Hi there, i am looking for some advice... appreciate you can help with your experience.

My current situation:

1. Investing in US market via Maybank Global and eToro.

2. Planning to switch to IB or TD Ameritrade

3. Applying both concurrently. IBKR Pro approved within 3 days (considering to link it with Tradestation Global), however still pending TD approval after 3 weeks.

4. Reason to change: MB Global - USD25/ 0.4% per trade... conversion loss.......eToro - i reached Platinum level... 0 fees for withdrawal... deposit via credit card... no fee just conversion loss.. everything seems good.... however... i don't like to receive money from funny funny accounts... u know what i am talking if you are eToro users.... feeling weird

5. Trade only US stocks…..no ETF, Option, Forex or whatever cos I no knowledge in it…. 60% invested for long term.... 40% short term

6. Pump in money whenever got extra.... hardly withdraw... the most.... maybe once a year.... nowadays USD seems weaker... no way...

My questions:

1. i have done some howework and generally IB is cheaper in everything (mostly) except the inactive fees... i personally dont find it convincing for me to trade via IB.... because of the inactive fees...even i link to tradestation also will incur some minimal trading fees like minimum $1.5/trade.... whereby TD is free... if i do not mind the USD 25 withdrawal fee (cos i hardly withdraw...IBKR only USD 10).... Do you think it is ok to use TD SG? I know the other best thing about IB is their low margin fees.... i have margin account in MY market but i don't think i will need margin in UD market...yet

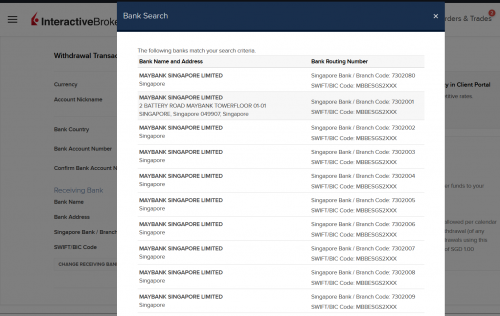

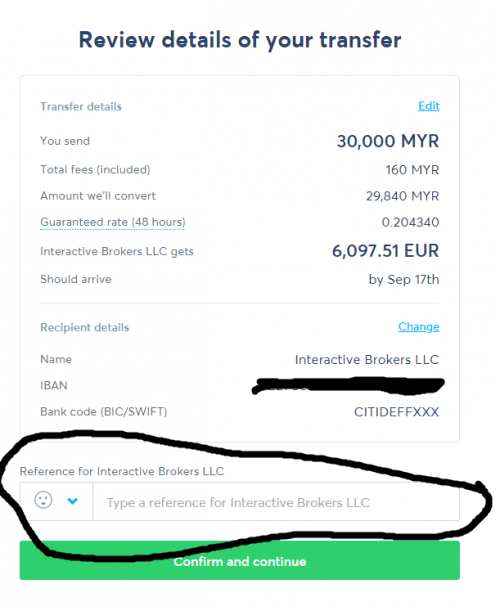

2. about Fund transfer… I do not have experience in this…. For eToro…very easy…..can use credit card only…. So what if I use TD/IB….. I heard a lot transferwise and I already registered…. haven’t tried … I plan to transfer 1 time like USD 30k …. If TT really gonna cost a lot more compare to transferwise/bigpay/paypal/instaRem?

(I will avoid the CIMB SG route cos I do not even have CIMB account in Malaysia)

3. By the way…. Will TD and IB charge you a fee when u deposit money to them? I overlook this part…

Sorry for my long msg…. hope you guys who has experience can help. I do not really looking for the ‘cheapest’ option…. I prefer the most ‘cost effective’ way. Thank you

1. choose the one u're most comfortable with.. there's no perfect platform or there's one subject entirely to anyone's preference.. give or take a little here and there.. TD SG may be commission free but comes with withdrawal fee, while IB may not be commission free but comes with free withdrawal once per month

2. funding methods can be found from previous comments in here, probably a page or two prior.. been discussed quite extensively

3. for IB, if u transfer in USD, there's a USD25 fee.. say u transfer USD1,000, u will get USD975 reflected in ur account

Sep 4 2020, 10:42 PM

Sep 4 2020, 10:42 PM

Quote

Quote

0.0400sec

0.0400sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled