QUOTE(TOS @ Mar 3 2023, 05:46 PM)

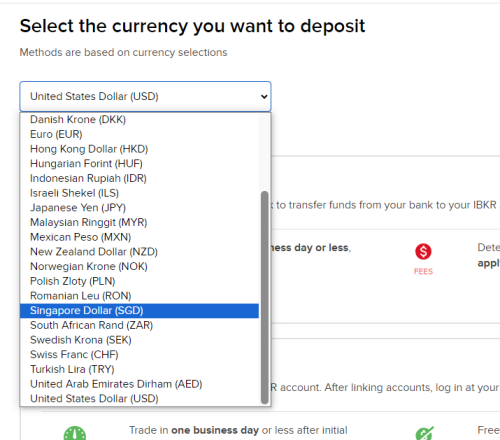

Not many here will leave 10k USD in their IBKR account. Per the link below, the 4.08% p.a. is paid to the USD cash portion only. If you have EUR/CHF/SGD etc. they will have their respective cash balance interest rates (also shown in the link below).

https://www.interactivebrokers.com.hk/en/index.php?f=46740

In theory, you can convert all your monies into USD cash to enjoy the 4.08% p.a. interest then convert back to the desired currencies when you need them. But be mindful of transaction costs and fluctuations of FX markets, though the FX will most likely move in your favour*.

(*Empirical data supports the currency carry trade strategy, i.e. higher yielding currencies will appreciate. Sharpe ratio is about 0.5, as mentioned by my derivative professors.)

-------------------------------

In another news, https://www.reuters.com/business/finance/bl...ews-2023-03-02/

If i got access cash, I will park them in moomoo or tiger. I won't bother parking inside IBKR.https://www.interactivebrokers.com.hk/en/index.php?f=46740

In theory, you can convert all your monies into USD cash to enjoy the 4.08% p.a. interest then convert back to the desired currencies when you need them. But be mindful of transaction costs and fluctuations of FX markets, though the FX will most likely move in your favour*.

(*Empirical data supports the currency carry trade strategy, i.e. higher yielding currencies will appreciate. Sharpe ratio is about 0.5, as mentioned by my derivative professors.)

-------------------------------

In another news, https://www.reuters.com/business/finance/bl...ews-2023-03-02/

Mar 3 2023, 11:18 PM

Mar 3 2023, 11:18 PM

Quote

Quote

0.2653sec

0.2653sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled