QUOTE(eddie2020 @ Jan 23 2021, 11:44 PM)

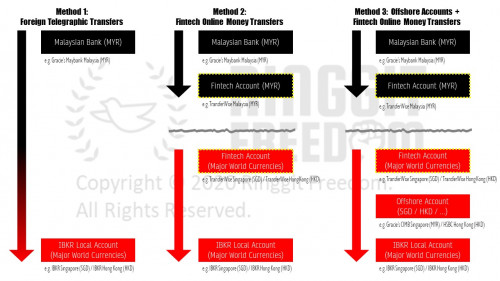

normally you put in usd and transfer to TW? sorry for outtopic, do TW easily to reg an USD acc? currently i use ib convert back to sgd n transfer to sg bank lol

pardon me, don't really get u.. put in usd and transfer to TW?

yea it's a breeze to register for TW account.. way much easier compare to register for ibkr.. but whether u will have the multi-currency account in TW, im not sure.. some users in here have while some don't..

the sgd transfer is the way to go.. the USD way is just another option

QUOTE(moosset @ Jan 24 2021, 12:50 AM)

debit? Meaning IBKR will take back the two small sum? They didn't take back from my TW worr..... how?

yes they will request for TW to transfer back the total of the two small sums.. only then the link is successfully set up

for ur case, the two small sums remain in ur TW account? how good, extra cash

seriously, im not too sure why though.. have u verified the two small amount in ibkr? after they sent u the amount in TW, u'll need to key in the two amount in ibkr as a verification process

Oct 13 2020, 09:46 AM

Oct 13 2020, 09:46 AM

Quote

Quote

0.2443sec

0.2443sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled