QUOTE(GE-DavidK @ Jul 23 2020, 11:47 AM)

Standalone for male age 49, 1971, is estimated to be around RM1.7k annually with 1 million annual limit.

There are a few ways to do this.

1) You cancel this policy and get a second medical policy. Remember to pay for both policies for at least 120 days for the waiting period just to be safe.

2) You keep this policy and get a second policy with deductible of RM50k. The first 50k hospital expenses would be paid by the first policy and the remaining would be paid by the second. This option might be cheaper than the first option.

For life insurance, the ideal coverage is roughly to be 10 times of your annual income. If your budget allows you to continue these life insurance policies, then you should continue. I agree with you that your medical insurance is on the low side considering 50k annual limit is very limited in today's medical expenses.

thanksThere are a few ways to do this.

1) You cancel this policy and get a second medical policy. Remember to pay for both policies for at least 120 days for the waiting period just to be safe.

2) You keep this policy and get a second policy with deductible of RM50k. The first 50k hospital expenses would be paid by the first policy and the remaining would be paid by the second. This option might be cheaper than the first option.

For life insurance, the ideal coverage is roughly to be 10 times of your annual income. If your budget allows you to continue these life insurance policies, then you should continue. I agree with you that your medical insurance is on the low side considering 50k annual limit is very limited in today's medical expenses.

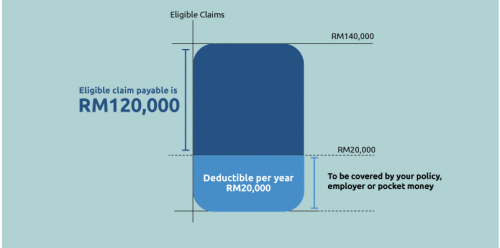

what is this deductible insurance? not all insurance act like it?

Jul 23 2020, 12:13 PM

Jul 23 2020, 12:13 PM

Quote

Quote

0.0214sec

0.0214sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled