Outline ·

[ Standard ] ·

Linear+

Opus Touch, Self-Service UT Platform

|

AnasM

|

Nov 20 2020, 08:18 PM Nov 20 2020, 08:18 PM

|

|

QUOTE(ironman16 @ Nov 20 2020, 05:30 PM) No need top a few k like u ppl le, no dip, top like normal, dip transfer money market fund go nia. Every time a few hundred oso can. My wife prefer fd n saving plan. I yg cari i saraan/prs/sspn for income tax rebate or investment. Dia dpt manfaat bcoz when my wife income too high n tax more, my son n others receipt that no name punya she ambil habis. I yg keluar duit tp i every month kering. 😭😭😭 how much is dip? -0.0001? -0.01? |

|

|

|

|

|

ironman16

|

Nov 20 2020, 08:52 PM Nov 20 2020, 08:52 PM

|

|

QUOTE(AnasM @ Nov 20 2020, 08:18 PM) how much is dip? -0.0001? -0.01? lagi besar i lagi suka......if like now situation, i wait .....may b dip lagi.....  |

|

|

|

|

|

majorarmstrong

|

Nov 21 2020, 12:38 AM Nov 21 2020, 12:38 AM

|

|

QUOTE(ironman16 @ Nov 20 2020, 08:52 PM) lagi besar i lagi suka......if like now situation, i wait .....may b dip lagi.....  Kasi dip deep deep |

|

|

|

|

|

GrumpyNooby

|

Nov 23 2020, 09:43 AM Nov 23 2020, 09:43 AM

|

|

NAV update for 20/11/2020:

IPF: 1.0754 -> 1.0752 (-0.0002)

SIPF: 1.0290 -> 1.0285 (-0.0005)

|

|

|

|

|

|

majorarmstrong

|

Nov 23 2020, 11:27 AM Nov 23 2020, 11:27 AM

|

|

QUOTE(GrumpyNooby @ Nov 23 2020, 09:43 AM) NAV update for 20/11/2020: IPF: 1.0754 -> 1.0752 (-0.0002) SIPF: 1.0290 -> 1.0285 (-0.0005) bagus soon gonna see 1.06xxx come come come |

|

|

|

|

|

GrumpyNooby

|

Nov 24 2020, 09:24 AM Nov 24 2020, 09:24 AM

|

|

NAV update for 23/11/2020:

IPF: 1.0752 -> 1.0746 (-0.0006)

SIPF: 1.0285 -> 1.0281 (-0.0004)

|

|

|

|

|

|

majorarmstrong

|

Nov 24 2020, 10:12 AM Nov 24 2020, 10:12 AM

|

|

QUOTE(GrumpyNooby @ Nov 24 2020, 09:24 AM) NAV update for 23/11/2020: IPF: 1.0752 -> 1.0746 (-0.0006) SIPF: 1.0285 -> 1.0281 (-0.0004) when will bottom |

|

|

|

|

|

majorarmstrong

|

Nov 24 2020, 10:29 AM Nov 24 2020, 10:29 AM

|

|

i really hope for another crazy drop till it can bottom out

|

|

|

|

|

|

noien

|

Nov 24 2020, 10:40 AM Nov 24 2020, 10:40 AM

|

|

QUOTE(majorarmstrong @ Nov 24 2020, 10:29 AM) i really hope for another crazy drop till it can bottom out today will go up. hopefully a lot like what US did |

|

|

|

|

|

!@#$%^

|

Nov 24 2020, 11:04 AM Nov 24 2020, 11:04 AM

|

|

aniki's method still valid? sell when down, buy when up?

|

|

|

|

|

|

majorarmstrong

|

Nov 24 2020, 11:37 AM Nov 24 2020, 11:37 AM

|

|

QUOTE(noien @ Nov 24 2020, 10:40 AM) today will go up. hopefully a lot like what US did how u know? |

|

|

|

|

|

noien

|

Nov 24 2020, 12:10 PM Nov 24 2020, 12:10 PM

|

|

QUOTE(majorarmstrong @ Nov 24 2020, 11:37 AM) US bond going up, will have similar effect to IPF |

|

|

|

|

|

GrumpyNooby

|

Nov 24 2020, 12:22 PM Nov 24 2020, 12:22 PM

|

|

Foreign net inflow into bond market soared to RM8b in October, says RAM RatingsKUALA LUMPUR (Nov 24): The foreign net inflow into the domestic bond market soared to RM8 billion in October, from RM500 million in the immediate preceding month, said RAM Rating Services Bhd (RAM Ratings). In a statement today, the credit rating agency said the bond market had chalked six straight months of net foreign inflows, with the vast improvement shown last month in sharp contrast to uncertainty over the FTSE Russel watch list decision in September which dissuaded investors. "MGS/GII (Malaysian Government Securities/Government Investment Issue) issuances in October continued to be robust at RM14.5 billion with healthy BTCs (bid-to-cover ratios) of close to two times or more. The Asian region will remain attractive in the coming months amid economic recovery prospects, especially in trade performance. https://www.theedgemarkets.com/article/fore...ays-ram-ratings

|

|

|

|

|

|

majorarmstrong

|

Nov 24 2020, 02:22 PM Nov 24 2020, 02:22 PM

|

|

QUOTE(GrumpyNooby @ Nov 24 2020, 12:22 PM) Foreign net inflow into bond market soared to RM8b in October, says RAM RatingsKUALA LUMPUR (Nov 24): The foreign net inflow into the domestic bond market soared to RM8 billion in October, from RM500 million in the immediate preceding month, said RAM Rating Services Bhd (RAM Ratings). In a statement today, the credit rating agency said the bond market had chalked six straight months of net foreign inflows, with the vast improvement shown last month in sharp contrast to uncertainty over the FTSE Russel watch list decision in September which dissuaded investors. "MGS/GII (Malaysian Government Securities/Government Investment Issue) issuances in October continued to be robust at RM14.5 billion with healthy BTCs (bid-to-cover ratios) of close to two times or more. The Asian region will remain attractive in the coming months amid economic recovery prospects, especially in trade performance. https://www.theedgemarkets.com/article/fore...ays-ram-ratings so today can start to buy? tomorrow will up up and up? |

|

|

|

|

|

TStan_aniki

|

Nov 24 2020, 11:05 PM Nov 24 2020, 11:05 PM

|

|

seems like still going down everywhere

|

|

|

|

|

|

GrumpyNooby

|

Nov 25 2020, 09:08 AM Nov 25 2020, 09:08 AM

|

|

NAV update for 24/11/2020:

IPF: 1.0746 -> 1.0737 (-0.0009)

SIPF: 1.0281 -> 1.0276 (-0.0005)

|

|

|

|

|

|

noien

|

Nov 25 2020, 09:19 AM Nov 25 2020, 09:19 AM

|

|

Looks like not following world market

Anyway klse having big drop as well

|

|

|

|

|

|

majorarmstrong

|

Nov 25 2020, 09:55 AM Nov 25 2020, 09:55 AM

|

|

QUOTE(noien @ Nov 25 2020, 09:19 AM) Looks like not following world market Anyway klse having big drop as well Lol Baru u tahu |

|

|

|

|

|

GrumpyNooby

|

Nov 25 2020, 09:58 AM Nov 25 2020, 09:58 AM

|

|

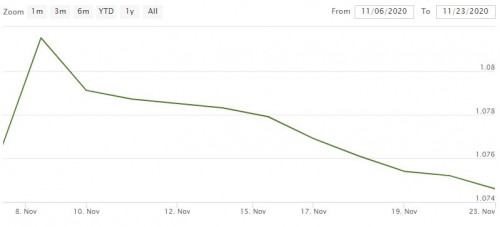

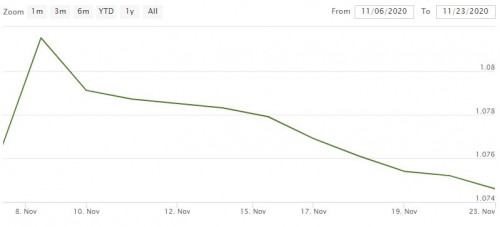

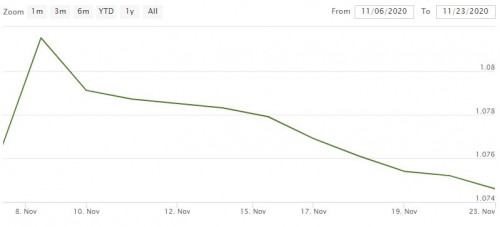

IPF has been sliding downward since 9/11/2020:  |

|

|

|

|

|

ironman16

|

Nov 25 2020, 10:08 AM Nov 25 2020, 10:08 AM

|

|

QUOTE(GrumpyNooby @ Nov 25 2020, 09:58 AM) IPF has been sliding downward since 9/11/2020:  i tunggu lagi |

|

|

|

|

Nov 20 2020, 08:18 PM

Nov 20 2020, 08:18 PM

Quote

Quote

0.0303sec

0.0303sec

0.33

0.33

6 queries

6 queries

GZIP Disabled

GZIP Disabled