PSA competitive rate is usually higher than RHB Smart Account.

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

|

Jul 29 2020, 10:42 PM Jul 29 2020, 10:42 PM

Return to original view | IPv6 | Post

#181

|

All Stars

12,387 posts Joined: Feb 2020 |

Come to think about it; revise to 2.6% pa vs RHB Smart Account @ 2.85% pa will have PSA less attractive.

PSA competitive rate is usually higher than RHB Smart Account. |

|

|

|

|

|

Jul 29 2020, 10:50 PM Jul 29 2020, 10:50 PM

Return to original view | IPv6 | Post

#182

|

All Stars

12,387 posts Joined: Feb 2020 |

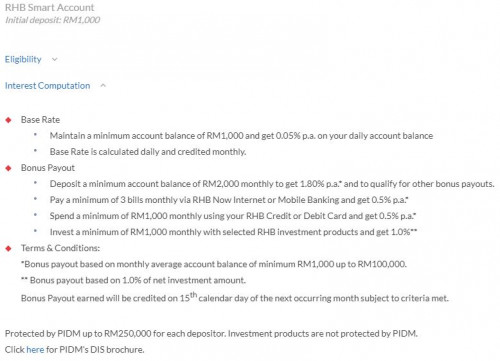

QUOTE(Tronoh @ Jul 29 2020, 10:48 PM) later transfer all to rhb, rhb revise down pulak. That's why I didn't open it but rhb got extra condition to pay 3 bills on top of rm1000 card spend, that condition would be a negative carry to me. maybe it'll be worth it to others who has many spendings Too much efforts to complete. |

|

|

Jul 30 2020, 07:43 AM Jul 30 2020, 07:43 AM

Return to original view | Post

#183

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(mamamia @ Jul 29 2020, 11:36 PM) So, the 3 bills requirement is not like OCBC that can transfer to other bank, must really pay to 3 different Bill ? “PAY” means the payment made from the Account of the Accountholder via RHB Now or RHB Now Mobile Banking to pay utilities bill or other bills under participating billing organizations. “Pay” is divided into two categories as shown in the table below  https://www.rhbgroup.com/files/others/terms...ing_tnc_eng.pdf |

|

|

Aug 1 2020, 01:55 PM Aug 1 2020, 01:55 PM

Return to original view | IPv6 | Post

#184

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 2 2020, 04:41 PM Aug 2 2020, 04:41 PM

Return to original view | IPv6 | Post

#185

|

All Stars

12,387 posts Joined: Feb 2020 |

NOTIFICATION – INTRODUCTION OF INBOX NOTIFICATION FEATURE TO STANDARD CHARTERED MOBILE APP (SC MOBILE APP)\\

We are introducing Inbox Notification to our SC Mobile App which will be available for download effective 1 August 2020 onwards. We are pleased to bring you this enhancement as part of our continuous effort to enrich the mobile banking experience to all our clients. What does this mean for you? Inbox Notification utilises Push Notification services to securely deliver banking transaction alerts and marketing messages (the alerts) via the internet and the alerts will pop up on your mobile device via SC Mobile App. For non-SC Mobile App users, you will continue to receive the alerts via SMS and/or electronic direct mailer. a. For New SC Mobile App users: After downloading the SC Mobile App on your device, you will be prompted to register for Soft Token and proceed to select your preferred PIN. Upon successful validation, you will be registered for both Soft Token and Inbox Notification. You will continue to receive marketing massages but will no longer receive banking transaction alerts via SMS. b. For Existing SC Mobile App users: Upon successful app version update and login, a popup message will inform you of this new enhancement and notify that you are now registered for Inbox Notification. You will continue to receive marketing messages but will no longer receive banking transaction alerts via SMS. What if you want to disable Inbox Notification and continue receiving alerts via SMS and/or electronic direct mailer? You are able to easily toggle between on / off for Inbox Notification in the SC Mobile App Settings menu. Besides, you have the option to choose to receive either banking transaction alerts or marketing messages or both and vice versa. By opting not to receive the alerts via Inbox Notification, you will continue to receive the alerts via SMS and/or electronic direct mailer. https://av.sc.com/my/content/docs/introduct...-mobile-app.pdf |

