QUOTE(cloudy_eye @ Nov 3 2020, 09:46 AM)

Haha, Ok this company had returned back my funds, I place in cash trust on 2017,

I recently renewed another term with them, but for this time the return is only 5-7% (last time was 6-8%)

I think since im not using the monies anytime soon, i just renew and see for another term how their performance,

on my side, i find this trust account is legit la.

only i dont know why people never heard about this company, i also know from the agent that sells me my insurance.

Satisfied customer <3

mind sharing

how much did you put in initially in 2017?

what is the actual total cumulative amount did you take back?

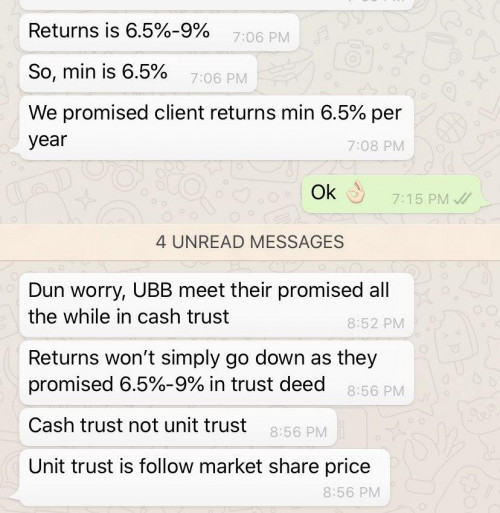

i am sure that this UBB is legal and regulated....

as to why nobody know much about them is, i think they did NOT officially publish the "Net historical rate of returns", only have to depends on the words of mouth of the agents.

As to why they did not officially publish the "Net historical rate of returns",....i guess, only the agents knows

May 6 2020, 09:17 AM

May 6 2020, 09:17 AM

Quote

Quote 0.0232sec

0.0232sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled