QUOTE(WaCKy-Angel @ Oct 30 2020, 04:34 PM)

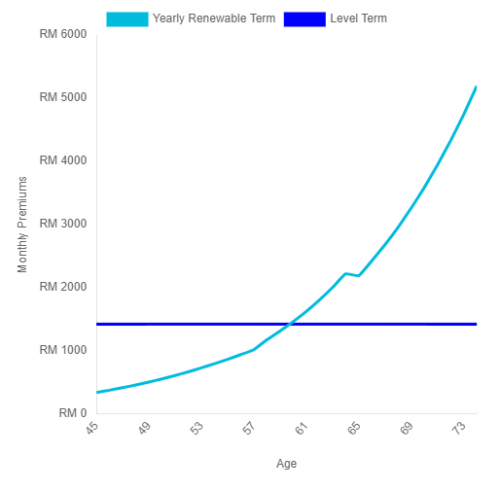

Thats why agent wont show comparison..

Just wondering since during quotation time agent song song show the premium chart showing steady same premium for 30 years (ofcourse got fine wording says premium may be revised according to market price) but im expecting maybe 10 years increase once or maybe none.

So what i wonder is, ILP quotation also has premium chart showing the premium amount every year. Does that amount

also may be revised according to market later or fixed as per the quotation?

Because if standalone premium is fixed as per quotation it looks like standalone is much cheaper in the long run.

oops, i think i got reported because i was "soliciting" business.

I think it's not fair to ask sales agent to to compare and make the chicken wing look like drumstick. maybe i'm wrong to said what i said previously but most people like chicken drumstick right, so they ok to eat chicken rice not just chicken? <-- back to my chicken rice analogy

i actually dont understand your question but i think in part you haven't fully be able to visualise the ILP plan. even cherroy's unit trust + medical does not seem quite easily understood by most people.

to keep it simple, you may be quoted RM2400 per year and you are expected to pay this same amount every year. Despite best effort from agents and insurance company, this 2400 may not be sufficient to last you until the end of the coverage term.

one of the most common event is medical repricing. HOWEVER, even if i own a policy that does not have medical, it is still no guarantee. bad market return, couple with late payment or mispayment, you may receive a letter next year from the insurance company, you may need to increase to 2700 per year.

Think for a moment, imagine, if you stop paying your house loan during your moratorium and you will want your loan to finish within the same period, what do you think you need to do? you gotta increase your installment.

as for standalone medical plan, the premium quoted is likely based on current experience and assumption, few years later, the pricing that you see, will no longer be applicable and will go up. it's not fair to merely say standalone cheaper in the long run without looking at other things. If really want to save money, buy co-insurance/deductible. frequency of happening is definitely lower

QUOTE(coolguy_0925 @ Oct 30 2020, 08:05 PM)

Yes you got what I wanted to do right

eg. premium now RM5000 and revised to RM5600 in 2021 so I plan to take RM1000 ~ RM2000 from fund depending on how much next year income from other sources

But when I asked the agent the answer is you need to pay the premium as stipulated in the letter of revised premium, no way to change so only can withdraw to use the fund

i dunno how to explain in the simplest manner. Imagine you have RM10000 in your cash value now. You Pay RM5000 every year. the medical COI is RM6000 every year. and you have 11 years left until the coverage end. assume cash value grow at 0%.

so year 1, you pay RM5000. your total cash value now is RM15000, your COI is RM6000, so your cash value will decrease to RM9000

year 2, rinse, repeat, decrease to 8000

year 10, decrease to 0

year 11, no coverage because decreased to zero. To avoid this, you can immediately pay 6000 before the insurance company terminate your coverage and you still can enjoy coverage for year 11 despite no cash value. because you have enough charges for year 11.

What happen in year 1 and year 2, is automatic. that "Withdrawal" of RM1000 in depleting your cash value happens automatically and does not need any explicit action from you.

that's the beauty of investment linked plan.

This post has been edited by adele123: Oct 30 2020, 09:37 PM

Oct 30 2020, 02:39 PM

Oct 30 2020, 02:39 PM

Quote

Quote

0.0381sec

0.0381sec

0.82

0.82

6 queries

6 queries

GZIP Disabled

GZIP Disabled