Outline ·

[ Standard ] ·

Linear+

Opus Touch, Self-Service UT Platform

|

GrumpyNooby

|

Jul 20 2020, 03:49 PM Jul 20 2020, 03:49 PM

|

|

QUOTE(majorarmstrong @ Jul 20 2020, 03:49 PM) which one faster FSM or Opus? cause when uncle need money for medical expenses i really need fast fast like 3 to 5 days lo for those who still young pls make sure keep 1 or 2 credit card that has high limit like 50k or 100k even you are cash rich you still need credit card cause u wont carry 50k to 100k cash go out but u will carry 1 single piece of platics to go out ma reason being when u go hospital credit card do wonders everything can speed up if you have one if dont have things go super slow sometimes 5 mins saves life Obviously is Opus. He has mentioned it earlier. |

|

|

|

|

|

GrumpyNooby

|

Jul 20 2020, 04:02 PM Jul 20 2020, 04:02 PM

|

|

QUOTE(majorarmstrong @ Jul 20 2020, 03:59 PM) btw can i use my son Boost account to top up? If the Opus account is opened using your son's mobile phone number. |

|

|

|

|

|

GrumpyNooby

|

Jul 20 2020, 08:17 PM Jul 20 2020, 08:17 PM

|

|

QUOTE(no6 @ Jul 20 2020, 08:13 PM) MER for IPF is 0.65%, SC is up to 2% offline and 0% using Opus Touch, II is RM 1000 MER for MPF is 0.28%, SC is 0%, II is RM 1000 Say my total investment is rm1000, fees that i get charged per annum is:- 1000x0.65% = rm6.50 1000x0.28% = rm2.80 is this calculation correct ? nothing else right Fund management fee and trustee fee are accrued in daily basis and reflected in daily published NAV. |

|

|

|

|

|

GrumpyNooby

|

Jul 20 2020, 08:24 PM Jul 20 2020, 08:24 PM

|

|

QUOTE(no6 @ Jul 20 2020, 08:24 PM) meaning i'll get charged from the "background" right ? say i buy the fund at nav 1.08 today, and decided to sell tomorrow at nav 1.05, the charges are already factored in the nav 1.05 ? Of course. No way to skip these fees. |

|

|

|

|

|

GrumpyNooby

|

Jul 21 2020, 09:35 AM Jul 21 2020, 09:35 AM

|

|

NAV as of 20/7/2020

IPF: 1.0840 (+0.0011)

SIPF: 1.0386 (+0.0008)

|

|

|

|

|

|

GrumpyNooby

|

Jul 21 2020, 10:46 AM Jul 21 2020, 10:46 AM

|

|

QUOTE(MNet @ Jul 21 2020, 10:45 AM) can u put the increament or decrement percentage as well? You can take over if you want. |

|

|

|

|

|

GrumpyNooby

|

Jul 21 2020, 12:30 PM Jul 21 2020, 12:30 PM

|

|

QUOTE(!@#$%^ @ Jul 21 2020, 12:24 PM) actually why need to update nav here? QUOTE(tan_aniki @ Jul 21 2020, 12:28 PM) actually i also dunno why  If annoying, you can click on the Report button This service is absolutely FREE and no charge will be billed to your bank account/credit card/e-wallet. This post has been edited by GrumpyNooby: Jul 21 2020, 12:30 PM |

|

|

|

|

|

GrumpyNooby

|

Jul 21 2020, 12:40 PM Jul 21 2020, 12:40 PM

|

|

QUOTE(!@#$%^ @ Jul 21 2020, 12:40 PM) actually, it's not annoying. just that it will be considered as abuse to get more post counts. Just click on the Report button. Some even said put this, put that somemore. This post has been edited by GrumpyNooby: Jul 21 2020, 12:41 PM |

|

|

|

|

|

GrumpyNooby

|

Jul 21 2020, 12:56 PM Jul 21 2020, 12:56 PM

|

|

QUOTE(no6 @ Jul 21 2020, 12:52 PM) may i know where can we see the bond maturity date? or rather do we need to know the bond maturity date before investing in IPF, is it necessary ?

what happened if i bought the IPF today and the bond maturity date is 1 month from now, does that mean will most likely loose money as the bond is expiring soon ?and why are some sifu here still timing the market, selling off the IPF before the nav drops ? FM will disclose this info in their monthly FFS. But info in this sheet is historical. Even you know this info, it's out of control to do anything. IPF FFS: https://www.opusasset.com/wp-content/upload...v=1595307295812 |

|

|

|

|

|

GrumpyNooby

|

Jul 22 2020, 01:58 PM Jul 22 2020, 01:58 PM

|

|

QUOTE(funboy555 @ Jul 22 2020, 01:55 PM) IPF: 1.0849 (+0.0009) SIPF: 1.0394 (+0.0008) MPF: 1.0055 (+0.0001) Today help GrumpyNooby to update. Hopefully he is back to help to update. Thanks Grumpy. dont be grumpy because of people's bad comment. Some of us really appreciate your update here. It's not about that. People is accusing me as cheater for post count increase. With that, I'm no longer be posting daily NAV even I do login to Opus Touch on daily basis to update my spreadsheet. |

|

|

|

|

|

GrumpyNooby

|

Jul 22 2020, 05:45 PM Jul 22 2020, 05:45 PM

|

|

Malaysia 10-year MGS yields fall to record lowKUALA LUMPUR (July 22): The 10-year Malaysian Government Securities (MGS) yields have fallen to a record low of 2.63%, after the nation registered in June 2020 its highest net foreign inflow in six years since May 2014. Bank Negara Malaysia said on its website that trading yields for the 10-year MGS maturing in August 2029, fell one basis point to close at 2.63% yesterday (July 21). https://www.theedgemarkets.com/article/mala...fall-record-low

|

|

|

|

|

|

GrumpyNooby

|

Jul 22 2020, 09:20 PM Jul 22 2020, 09:20 PM

|

|

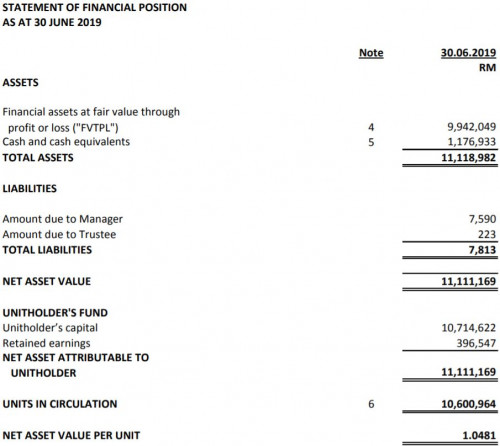

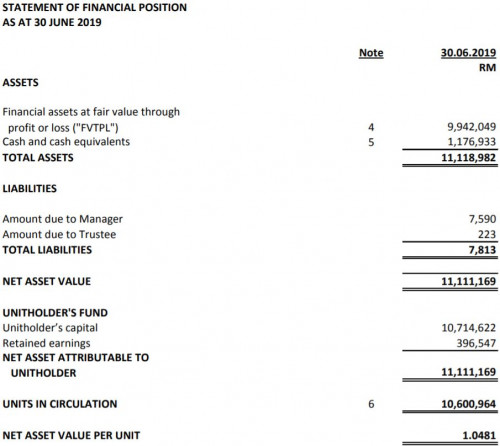

QUOTE(tan_aniki @ Jul 22 2020, 09:07 PM) i also dunno how to calculate out, just whack only better understanding than buying stock, no buy or sell price, just one NAV and no broker fee etc It is all in the fund annual or semi-annual report: Example for IPF:  IPF Annual Report: https://www.opusasset.com/wp-content/upload...v=1595423869922 |

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 09:41 AM Jul 23 2020, 09:41 AM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 09:40 AM) I just logged in and updated my spreadsheet 15 to 30 mins ago. |

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 11:56 AM Jul 23 2020, 11:56 AM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 11:45 AM) i notice that the fund size for Opus is quite small  IPF is launched on 28 September 2018 Less than 2 years old only. |

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 02:00 PM Jul 23 2020, 02:00 PM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 01:42 PM) Betul betul For ipf perlu dca? Like weekly rm200? QUOTE(majorarmstrong @ Jul 22 2020, 09:59 PM) so kantoi la for Opus IPF perlu jual semua ka? Yesterday night just asked if want to cash out all. Now DCA pulak?  |

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 05:09 PM Jul 23 2020, 05:09 PM

|

|

QUOTE(funboy555 @ Jul 23 2020, 05:08 PM) Dollar-cost averaging: Periodically pumping money in |

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 06:25 PM Jul 23 2020, 06:25 PM

|

|

QUOTE(no6 @ Jul 23 2020, 06:23 PM) Just wandering how is Opus performance compare to SAMY ? Opus which fund vs SAMY which risk % portfolio? The question is you're asking is basically open-ended question. And also Opus funds are dominantly in MYR while SAMY in USD (except for Simple™). This post has been edited by GrumpyNooby: Jul 23 2020, 06:27 PM |

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 10:51 PM Jul 23 2020, 10:51 PM

|

|

QUOTE(majorarmstrong @ Jul 23 2020, 10:38 PM) i want to ask the button "cooling off" buat apa? after click my screen turn blue saja and do nothing  To cancel your fund purchase. COOLING-OFF A Cooling-off Right is only given to an individual investor who is investing in any of the unit trust funds managed by us for the first time except for the following investor: our staff; and any person registered with a body approved by the SC to deal in unit trusts funds. If you are eligible for the Cooling-off Right, you may exercise the Cooling-off Right within 6 Business Days from our receipt of your application for Units. |

|

|

|

|

|

GrumpyNooby

|

Jul 24 2020, 09:04 AM Jul 24 2020, 09:04 AM

|

|

QUOTE(majorarmstrong @ Jul 24 2020, 09:02 AM) I not try to redeem I just want to experience how fast money can come out. So just in case emergency then I can still depend on some of the money inside People also shared their experience. It'll be T+1 business day. But you seem like don't believe at all.  Info is also provided in Post#1 by TS This post has been edited by GrumpyNooby: Jul 24 2020, 09:08 AM |

|

|

|

|

|

GrumpyNooby

|

Jul 24 2020, 09:31 AM Jul 24 2020, 09:31 AM

|

|

QUOTE(majorarmstrong @ Jul 24 2020, 09:29 AM) Can you share a little bit on which fund is kena default drop till gila gila? Or totally become zero value? Only of the RHB bond fund I believe most impacted when one of its holding being default. That was few years back. This post has been edited by GrumpyNooby: Jul 24 2020, 09:31 AM |

|

|

|

|

Jul 20 2020, 03:49 PM

Jul 20 2020, 03:49 PM

Quote

Quote

0.0676sec

0.0676sec

0.46

0.46

7 queries

7 queries

GZIP Disabled

GZIP Disabled