|

|

Aug 5 2020, 06:11 PM Aug 5 2020, 06:11 PM

Return to original view | IPv6 | Post

#186

|

All Stars

12,387 posts Joined: Feb 2020 |

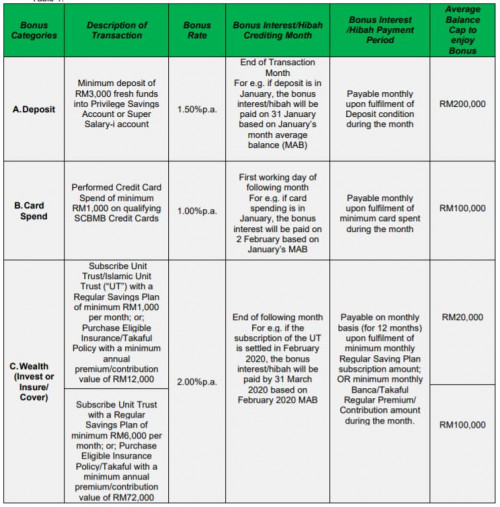

Revision of Privilege$aver Campaign Terms & Conditions Please take note, effective 1 Sep 2020, Deposit Bonus Interest of Privilege Savings Account /Deposit Bonus Hibah of Super Salary-i and Credit Card Spend Bonus Interest will be revised as follows: Clause 11 Table 1. • Deposit Bonus Interest/Hibah will be revised from 2.00% p.a. to 1.50% p.a. with average balance cap of RM 200,000 during the month • Credit Card Bonus Interest will be revised from 1.50% p.a. to 1.00% p.a. Clause 14 Eligible Account holders can earn up to 4.60% p.a. (from 5.60% p.a.) in the promotion account based on total interest/return earned from the Base Rate and total Bonus Rates on all Bonus Categories of Deposit, Card Spend and Wealth Management as seen in Table 1 of the Campaign Terms and Conditions. https://av.sc.com/my/content/docs/my-revisi...egeaver-tcs.pdf Eurobeater: Please update the thread title This post has been edited by GrumpyNooby: Aug 5 2020, 06:13 PM Eurobeater liked this post

|

|

|

|

|

|

Aug 5 2020, 07:15 PM Aug 5 2020, 07:15 PM

Return to original view | IPv6 | Post

#187

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 5 2020, 07:20 PM Aug 5 2020, 07:20 PM

Return to original view | IPv6 | Post

#188

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 5 2020, 07:33 PM Aug 5 2020, 07:33 PM

Return to original view | IPv6 | Post

#189

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(!@#$%^ @ Aug 5 2020, 07:32 PM) I think different product.CIMB TIA: https://www.cimb.com.my/en/personal/day-to-...-account-i.html 2020 Q1 report: https://www.cimb.com.my/content/dam/cimb/pe...12020-final.pdf |

|

|

Aug 8 2020, 05:45 PM Aug 8 2020, 05:45 PM

Return to original view | IPv6 | Post

#190

|

All Stars

12,387 posts Joined: Feb 2020 |

Eurobeater

Here's the new T&C for PSA (effective 1/9/2020): https://av.sc.com/my/content/docs/my-privilegeaver-tcs.pdf |

|

|

Aug 13 2020, 06:56 PM Aug 13 2020, 06:56 PM

Return to original view | IPv6 | Post

#191

|

All Stars

12,387 posts Joined: Feb 2020 |

IMPORTANT INFORMATION INTERNATIONAL POST SERVICE DISTRUPTION IMPACTING BANK STATEMENT AND NOTICES

Please be advised that Pos Malaysia international post service will be disrupted starting 3rd August 2020. Refer to the full announcement here. The disruption would impact the delivery of physical statements and investment transaction notices to international mailing address registered under Standard Chartered Bank Malaysia Berhad and Standard Chartered Saadiq Berhad. We understand that your finances are important, and your time is valuable. We strongly encourage you to opt in for eStatement available through the following channels: SC Mobile and Online Banking. https://av.sc.com/my/content/docs/my-intern...-disruption.pdf |

|

|

Aug 14 2020, 04:19 PM Aug 14 2020, 04:19 PM

Return to original view | IPv6 | Post

#192

|

All Stars

12,387 posts Joined: Feb 2020 |

Introduction of Paper Statement Fee for Individual Retail Clients effective 1 November 2019 (Not Applicable for Company Accounts – SME/ Business Banking & Corporate Accounts)

