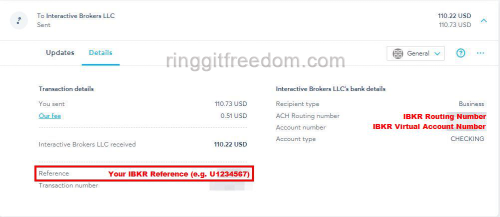

Summary: Proof of deposit

[My username] 2022/12/02 08:47:21

Hi,

I would like to inquire about the charging policy by JP Morgan, the correspondent bank on my fund transfer to DBS Singapore.

During my last transfer (referring to the failed one back in 14th November 2022, reference number 239870272, see uploaded file below), there was no 10 USD fee imposed. May I inquire why is there a 10 USD fee charged this time?

The charges seem to be imposed inconsistently and in an opaque manner.

Thank you.

Best regards,

[My name]

---------------------------

IBCS 2022/12/05 11:52:56

Dear [My name],

Thank you for providing the screenshot.

A request for clarification on the fees involved has been sent to our Cashier department for further review.

A new communication will be sent on this ticket once we have further updates / feedback.

Kind regards,

Dimple

Funds & Banking

IBKR Customer Service

-------------------------------

IBCS 2022/12/06 17:27:00

Dear [My name],

Our Cashier department has advised that unfortunately they are unable to provide information on the fee schedule that correspondent banks charge; and when / why they do so.

This is out of IBKRs control, as to the fees are charged by the correspondent banks involved (and not IBKR).

Kind regards,

Dimple

Funds & Banking

IBKR Customer Service

---------------------------------

[My username] 2022/12/06 22:57:29

Dear Dimple,

Thanks for the reply. Can IBKR help provide the contact details of the correspondent bank, i.e. JP Morgan so that I can inquire them directly? As I am not based in the States, I can't call the US number and would like to email JP Morgan instead but unsure of which division of JP Morgan "Contact Us" page should I contact.

https://www.jpmorgan.com/contact-us I believe IBKR should be able to contact JP Morgan given that you are able to trace the money through the correspondent bank and even detail the fees involved through the transfer process.

Thanks again for your assistance.

Regards,

[My name]

--------------------------------

IBCS 2022/12/07 15:53:24

Dear [My name],

Thank you for your message.

Please be advised that for fund transfers, the bank details and routing instructions are to be provided by the recipient of the funds. For this transaction, the receiver of the funds is your bank (DBS); and since your bank requires a correspondent to effect cross-border USD wire transfers, they use correspondent services for JP Morgan.

Hence, IBKR as the sender of the funds will only send funds out as per the details entered by you in the withdrawal request. We are unfortunately unable to provide any contact details for JP Morgan.

You would need to discuss with your bank the relationships they maintain to route these payments, and how that impacts your costs.

Correspondent banks are most likely to be used by domestic banks to service transactions that either originate or are completed in foreign countries, acting as a domestic bank's agent abroad. Correspondent banking is an essential component of the global payment system, especially for cross-border transactions.

Kind regards,

Dimple

Funds & Banking

IBKR Customer Service

I have contacted DBS Singapore to request for clarification regarding correspondent bank charges. Updates will be provided here later.

Nov 22 2022, 07:32 PM

Nov 22 2022, 07:32 PM

Quote

Quote

0.2445sec

0.2445sec

0.83

0.83

7 queries

7 queries

GZIP Disabled

GZIP Disabled