Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

Medufsaid

|

Oct 23 2023, 10:06 AM Oct 23 2023, 10:06 AM

|

|

you can pick VUSA instead of VOO... save 15% on dividend tax. to save on transaction fees, use the "recurring investment" feature in IBKR to buy https://www.bogleheads.org/wiki/Nonresident..._domiciled_ETFsThis post has been edited by Medufsaid: Oct 23 2023, 10:08 AM |

|

|

|

|

|

Medufsaid

|

Oct 23 2023, 11:39 AM Oct 23 2023, 11:39 AM

|

|

track record suggest MGK is underperforming This post has been edited by Medufsaid: Oct 23 2023, 12:25 PM |

|

|

|

|

|

Medufsaid

|

Oct 24 2023, 12:00 PM Oct 24 2023, 12:00 PM

|

|

if you DCA often (e.g., every week), VUSA:LON shouldn't be an issue to you. as you'll redeposit it back anyway.

if you are the kind that only deposits e.g., once a year, then CSPX is good. however IBRK doesn't support fractional CSPX shares. so you'll have to purchase it manually & pay 0.05% commission fees than the $0.35 under recurring purchase

This post has been edited by Medufsaid: Oct 24 2023, 12:06 PM

|

|

|

|

|

|

Medufsaid

|

Oct 25 2023, 09:27 AM Oct 25 2023, 09:27 AM

|

|

QUOTE(ericcheng2021 @ Oct 15 2023, 10:28 AM) May I know which way is the best to move money to SG / USD? Thanks. QUOTE(Ramjade @ Oct 25 2023, 12:58 AM) have to ask ericcheng2021 what he intends to do with the $$. if only to store and put into FD, then better for him to put into RHB MCA even though there are not many things to do (as compared to convert & deposit into IBKR) |

|

|

|

|

|

Medufsaid

|

Oct 30 2023, 10:48 PM Oct 30 2023, 10:48 PM

|

|

tadashi987 what Ramjade said. also, take note that - IBKR will withdraw to Cittibank, and citibank will take their own sweet time to send to your sg account

- remember to only convert SGD->MYR during working hours

|

|

|

|

|

|

Medufsaid

|

Nov 8 2023, 04:11 PM Nov 8 2023, 04:11 PM

|

|

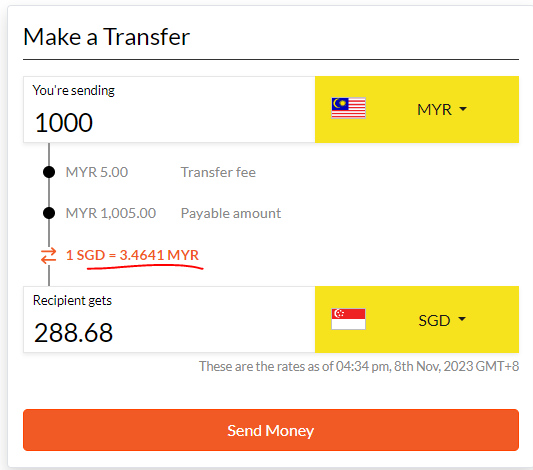

i just transferred today at 10am. moneymatch banked into my CIMB sg acct when i got back from lunch 2pm. this morning rate is RM3.45377. now RM3.4642

|

|

|

|

|

|

Medufsaid

|

Nov 8 2023, 04:15 PM Nov 8 2023, 04:15 PM

|

|

looks like 41 basis points to me (or 0.41891%). this round my funds will go into FD, so i won't be routing to IBKR to tell you if it'll appear in IBKR for tonight or not

|

|

|

|

|

|

Medufsaid

|

Nov 8 2023, 04:36 PM Nov 8 2023, 04:36 PM

|

|

not relevant bcos i gave you this figure not the exchange rate when you divide Ringgit sent by Sing dollar received |

|

|

|

|

|

Medufsaid

|

Nov 10 2023, 02:36 PM Nov 10 2023, 02:36 PM

|

|

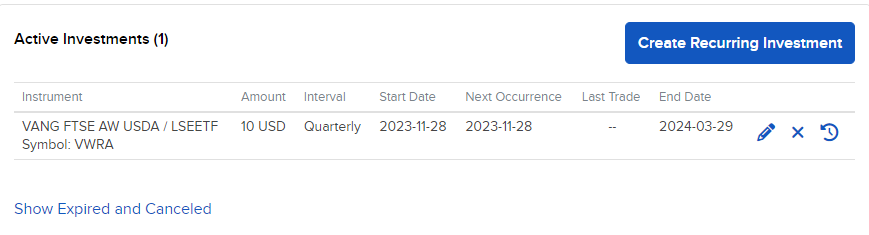

QUOTE(Medufsaid @ Oct 24 2023, 12:00 PM) commission fees [...] $0.35 under recurring purchase just tried recurring purchase and can confirm that it's $0.35. U$1300 of 1 Irish domiciled ETF |

|

|

|

|

|

Medufsaid

|

Nov 14 2023, 03:54 PM Nov 14 2023, 03:54 PM

|

|

Takudan so i try to invest $10 in VWRA (i'll just put a distant start date) and tell u if i can?

This post has been edited by Medufsaid: Nov 14 2023, 03:54 PM

|

|

|

|

|

|

Medufsaid

|

Nov 14 2023, 05:47 PM Nov 14 2023, 05:47 PM

|

|

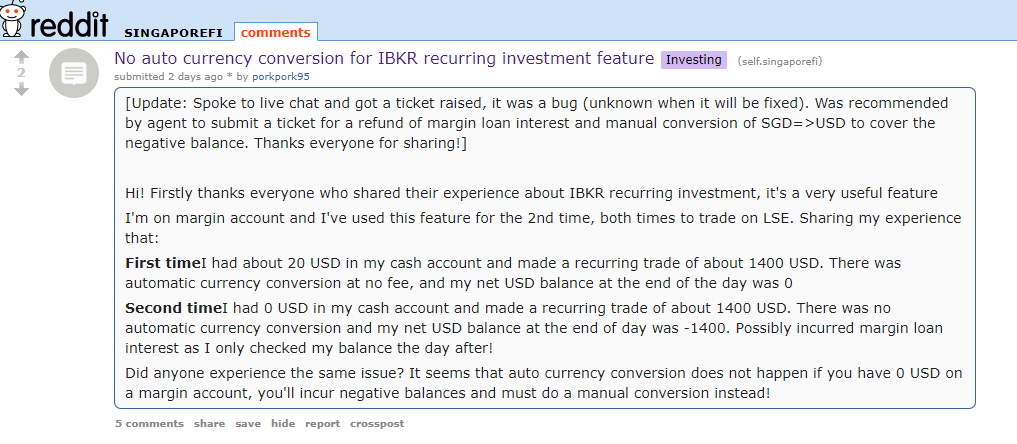

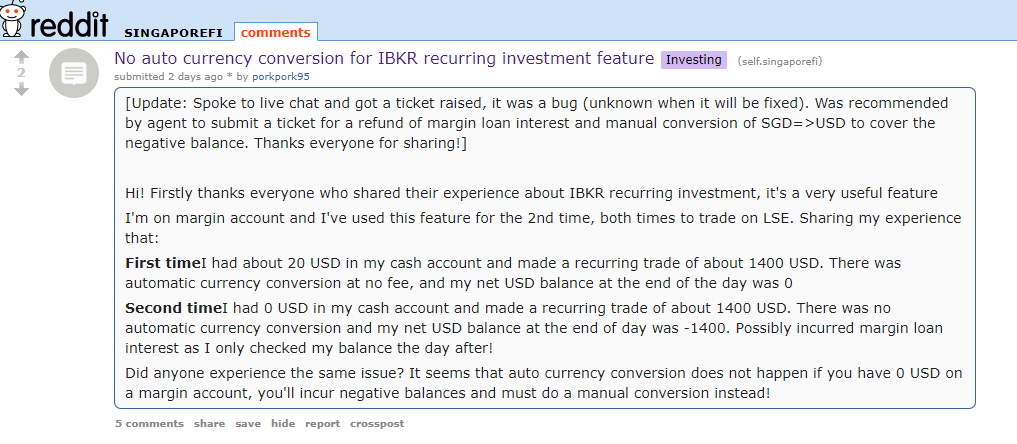

no issues creating QUOTE(Medufsaid @ Oct 7 2023, 05:03 PM) possible bug on IBKR. even so, if u manually convert your currency, U$0.35 commission fees is still cheaper than 0.05% for LSE instruments  no update on whether it's fixed yet https://www.reddit.com/r/singaporefi/commen...ibkr_recurring/This post has been edited by Medufsaid: Nov 14 2023, 05:54 PM |

|

|

|

|

|

Medufsaid

|

Nov 15 2023, 12:23 PM Nov 15 2023, 12:23 PM

|

|

my IBKR base currency is USD. i can deposit SGD from my CIMB sg acct to IBKR and it won't auto convert to USD.

|

|

|

|

|

|

Medufsaid

|

Nov 15 2023, 09:19 PM Nov 15 2023, 09:19 PM

|

|

QUOTE(Medufsaid @ Sep 22 2023, 11:45 AM) Kamina51 you need to enable fractional shares. search for the question How do I enable fractional shares?This post has been edited by Medufsaid: Nov 15 2023, 09:20 PM |

|

|

|

|

|

Medufsaid

|

Nov 16 2023, 07:40 PM Nov 16 2023, 07:40 PM

|

|

do you have a Singapore bank account? lesser steps if you bring it into singapore instead

|

|

|

|

|

|

Medufsaid

|

Nov 16 2023, 08:57 PM Nov 16 2023, 08:57 PM

|

|

oh wait, possible to directly transfer the positions from TD Ameritrade USA to IBKR? i think someone in this very thread has done it before

|

|

|

|

|

|

Medufsaid

|

Nov 17 2023, 11:52 AM Nov 17 2023, 11:52 AM

|

|

--deleted--

This post has been edited by Medufsaid: Nov 17 2023, 12:46 PM

|

|

|

|

|

|

Medufsaid

|

Nov 17 2023, 04:18 PM Nov 17 2023, 04:18 PM

|

|

since this is an IBKR thread, what if he ACH the funds (assuming it's not funds that is needed in an emergency in the near future) from a us bank account into IBKR, and then only withdraw it to a singapore bank account at least 3-5 years down the line?

won't be flagged for "using IBKR to forex" yea?

the stock positions (except for fractional units), he can directly transfer to IBKR without liquidating

This post has been edited by Medufsaid: Nov 17 2023, 04:19 PM

|

|

|

|

|

|

Medufsaid

|

Nov 17 2023, 04:23 PM Nov 17 2023, 04:23 PM

|

|

i read in this thread that quick turnaround will trigger their alarm. so if 3-5 years, should be ok?

This post has been edited by Medufsaid: Nov 17 2023, 04:33 PM

|

|

|

|

|

|

Medufsaid

|

Nov 19 2023, 08:51 AM Nov 19 2023, 08:51 AM

|

|

evangelion wat's your concern? Even if u use rakuten, they still require IC. Guess what, rakuten uses ibkr to trade your us stocks

|

|

|

|

|

|

Medufsaid

|

Nov 19 2023, 10:03 PM Nov 19 2023, 10:03 PM

|

|

not essential to have a SG bank account. only recommended

just be aware of leaving RM20k equivalent in wise by the end of the day (assuming your wise is tied to malaysian address), it'll trigger the account freeze process. if you are transacting more than RM20k, it has to leave wise before EOD

|

|

|

|

|

Oct 23 2023, 10:06 AM

Oct 23 2023, 10:06 AM

Quote

Quote

0.0364sec

0.0364sec

0.17

0.17

7 queries

7 queries

GZIP Disabled

GZIP Disabled