As notified during September 2019 and November 2019 ,with a view to drive the reduction of paper consumption and to ensure you receive your statements in the most convenient, secure, and timely way possible, we have made it possible for customers to receive their bank statements via email or for download from our online banking website. We strongly encourage all our clients to enrol to eStatements as soon as possible to start enjoying these benefits. Effective 1st November 2019, a Paper Statement Fee of RM5.00 per statement will be applied for Standard Chartered/Standard Chartered Saadiq accounts as follows: • Current Accounts • Savings Accounts • Credit Card Account https://av.sc.com/my/content/docs/my-paper-...-fee-notice.pdf |

|

|

Aug 18 2020, 02:39 PM Aug 18 2020, 02:39 PM

Return to original view | Post

#193

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(??!! @ Aug 18 2020, 02:36 PM) RHB Smart Account interest rate has been revised to 2.85% pa effective 13/7/2020 This post has been edited by GrumpyNooby: Aug 18 2020, 02:40 PM ??!! liked this post

|

|

|

|

|

|

Aug 18 2020, 05:38 PM Aug 18 2020, 05:38 PM

Return to original view | IPv6 | Post

#194

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(??!! @ Aug 18 2020, 05:30 PM) Ask here:https://forum.lowyat.net/topic/2855886/+3640#entry97864331 |

|

|

Aug 22 2020, 03:44 PM Aug 22 2020, 03:44 PM

Return to original view | IPv6 | Post

#195

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(??!! @ Aug 22 2020, 03:40 PM) Say-- 1/8 balance b/f = RM10,000 Calculate MAB for the month of August.5/8 transferred RM3,000 into account 20/8 transferred RM13,000 out of account. Balance after transfer RM0 Used > RM1,000 on CC during Aug Would I still get the 3.6% pa interest on the 10k and 3k for the number of days in Aug that the amount were in the account? That MAB should be entitled to bonus interest as long as condition is fulfilled. |

|

|

Aug 25 2020, 10:21 AM Aug 25 2020, 10:21 AM

Return to original view | Post

#196

|

All Stars

12,387 posts Joined: Feb 2020 |

Received email from SC regarding upcoming change in the bonus interest starting 1/9/2020

|

|

|

Aug 25 2020, 01:14 PM Aug 25 2020, 01:14 PM

Return to original view | Post

#197

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Hobbez @ Aug 25 2020, 01:07 PM) How does this compare with StanChart? It's just 2.6% (2 conditions for SC PSA) vs 2.85% (3 conditions for RHB Smart Account).It looks much better if their base rate is currently 2.85% while StanChart is going to be 1.5% within a few days from now. StanChart rate only looks good if you invest in one of their Insurance/Unit Trust products. No investment/insurance to be considered for both. This post has been edited by GrumpyNooby: Aug 25 2020, 01:14 PM |

|

|

Aug 25 2020, 02:45 PM Aug 25 2020, 02:45 PM

Return to original view | Post

#198

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Hobbez @ Aug 25 2020, 02:38 PM) Effective 1/9/2020: *Base interest: 0.1% pa T&C: https://av.sc.com/my/content/docs/my-privilegeaver-tcs.pdf |

|

|

Aug 25 2020, 03:26 PM Aug 25 2020, 03:26 PM

Return to original view | Post

#199

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Hobbez @ Aug 25 2020, 03:20 PM) Ya this is what I meant. With RM3000 every mth in, the interest is 1.5%. And then with Bancassurance can get additional 2%. I don't know what you aim for but I have no interest with those Bancassurance. Perhaps, your preference is not spending from credit card. With additional credit card from SC that I have been using before I opened PSA, I can still get 2.6% pa without any commitment to Bancassurance. I also stated clearly since earlier posts for comparison between PSA and RHB Smart Account, no Bancassurance (insurance/unit trust) is being considered. Even if I were to migrate to RHB Smart Account, I will also aim for 2.85% pa (Save+Pay+Spend) only. This post has been edited by GrumpyNooby: Aug 25 2020, 03:34 PM |

|

|

Aug 25 2020, 04:05 PM Aug 25 2020, 04:05 PM

Return to original view | IPv6 | Post

#200

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(jiaen0509 @ Aug 25 2020, 03:53 PM) It's up to your preference.I don't have account with RHB. I shared the below opinions too and I hate to go to the branch! QUOTE(CPURanger @ Aug 25 2020, 11:11 AM) CPURanger liked this post

|

| Change to: |  0.0331sec 0.0331sec

0.89 0.89

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 12:16 PM |