QUOTE(dwRK @ Jan 24 2021, 12:22 PM)

I'm old user... last time got borderless option but I didn't activate... now no more

so I think only available to old users who activated before

i remembered i read in here before that the borderless is available in m'sia already? got users login/logout or close the usd balance and re-open again to activate the boderless facility?so I think only available to old users who activated before

QUOTE(moosset @ Jan 24 2021, 12:51 PM)

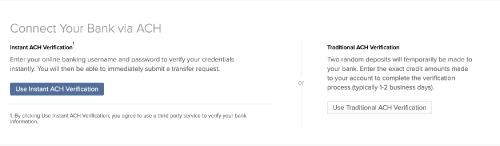

use traditional.. don't think we can use the instant one, that'll require username and password.. even if i have US bank account, wouldn't be comfortable to just give it to themQUOTE(pu27 @ Jan 24 2021, 12:52 PM)

It's now available for every southeast asian country except us. 🤡

You caught the last train, lucky you.

ah ok.. just in timeYou caught the last train, lucky you.

Jan 24 2021, 01:08 PM

Jan 24 2021, 01:08 PM

Quote

Quote

0.1423sec

0.1423sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled