Outline ·

[ Standard ] ·

Linear+

Insurance Talk V6!, Everything about Insurance

|

nxtpg

|

Jul 23 2020, 09:56 AM Jul 23 2020, 09:56 AM

|

|

how to upgrade GE policy with higher coverage?

have an old policy from 2005.

Great Protectlink Insurance with IL Health Protection

Annual Coverage is only 50K

Lifetime 200K.. mana cukup

Paying rm375 x4 per year

Investment value got rm12k now

Shall i just cancel this policy and buy a new one with unnlimited Lifetime? Or possible buy another policy as a second policy?

|

|

|

|

|

|

nxtpg

|

Jul 23 2020, 10:10 AM Jul 23 2020, 10:10 AM

|

|

QUOTE(lifebalance @ Jul 23 2020, 10:00 AM) You will need to buy a new one if you wish to upgrade the coverage as the older plan can't be upgraded. If you have no history of health problem then getting a new one instead of maintaining 2 medical plan (including the old plan) (double your cost) is more advisable. However I would advise you to get your new policy approve first & wait for 120 days before cancelling your old card. thanks. like this it would be better to get a standalone plan right instead of the ilp i currently have for better coverage? Already over 40 but no history of health problems so far. i have another 2 other policies under ge , Life 87 (sum assured rm75k - paying rm513x4 /year) and Supreme livingcare series 2 (sum assured rm52k - paying rm386x4/year) ... all started in 2002. Shall i just leave those policies alone and keep paying..? my concern now is on medical card ... |

|

|

|

|

|

nxtpg

|

Jul 23 2020, 12:13 PM Jul 23 2020, 12:13 PM

|

|

QUOTE(GE-DavidK @ Jul 23 2020, 11:47 AM) Standalone for male age 49, 1971, is estimated to be around RM1.7k annually with 1 million annual limit. There are a few ways to do this. 1) You cancel this policy and get a second medical policy. Remember to pay for both policies for at least 120 days for the waiting period just to be safe. 2) You keep this policy and get a second policy with deductible of RM50k. The first 50k hospital expenses would be paid by the first policy and the remaining would be paid by the second. This option might be cheaper than the first option. For life insurance, the ideal coverage is roughly to be 10 times of your annual income. If your budget allows you to continue these life insurance policies, then you should continue. I agree with you that your medical insurance is on the low side considering 50k annual limit is very limited in today's medical expenses. thanks what is this deductible insurance? not all insurance act like it? |

|

|

|

|

|

nxtpg

|

Jul 23 2020, 12:27 PM Jul 23 2020, 12:27 PM

|

|

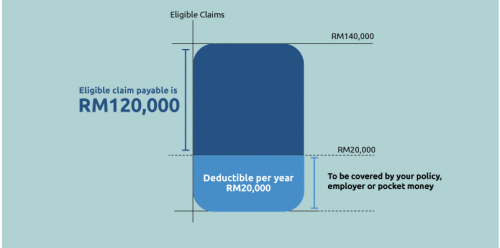

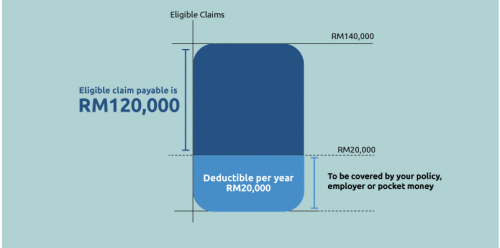

QUOTE(lifebalance @ Jul 23 2020, 12:17 PM) A deductible is a fixed amount (cost) that you need to pay for your hospitalization bill before the balance is paid by the insurance company. Depending on how much deductible you've chosen for your insurance plan. Insurance company will normally give you a % discount on your premium payable, the higher the deductible, the higher the discount, but bear in mind also the higher amount you need to pay upfront to the hospital. If you have an existing card then you may choose to pick a deductible on the 2nd card to save on the cost, however you will need to do some extra paper work to file for the claim with 2 insurance companies. Also not all insurance offers high deductible options up to 50k.  Here's an illustration of how deductible works, credit @ringgitplus so if for the 2nd insurance , if i dont buy deductible also can rite? say the Ge covers 50K.... if not sufficient i present my second medical card then? will they accept? |

|

|

|

|

|

nxtpg

|

Jul 23 2020, 06:22 PM Jul 23 2020, 06:22 PM

|

|

QUOTE(Ewa Wa @ Jul 23 2020, 04:21 PM) I have helped my customer upgraded this policy b4 to the latest medical rider. Speaking as I’m representing this company. You may just upgrade from great protect link by withdraw the ILHP and insert the new rider. Annually Rm990k-1.32mil and unlimited lifetime. You need to submit a form called psf02 to declare your current health status. Thanks The new rider will be still ilp or standalone? Is this a better option comparing to getting a new plan? I am also looking for another 2 medical cards for wife n kid. Currently all of us are under co group coverage rm30k per issue. So most prob get a deductible type as suggested by lifebalance |

|

|

|

|

|

nxtpg

|

Jul 23 2020, 08:17 PM Jul 23 2020, 08:17 PM

|

|

QUOTE(Cyclopes @ Jul 23 2020, 07:55 PM) Both policies would has accumulated cash value, but you can consider to enhance your life policies. This is to ensure your other risks, other than medical cost, are also adequately covered. Yup. Cash value is there. Not interested to enhance life policy. I have other supporting investments fully covering need for family. |

|

|

|

|

|

nxtpg

|

Jul 23 2020, 08:19 PM Jul 23 2020, 08:19 PM

|

|

QUOTE(lifebalance @ Jul 23 2020, 06:44 PM) It will still be an ILP, basically you are dropping your existing medical rider to take on a new one, of course you may need to top up on your premium payable for the newer benefit. In this case, it might be better to consider a new policy- standalone policy. ILP premium is high n i rather just focus on pure health protection . |

|

|

|

|

|

nxtpg

|

Jul 26 2020, 12:05 PM Jul 26 2020, 12:05 PM

|

|

QUOTE(ckdenion @ Jul 26 2020, 11:38 AM) for a million annual limit, then the premium will be slightly lesser than 5k/year (standalone). if lower limit, lesser than 4k/year premium. yea, you are right about the GE ILP medical riders, the COI got increased starting 1st June 2020. for standalone, there is no repricing that i know so far. abnormal heartbeat 2-3 years back, any treatment done at that time? what is the condition now? if got latest test report, just standby to submit upon existing insurance upgrade/new insurance application. What about supraventricular tachycardia? Will it affect the policy. Echo results all good |

|

|

|

|

|

nxtpg

|

Jul 26 2020, 12:11 PM Jul 26 2020, 12:11 PM

|

|

QUOTE(ckdenion @ Jul 24 2020, 03:39 PM) hi nxtpg, you just need to change the rider to the latest medical rider. only buy 2nd policy if you have a new needs - for example a dedicated policy just to protect your family's expenses or kid's future education. for your case like that, it depends on looking into a proper insurance planning first, then only after that, the plans come into play to see what is really best for you. cant really give a clear advise to you without knowing your current situation and goals in life. hi truecolor, that rule of thumb is just in general. basically one shall look into own's financial situation and current commitments, and find out what is needed to be covered. then only after that when the plan is proposed then only we know how much premium is needed for the plan that covers your needs. hmmm like this i better check on changing the rider. Can this b done at GE branch or have to go thru agent? Family expenses n education fund is all well planned and secured. Just unexpected medical cost. Thats why planning medical coverage for all now |

|

|

|

|

|

nxtpg

|

Jul 26 2020, 12:12 PM Jul 26 2020, 12:12 PM

|

|

QUOTE(lifebalance @ Jul 26 2020, 12:07 PM) Can't comment much whether there would be exclusion, loading or decline. It's best you submit your application with the insurance company to consider first. ok. Thanks. |

|

|

|

|

|

nxtpg

|

Jul 26 2020, 12:16 PM Jul 26 2020, 12:16 PM

|

|

QUOTE(lifebalance @ Jul 26 2020, 12:13 PM) You can walk into the branch to submit your application to change the rider, the customer service can assist you on that, otherwise get your servicing agent to do it for yo if he's still in the business. Cs will explain on the new rider? |

|

|

|

|

|

nxtpg

|

Jul 26 2020, 12:31 PM Jul 26 2020, 12:31 PM

|

|

QUOTE(ckdenion @ Jul 26 2020, 12:23 PM) need to submit the latest report with disclosure for company to decide. if the upgrade will have exclusion, then will advise you to keep the current one since it is a standard medical card that has no exclusion. btw what's your current GE medical card? IL health protector. The svt is my wife 😅 |

|

|

|

|

Jul 23 2020, 09:56 AM

Jul 23 2020, 09:56 AM

Quote

Quote

0.1286sec

0.1286sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled