Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

dwRK

|

Feb 21 2022, 08:26 PM Feb 21 2022, 08:26 PM

|

|

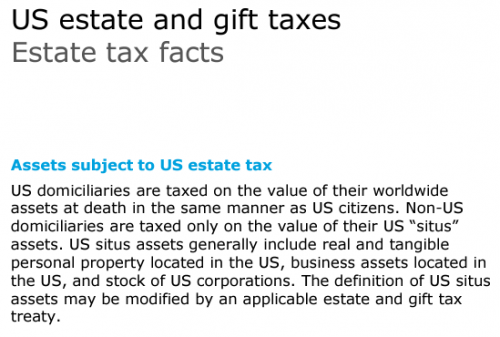

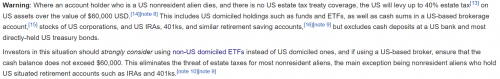

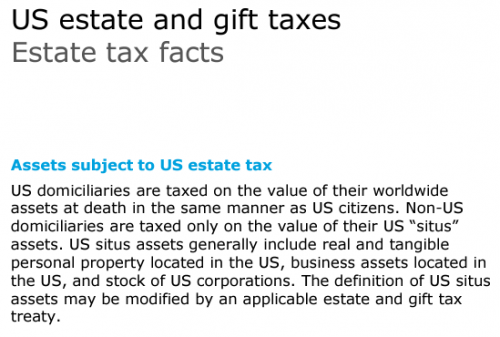

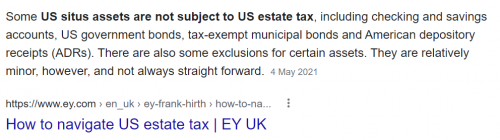

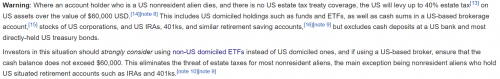

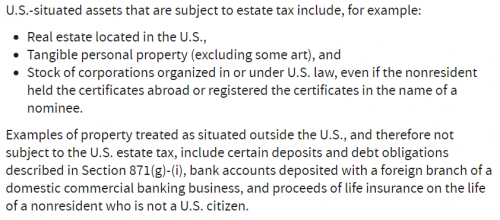

QUOTE(Toku @ Feb 21 2022, 05:02 PM) I think it doesn't matter if your broker account is IBKR USA or IBKR UK, if your asset is US domiciled, it will be subjected to the domiciled country estate tax law. If you hold US stock, even in IBKR UK account, IBKR UK will keep your US asset in their US broker branch. Vice versa, if you hold UK stock in IBKR USA account, it is subject to UK estate tax law. UK has no estate tax. Conclusion is, if you want to avoid US estate tax, try to keep less than 60k of US asset. However, USD cash in US bank is not counted as asset. If may try to invest in Irish ETF which domiciled in Ireland that hold US asset. That way you can save 15% WHT as well as avoiding US estate tax. UK is inheritance tax keep < 60k is not an option any cash with us broker is counted for estate tax... with uk broker is not This post has been edited by dwRK: Feb 21 2022, 08:28 PM |

|

|

|

|

|

dwRK

|

Feb 22 2022, 11:47 AM Feb 22 2022, 11:47 AM

|

|

QUOTE(Toku @ Feb 21 2022, 10:28 PM) USD cash in bank is not counted for US estate tax. USD cash in broker account is subject to US estate tax. Other foreign currency is not subject to US estate tax as they are kept in respective countries bank account. us law say CASH in us bank is not counted... CASH in broker account is counted... afaik, there is no distinction to currencies... whilst it does distinguish between us stocks and non-us stocks, so this omission probably imply foreign cash is also counted...because they cant be so stupid right? you're trying to make a case based on CASH in us banks is not counted, therefore cash kept by ibkr usa, especially in foreign currencies in foreign countries should especially not be counted, because you sent in sgd to a singapore bank or eur to a europe bank...and not usd to us bank... imho, you sent it to ibkr usa and is now under their custodianship... where they keep it is immaterial... anyways i dunno for sure... best to contact cs or tax lawyer to ask the question... with this said, ibkr uk better than ibkr us is still correct |

