and able to solve all my doubts and inquries. |

|

|

Sep 29 2020, 10:03 AM Sep 29 2020, 10:03 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(jonathanchee315 @ Sep 29 2020, 09:52 AM) Hey bro, yeah at the end of the day, thats what matters right? Where is he based at? No worries, not like life saving EPF and all la. My family just treat this like FD and put the amount we feel comfortable with. I am not encouraging u put all your money into it , but whatever one feels comfortable with and not going to use it in few years down the road. As I mentioned before, the penalty of early withdrawal is quite high 10% first year and 8% for subsequence year. So just exercise own cautions and invest wisely. Yeah sure bro, I am not the agent but i can share you the contact. I dun have any refferal fees from these perhaps you can directly ask my consultant. Cause I feel his service quite good and able to solve all my doubts and inquries. KL or Klang Valley? |

|

|

Sep 29 2020, 10:10 AM Sep 29 2020, 10:10 AM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

|

|

|

Sep 29 2020, 10:11 AM Sep 29 2020, 10:11 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Nov 3 2020, 09:46 AM Nov 3 2020, 09:46 AM

|

Newbie

37 posts Joined: Feb 2019 |

Haha, Ok this company had returned back my funds, I place in cash trust on 2017,

I recently renewed another term with them, but for this time the return is only 5-7% (last time was 6-8%) I think since im not using the monies anytime soon, i just renew and see for another term how their performance, on my side, i find this trust account is legit la. only i dont know why people never heard about this company, i also know from the agent that sells me my insurance. Satisfied customer <3 |

|

|

Nov 3 2020, 11:37 AM Nov 3 2020, 11:37 AM

Show posts by this member only | IPv6 | Post

#64

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(cloudy_eye @ Nov 3 2020, 09:46 AM) Haha, Ok this company had returned back my funds, I place in cash trust on 2017, mind sharingI recently renewed another term with them, but for this time the return is only 5-7% (last time was 6-8%) I think since im not using the monies anytime soon, i just renew and see for another term how their performance, on my side, i find this trust account is legit la. only i dont know why people never heard about this company, i also know from the agent that sells me my insurance. Satisfied customer <3 how much did you put in initially in 2017? what is the actual total cumulative amount did you take back? i am sure that this UBB is legal and regulated.... as to why nobody know much about them is, i think they did NOT officially publish the "Net historical rate of returns", only have to depends on the words of mouth of the agents. As to why they did not officially publish the "Net historical rate of returns",....i guess, only the agents knows |

|

|

Nov 4 2020, 11:02 AM Nov 4 2020, 11:02 AM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

QUOTE(yklooi @ Nov 3 2020, 11:37 AM) mind sharing Regarding this I can shed some insight as i also quite 38. I had went and speak with one of the management and it is against the rule of BNM to publish the rate and historical return in website or publically. They did show me under the trustee act 1949, it is forbidden to do so. As they are not investment link scheme or unit trust which are categories as financial product. how much did you put in initially in 2017? what is the actual total cumulative amount did you take back? i am sure that this UBB is legal and regulated.... as to why nobody know much about them is, i think they did NOT officially publish the "Net historical rate of returns", only have to depends on the words of mouth of the agents. As to why they did not officially publish the "Net historical rate of returns",....i guess, only the agents knows It is different kind of thing under Trust service. So I hope this can clear your doubt. yklooi liked this post

|

|

|

Nov 4 2020, 11:04 AM Nov 4 2020, 11:04 AM

|

Junior Member

582 posts Joined: Dec 2005 From: Kuala Lumpur |

QUOTE(cloudy_eye @ Nov 3 2020, 09:46 AM) Haha, Ok this company had returned back my funds, I place in cash trust on 2017, Same here bro , already renewed once and cash out once too . They are having the crisis trust now @ 7.5% but only valid for one month period. Are you going in too bro? I recently renewed another term with them, but for this time the return is only 5-7% (last time was 6-8%) I think since im not using the monies anytime soon, i just renew and see for another term how their performance, on my side, i find this trust account is legit la. only i dont know why people never heard about this company, i also know from the agent that sells me my insurance. Satisfied customer <3 I am tempted here as the tenure lock in is short too. |

|

|

Nov 4 2020, 04:19 PM Nov 4 2020, 04:19 PM

Show posts by this member only | IPv6 | Post

#67

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(jonathanchee315 @ Nov 4 2020, 11:02 AM) Regarding this I can shed some insight as i also quite 38. I had went and speak with one of the management and it is against the rule of BNM to publish the rate and historical return in website or publically. They did show me under the trustee act 1949, it is forbidden to do so. As they are not investment link scheme or unit trust which are categories as financial product. It is different kind of thing under Trust service. So I hope this can clear your doubt. i was wondering if it is "OK" for their agents to do it publicly inclusive in social medias? will the company deny any responsibilities or accountabilities for the "words/information" spoken/provided/conveyed by the agents publicly inclusive in social media?? This post has been edited by yklooi: Nov 4 2020, 04:27 PM |

|

|

May 22 2022, 04:48 PM May 22 2022, 04:48 PM

|

Probation

7 posts Joined: Aug 2019 |

QUOTE(lifebalance @ Aug 3 2020, 11:27 AM) I was engaged by UBB as well. HI,Can’t really say I would invest into it as there is no factsheet to proof how this 6.5% is given especially with a high initial charge 4.5%. Take it at your own risk. UBB Co. is not a Company in Investment for you. UBB is Trust Service Company. So there is no factsheet to everyone. |

|

|

May 22 2022, 05:28 PM May 22 2022, 05:28 PM

Show posts by this member only | IPv6 | Post

#69

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Jul 18 2022, 12:26 PM Jul 18 2022, 12:26 PM

Show posts by this member only | IPv6 | Post

#70

|

Probation

5 posts Joined: Jul 2022 |

guys,

can search for more educational videos on cash trust in learnabee or KCLau facebook page. Just search keyword *cash trust* in learnabee OR, In gripeo website, search for UBB Amanah Berhad. |

|

|

Jul 18 2022, 01:05 PM Jul 18 2022, 01:05 PM

Show posts by this member only | IPv6 | Post

#71

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(annyeongabe @ Jul 18 2022, 12:26 PM) guys, Btw, just for info, there are many BAD reviews by readers of the article written n posted in gripeo .. can search for more educational videos on cash trust in learnabee or KCLau facebook page. Just search keyword *cash trust* in learnabee OR, In gripeo website, search for UBB Amanah Berhad. Personally I think the writer did not post any useful solid proof by merely postings of "speculative", "non proven" accusations...... Posted or questioned by others..... Just like what "I" (or "we) do mostly here |

|

|

Jul 18 2022, 02:23 PM Jul 18 2022, 02:23 PM

Show posts by this member only | IPv6 | Post

#72

|

Senior Member

1,662 posts Joined: Jun 2006 |

Hmm suddenly noticed quite a number of billboards in Penang showing Ubb while I was driving. Marketing kuat ni. TOS liked this post

|

| Change to: |  0.0504sec 0.0504sec

0.47 0.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 11:19 AM |