QUOTE(afif737 @ May 2 2020, 09:29 PM)

Hi,

I'm 32yo. Airline pilot.

Looking for a good insurance plan. Leaning towards AIA. Medical card and maybe life insurance.

I used to have one with AIA 9 years ago. The sale pitch by the agent was it was a 'Loss of licence' policy. But actually there's no such thing. It says on my policy booklet, the plan is : AIA Assurance Account. If i'm not mistaken it is under 'occupational' policy or something like that I really don't remember. It was also an ILP. I cancelled it years ago. An agent tried to sell me the same policy, but i'm a bit wiser now, so i asked to show where it says 'loss of licence', well it doesn't. I don't think it is right to sell something when it is not what you say it is, even when it is similar.

My company does cover me for permanent loss of licence, hospitalization and also death. But the amounts are not that high. So thinking of additional insurance.

Okay so now for me personally I don't mix insurance with investment. Can anyone suggest any policy that i can read up on? Medical card and life insurance. Preferably AIA.

And also is it true when people say you should get either a life insurance OR an MLTA but not both?

Thank you in advance.

I have yet to heard of such term.

To make it simple for you, insurance nowadays are sold as term insurance or as investment linked policies which insurance company will invest part of your insurance premium to cover future cost of insurance.

Of course you can still opt for term insurance if you do not want to partake in any investment but you will be subject to pay an increasing annual premium as you grow older.

Also, insurance company will put more restriction for term insurance as compared to investment link policies for financial and health checks.

QUOTE(afif737 @ May 4 2020, 03:23 AM)

Thank you for your reply. The bolded part, it's quite difficult to say because if we lose our licence for example bcoz of a critical illness like diabetes, we won't be able to fly but we can still work elsewhere. but since we fall back to our spm bcoz we lost our licence,its gonna be hard to find a job. So an agent explained to me, in that case the insurance company will not pay up because we can still work elsewhere.

Hi. You've never heard of loss of licence because it is only offered by airlines. So as far as i know, no insurance company offers it. But some agents try to sell their product using this term which i think is wrong. I was young and ignorant when i got the policy 9 years ago. A few associations outside Malaysia do offer loss of licence. This is why I'm only looking for a medical card and life insurance.

There was a friend who told me that his life insurance coverage is RM1 mil+ and he's only paying like RM2000+ a year for it. I forgot to ask him from which company and i honestly don't know anything else about it other than those figures. Is it plausible to have that kind of coverage at that price?

aviation company has their own specific insurance which covers for higher risk faced by pilots.

However, you can still get your personal coverage with the insurance company directly which is not subject to whatever you've mentioned on lost of license.

QUOTE(farizmalek @ May 4 2020, 07:11 AM)

https://www.aia.com.my/content/dam/my/en/do...rochure_1st.pdfIs this insurance ok?

one of the Q&A in the AIA website:-

06: WILL MY COST OF INSURANCE INCREASE

AS I GET OLDER?

As the Cost of Insurance for A-Plus Health is

deducted depending on your attained age, it will

increase as your age increases.

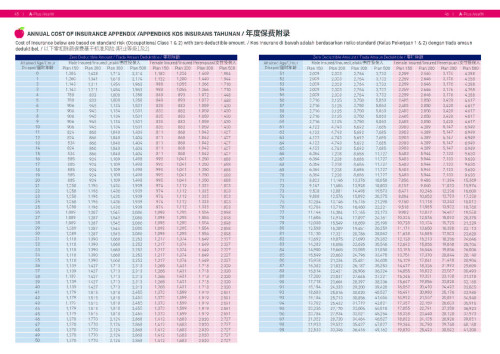

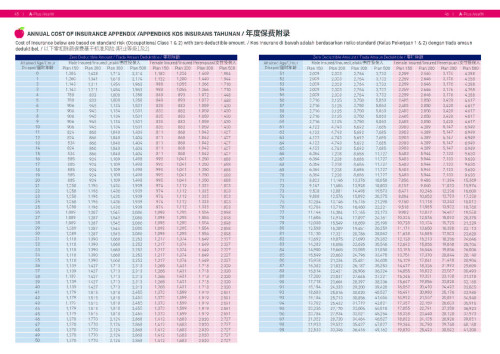

Is this mean that every year the premium will be increased as per the table below...

The cost of insurance will increase overtime as per the schedule written as you grow older.

May 2 2020, 03:47 PM

May 2 2020, 03:47 PM

Quote

Quote

0.1302sec

0.1302sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled