So, a week to go until ASM2 dividend announcement. I am 90% confident of 4.75% with a 10% chance of a little higher.

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

|

|

Aug 23 2024, 10:47 AM Aug 23 2024, 10:47 AM

Return to original view | IPv6 | Post

#861

|

Senior Member

1,072 posts Joined: Aug 2020 |

So, a week to go until ASM2 dividend announcement. I am 90% confident of 4.75% with a 10% chance of a little higher.

|

|

|

|

|

|

Aug 23 2024, 07:29 PM Aug 23 2024, 07:29 PM

Return to original view | Post

#862

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(Mike3 @ Aug 23 2024, 05:54 PM) Nice watch bro! It wasn’t so long ago that banks in the UK were offering 105% mortgages. That rarely ended well.No more full loan? i see got ppl still promote. Banker or showroom same. janji ada sales. Later become like use house crisis mampus hahahha BNM must intervene hahah |

|

|

Aug 24 2024, 08:23 PM Aug 24 2024, 08:23 PM

Return to original view | Post

#863

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(GambitFire @ Aug 24 2024, 08:14 PM) Just say if I have certain amount in ASM3 and want to switch to ASM1, should I wait until 30th Sept once dividend is paid out for ASM3 then switch to ASM1? Don't reduce your ASM3 account to zero and you will get a pro rata dividend.If I switch now, I will not be entitled for ASM3 dividend right? Just checking if my understanding is correct |

|

|

Aug 25 2024, 01:55 PM Aug 25 2024, 01:55 PM

Return to original view | Post

#864

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(guy3288 @ Aug 25 2024, 11:03 AM) Switch on 10.10.24 no losing interest ? Lose 20 days interest also. No? Interest is calculated on the lowest balance in the entire month so, in your example, you would lose the full month’s interest.I think only switch on 1.10.24 can avoid losing interest as you get full interest for September and October The only exception is if you add funds on the 1st of the month the higher of the 2 balances on the 1st of the month is used to calculate interest for that month - provided there are no withdrawals in the rest of the month. So, if you switch from ASM3 to ASM1 on 1st of the month you obviously lose the full months interest on ASM3 but it would be replaced by a full month’s interest on ASM1. If you do the same switch on the 2nd of the month you lose a full month’s interest in both ASM3 and ASM1. This post has been edited by MattSally: Aug 25 2024, 01:59 PM |

|

|

Aug 25 2024, 06:23 PM Aug 25 2024, 06:23 PM

Return to original view | Post

#865

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(guy3288 @ Aug 25 2024, 04:43 PM) i am confused now.. 1/10/24 is best. You obviously get no interest on funds taken out of ASM3 for Oct but if those funds are switched to ASM1 1/10/24 then you would get the full Oct interest on the switched funds in ASM1. If you made the switch one day later your additional funds in ASM1 would not start earning interest until 1/11/24.i thought if deposit on 1.10.24 will get full interest for the month if deposit on 2.10.24 lose October interest, for withdrawal it doesnt matter when?? use numbers easy Say balance ASM3 on 30.9.24 is RM100,020.00 To Switch RM100k from ASM3 to ASM1 , when is the best day to switch? 1)30.9.24 That RM100k ASM3 trf out on 30.9.24 can still get 30days interest for Sept? No, Lose all September interest. if tak dapat interest for Sept you lose 30days interest. 2)1.10.24 i believe that RM100k ASM3 taken out on 1.10.24 would get full Sept interest. Yes, you would get all September interest but obviously nothing for October. you said will lose 1 whole month interest ? how? You would lose (probably ‘not get’ is better term) any interest for Oct on amount taken out of ASM3 1/10/24 but if switched to ASM1 1/10/24 you would get Oct interest for additional funds in ASM1. and on 1.10.24 that RM100k switched in to ASM1 it will earn ASM1 full Oct interest also. Yes so minimal loss. 3)10.10.24 Withdraw RM100k ASM3 on 10.10.24 , would it be paid 10days interest in October? No, zero days interest paid. if not , you rugi 10days interest of ASM3 there Yes, but if you switch the funds to ASM1 10/10/24 you would get no interest on ASM1 additional funds until the full month of November ie no interest on switched funds from 10/10/24 to 31/10/24. worse that RM100k switched in to ASM1 on 10.10.24 will not get any interest for ASM1 in Oct right? Correct so how is this better? 1.10.24 and 10.10.24 guy3288 liked this post

|

|

|

Aug 26 2024, 10:31 AM Aug 26 2024, 10:31 AM

Return to original view | Post

#866

|

Senior Member

1,072 posts Joined: Aug 2020 |

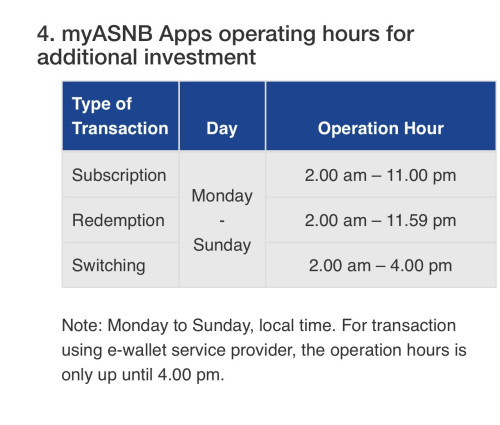

QUOTE(sweetpea123 @ Aug 26 2024, 01:08 AM) Why 1/10/24 and not 1/9/24? Is it because 1/9/24 is a weekend? You can still switch online 1/9/24 and no interest will be lost but availability of funds to switch at a weekend can be an issue. With the latest funds being made available, though, it may well be worth trying 1/9/24. Switching is available from 2-00am to 4-00pm 7 days a week.I am planning to switch some from ASM3 to ASM1 this 1/9/24 but not sure if dividends will be affected cos it's a WEEKEND. Can sifus here pls advise? TIA  This post has been edited by MattSally: Aug 26 2024, 03:42 PM sweetpea123 and nexona88 liked this post

|

|

|

|

|

|

Aug 26 2024, 03:50 PM Aug 26 2024, 03:50 PM

Return to original view | Post

#867

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(gerald7 @ Aug 26 2024, 10:35 AM) It depends which fund you are switching from/to. As a general rule, best FP Fund dividends in decreasing order tend to be: Most recent dividends in brackets:ASB1 (5.25%) ASB2 (5.25%) ASB3 (5.25%) ASM1 (4.75%) ASM2 (4.75%) ASM3 (4.75%) I think it is fair to say that the expectation is for all funds to increase their dividends over the next few years. This will allow the 'normal' situation to be restored whereby ASB1 pays slightly more than ASB2 and ASM1 pays slightly more than ASM2 etc. |

|

|

Aug 27 2024, 05:14 PM Aug 27 2024, 05:14 PM

Return to original view | Post

#868

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(nexona88 @ Aug 27 2024, 02:27 PM) Yes.. As we say in the UK: ‘Look after the pennies (cents) and the pounds (Ringgit) will take care of themselves!’Saw my own eye... Maybe I'm generalizing @ one sided... But these people keep arguing even for cents.... So yeah cents & ringgit is counted.... It seems to have gone a bit quiet on the ASM2 predictions. Does that mean we are all confident of and happy with 4.75%? This post has been edited by MattSally: Aug 27 2024, 05:28 PM nexona88 liked this post

|

|

|

Aug 27 2024, 05:41 PM Aug 27 2024, 05:41 PM

Return to original view | Post

#869

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(nexona88 @ Aug 27 2024, 05:33 PM) Ohh really... I am inclined to agree with you regarding next year. Provided we see continued year on year improvements towards 6% over the next few years I shall be happy enough.New word / proverbs learned today 😁 Well... Not expecting any surprises for this week dividend rates announcement 😉 Next year is where the fun begins.... Can see the full impact on the various openings of ASMx funds previously.... They invest wisely or not... nexona88 liked this post

|

|

|

Aug 27 2024, 09:50 PM Aug 27 2024, 09:50 PM

Return to original view | Post

#870

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(coolguy_0925 @ Aug 27 2024, 09:07 PM) The more well known one that involves Pound & Penny here in Msia is Penny wise Pound foolish I agree with you entirely. Now is not the time to get carried away with too much optimism imho, but there is certainly room for cautious optimism and I would like (and expect) to see all ASM and ASB returns in 2025 being between 5% and 6%. I would say ASM1 5.25% ASM2, ASM3 5.0% ASB1 6.0% and ASB2, ASB3 5.75% is certainly a reasonable expectation. That would really need ASB1 this December to return at least 5.75% and I think that is more than possible at the moment.On the dividend well maximum of 4 days left to know Prediction still @ 4.75% for me but who knows they got crazy and go all out so that give some *cough* hope to boost ASM & ASM 3 sales ASM on March 31st 2025 @ 5% will be something I am looking fwd to but if the next 6 months of Sep till Feb are stable without hoo haa Of course anything higher is very much welcome Anyway recently results are quite positive, PBB profit, TM profit (lower vs history due to tax don't know what issue but still high profit) This post has been edited by MattSally: Aug 27 2024, 09:50 PM coolguy_0925 liked this post

|

|

|

Aug 28 2024, 03:49 PM Aug 28 2024, 03:49 PM

Return to original view | Post

#871

|

Senior Member

1,072 posts Joined: Aug 2020 |

KLSE is doing well today. Up 1.37% so far to 1673.86 and most forecasts expect it to be above 1700 by the end of this year and above 1800 by the end of 2025. Great news for ASM (and ASB) FP funds. If the KLSE continues at this rate it could actually be above 1700 by the end of this week! This post has been edited by MattSally: Aug 28 2024, 03:50 PM coolguy_0925 and nexona88 liked this post

|

|

|

Aug 30 2024, 11:58 AM Aug 30 2024, 11:58 AM

Return to original view | Post

#872

|

Senior Member

1,072 posts Joined: Aug 2020 |

|

|

|

Aug 30 2024, 04:28 PM Aug 30 2024, 04:28 PM

Return to original view | Post

#873

|

Senior Member

1,072 posts Joined: Aug 2020 |

|

|

|

|

|

|

Aug 30 2024, 05:04 PM Aug 30 2024, 05:04 PM

Return to original view | Post

#874

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(theevilman1909 @ Aug 30 2024, 04:36 PM) The website will allow the switch on a weekend, yes. The problem may be availability of funds. But if funds are available, it will work fine. If funds are not available, then doesn't matter if at home or at agent bank and at least you can be sat at your keyboard in your pyjamas with a cup of coffee rather than being in a long queue at the agent bank or ASNB office.This post has been edited by MattSally: Aug 30 2024, 05:05 PM theevilman1909 and oks911 liked this post

|

|

|

Aug 30 2024, 06:08 PM Aug 30 2024, 06:08 PM

Return to original view | Post

#875

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(MGM @ Aug 30 2024, 05:08 PM) The worry is this 1Sep is Sunday &: I think I have switched at a weekend and it worked fine and instantly. I need to check now.See point no3 that switching needs to be done on a business day. Most probably Sunday switching would not work and whole process is delayed to Monday. Edit: Latest info is that switching is available 7 days a week from 2-00am to 4-00pm. This post has been edited by MattSally: Aug 30 2024, 06:13 PM Attached thumbnail(s)

|

|

|

Sep 2 2024, 08:08 AM Sep 2 2024, 08:08 AM

Return to original view | Post

#876

|

Senior Member

1,072 posts Joined: Aug 2020 |

Has anyone else experienced a minor issue with the website? My iphone app works fine but the website loads correctly and shows the correct total balance but when I click on 'View All' the individual fund balances all show as **** and I can find no way to get them to show the individual fund balance. When I click on withrawal or switch etc for that fund, the fund balance does

Edited to add: Just spoken with Customer Support who say it is a system wide problem which should be resolved later today. This post has been edited by MattSally: Sep 2 2024, 09:31 AM |

|

|

Sep 3 2024, 05:58 PM Sep 3 2024, 05:58 PM

Return to original view | Post

#877

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(Chrono-Trigger @ Sep 3 2024, 04:18 PM) question is, will EPF consistently outperformed ASM? It all depends on your appetite for risk.ASM outperformed EPF in the 2010s and 2000s. 7-8% maybe those days are over In my case, I am 62 years old and have substantial $ in ASMx. I am quite happy to accept a steady return of not below 5% (from next year) for the peace of mind that it brings. If you are younger, in well paid employment and have a longer time line to look at then a higher risk in some of your portfolio may make sense. Ultimately, you pay your money and make your choices. This post has been edited by MattSally: Sep 3 2024, 06:00 PM |

|

|

Sep 4 2024, 07:29 AM Sep 4 2024, 07:29 AM

Return to original view | Post

#878

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(virtualgay @ Sep 3 2024, 11:29 PM) ASM3 will, almost certainly, be 4.75% imho. The important dividend (whether you are invested in the fund or not) will be ASB1 at the end of December as it will determine the upper limit of all the other FP funds (ASB & ASM) for the following 12 months.My own view is that ASB1 should declare at least 5.75% and, if we are lucky, 6.0%. This would pave the way for at least 5% in all ASM FP funds in 2025 and maybe 5.5% to 5.75% for ASB2 and ASB3. I wouldn't say that the good times are back yet, but better times are on their way I think. nexona88 liked this post

|

|

|

Sep 4 2024, 09:20 AM Sep 4 2024, 09:20 AM

Return to original view | Post

#879

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(Chrono-Trigger @ Sep 4 2024, 07:54 AM) Indeed. Diversifying your portfolio is always a good idea.The thing about asnb is my sentiment after taking so much effort over the years chasing the limited units. So it’s kind of sentimental to sell it off but I know it’s logical to put money into epf that has more returns. But I’ll withdraw a bit from asnb to put inside epf |

|

|

Sep 4 2024, 06:55 PM Sep 4 2024, 06:55 PM

Return to original view | Post

#880

|

Senior Member

1,072 posts Joined: Aug 2020 |

QUOTE(Ayambetul @ Sep 4 2024, 04:26 PM) It is, but higher returns generally come with higher risks. In the case of ASM1,2,3 when there is a difference in dividends it is invariably so small that what you say is quite correct. For example, I have maxed out ASB1 and ASB2 accounts and am transferring from ASM2, ASM3 to ASB3 as fast as I can.As far as ASM/EPF comparison goes; EPF has certainly outperformed ASM in the last few years but ASM is now steadily improving and who knows where the higher return will be in 2 or 3 years time. Pre pandemic, ASM (I believe) generally outperformed EPF. This post has been edited by MattSally: Sep 4 2024, 07:00 PM |

| Change to: |  0.0489sec 0.0489sec

0.26 0.26

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 06:40 PM |