|

|

|

|

|

dwRK

|

Feb 22 2022, 02:11 PM Feb 22 2022, 02:11 PM

|

|

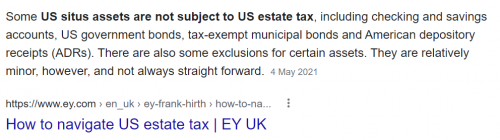

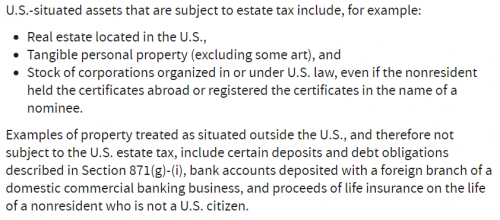

QUOTE(Toku @ Feb 22 2022, 01:20 PM) I think Ibkr uk and Ibkr us is comparable if your focus is the risk of US estate tax. Because it is the US 'Situ' asset that is matter. Only US 'Situ' asset is subject to US estate tax but there is exception like cash, bonds & ADRs. Below are some screenshots on this topic from Deloitte, EY, bogleheads and IRS. The reason I believe foreign cash is not affected is because it is not a US domiciled holding. It is the legal tender of the other countries and the account housing those cash is actually resides in the respective countries of the legal tender notes. Say if you convert USD to SGD in Ibkr uk account, the SGD is actually kept in a corresponding bank in the SGD account in Singapore. So it is not a 'Situ' asset to US and is not subject to US estate tax. It surprises me that certain US bonds is also not subject to the estate tax.     you are making an assumption that all foreign currencies under ibkr will be kept in their respective country... and any currency conversion means they must also make a cross border transaction... I doubt this to be the case... but fact is we don't know... let's just focus on usd... us law says usd held by us broker is us estate taxable... you just need to check if usd held by uk broker is it the same... |

|

|

|

|

|

dwRK

|

Feb 22 2022, 02:14 PM Feb 22 2022, 02:14 PM

|

|

QUOTE(Hansel @ Feb 22 2022, 01:42 PM) bro you opened ibkr account ar?... or just lurking here...  |

|

|

|

|

|

dwRK

|

Feb 22 2022, 11:16 PM Feb 22 2022, 11:16 PM

|

|

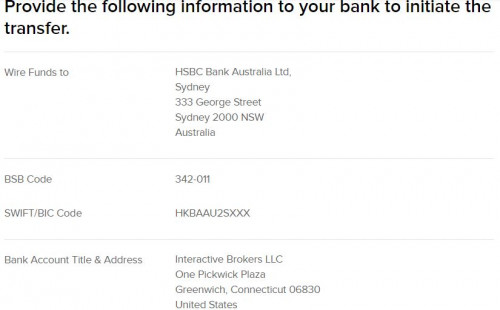

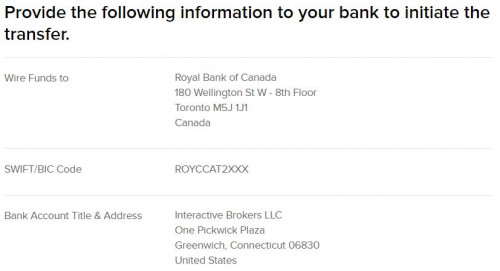

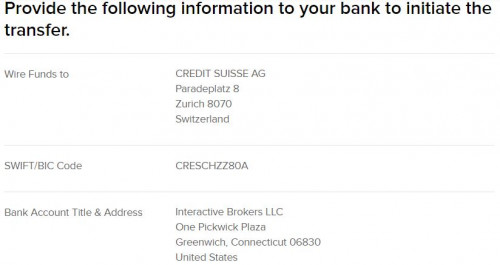

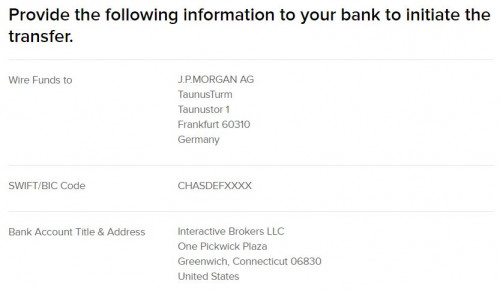

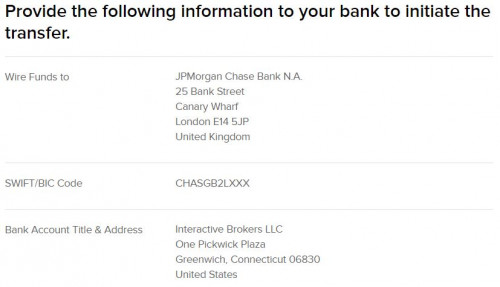

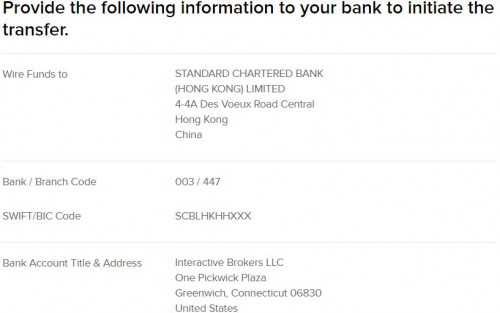

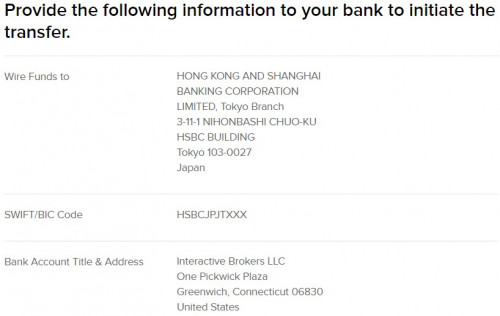

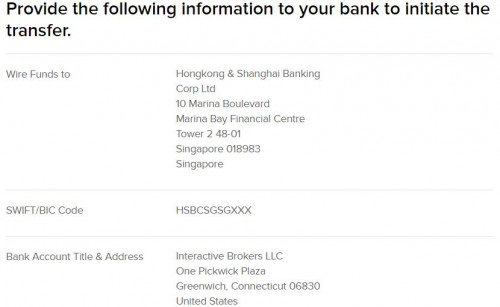

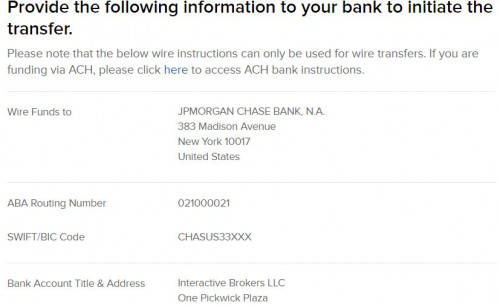

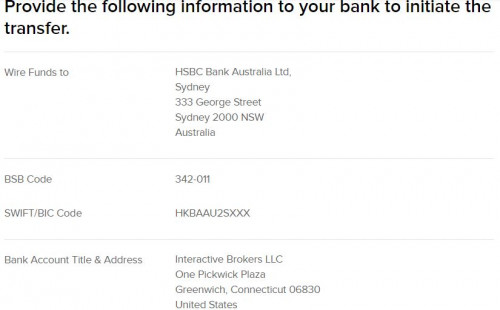

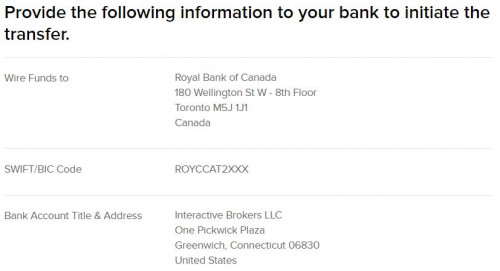

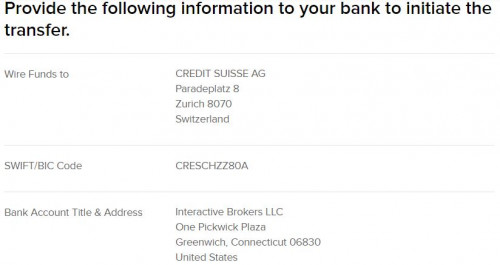

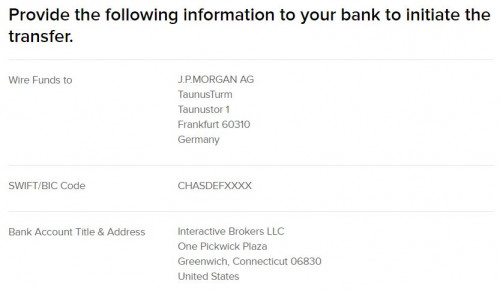

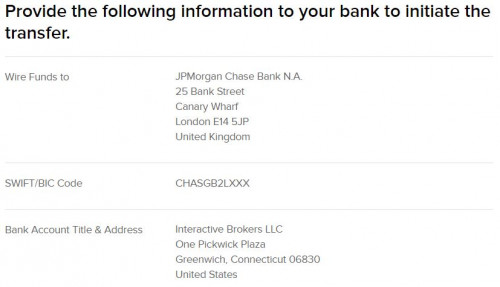

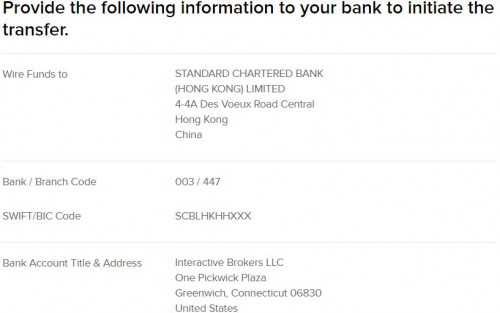

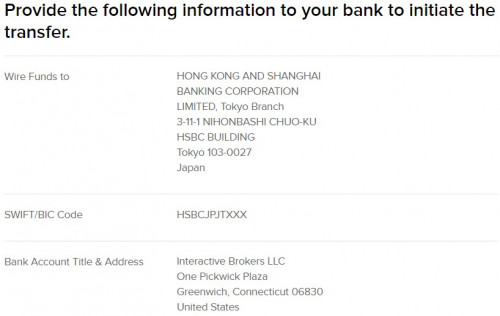

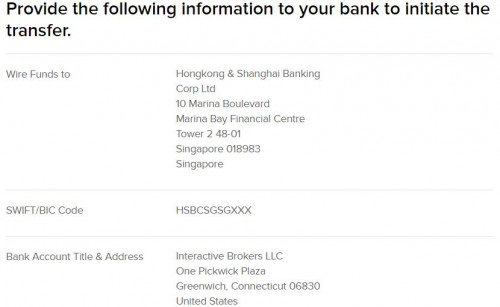

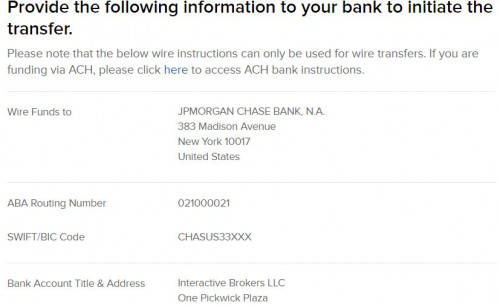

QUOTE(Toku @ Feb 22 2022, 09:22 PM) I tried deposit different currencies thru IBKR US and I got all the different bank address, swift code and account # in accordance to the country of the currency from IBKR US. It seems clear that IBKR has respective accounts in various countries to keep the currencies. You may try using IBKR UK to deposit USD and see if it provides you with a UK addressed bank or US addressed bank. » Click to show Spoiler - click again to hide... « AUD  CAD  CHF  EUR  GBP  HKD  JPY  SGD  USD  ib considers these to be major currencies with good liquidity and aml control, and have set up accounts to facilitate deposits. You can hold and trade a lot more other currencies... many do not have a corresponding bank » Click to show Spoiler - click again to hide... « The currencies that can be held are:

Australian Dollar (AUD)

British Pound (GBP)

Canadian Dollar (CAD)

Chinese Offshore Yuan (CNH)

Czech Koruna (CZK)

Danish Krone (DKK)

Euro (EUR)

Hong Kong Dollar (HKD)

Hungarian Forint (HUF)

Israeli Shekel (ISL)

Japanese Yen (JPY)

Korean Won (KRW)

Mexican Peso (MXN)

New Zealand Dollar (NZD)

Norwegian Krone (NOK)

Polish Zloty (PLN)

Russian Ruble (RUB)

Singapore Dollar (SGD)

South African Rand (ZAR)

Swedish Krone (SEK)

Swiss Franc (CHF)

Turkish Lira (TRY)

United States Dollar (USD) there is this thing called foreign exchange accounting... |

|

|

|

|

|

dwRK

|

Feb 22 2022, 11:23 PM Feb 22 2022, 11:23 PM

|

|

QUOTE(silverwave @ Feb 22 2022, 11:08 PM) Hi, for IBKR day trading, must it be a normal cash account or margin only? 3 day trades within 5 consecutive days seems ok for those below USD25k. cash acc must wait for T+2 days for to settle... trade any earlier you violate free riding trading regulation and you get suspended... margin account no such problem... if you can manage obviously no problem with either This post has been edited by dwRK: Feb 23 2022, 08:42 AM |

|

|

|

|

|

dwRK

|

Feb 23 2022, 12:08 PM Feb 23 2022, 12:08 PM

|

|

QUOTE(silverwave @ Feb 23 2022, 10:47 AM) Meaning if i buy on a Monday, i can only sell on Thursday/Friday right? In IBKR, can we have 2 accounts, margin and cash or either 1 only? my understanding you can buy and sell on monday... thursday can trade again |

|

|

|

|

|

dwRK

|

Feb 26 2022, 06:31 PM Feb 26 2022, 06:31 PM

|

|

QUOTE(TOS @ Feb 26 2022, 06:28 PM) No newspapers on Saturdays and Sundays due to "labour shortage in library" as a result of pandemic  Anyway. not sure if you guys like to read The Economist. Just realize my uni has electronic subscription as well, next time I will just share the permalink directly. Also some news for prospective or current TSMC shareholders published by 天下杂志 from Taiwan. https://zh.wikipedia.org/wiki/%E5%A4%A9%E4%...%9B%9C%E8%AA%8CEnjoy. The Economist (5th Feb 2022 edition) https://drive.google.com/file/d/19dHLgCyxMd...iew?usp=sharingThe Economist (12th Feb 2022 edition) https://drive.google.com/file/d/1YnSkHvyaq-...iew?usp=sharing天下杂志 12-01-2022 articles related to TSMC https://drive.google.com/file/d/1N6x4URRBZF...iew?usp=sharingyou really have too much free time... lol BTW... you doing MBA or what in HK? |

|

|

|

|

|

dwRK

|

Feb 26 2022, 11:23 PM Feb 26 2022, 11:23 PM

|

|

QUOTE(TOS @ Feb 26 2022, 09:44 PM) You guys don't like to read the magazines and newspapers I posted? I can stop uploading them if that is the case. Now I am doing my undergrad, BSc in Physics, but my interest these days are in Finance, and I am please to find out that there are research works combining both Physics and Finance/Economics, a field called "physical economics" Pretty interesting stuff and that is my future research topic for my postgrad study (hopefully in Singapore, BTW gonna go SG this summer for a 3-month research exchange program at SUTD). The free time is due to the nature of the coursework for me this semester, as it's mostly writing reports, I can prepare them earlier. I only have one mid-term and final exam to take, so the workload is a bit lighter for the study part, though pretty heavy on writing assignments. I need some rest and "standing" time, so standing while scanning newspapers and magazines just to kill time and rest in a quiet library. i used to subscribe to the economist and others... but nowadays I don't read anything anymore... lol... I hope many folks appreciate your efforts... it really does take a lot of time I was just curious with all the financials and business info you keep posting, that you might be doing research in this area.  |

|

|

|

|

|

dwRK

|

Feb 27 2022, 01:44 PM Feb 27 2022, 01:44 PM

|

|

QUOTE(TOS @ Feb 27 2022, 12:41 PM) Oh what do you read these days for business news? Bloomberg? Reuters? Not that much efforts actually, just scan the pages into a single PDF files or multiple PDF files and save it to my thumdrive (all done by the scanner automatically), then I just split and reorganize some of them e.g. ETF stuff to the ETF thread, others here at IB etc. before uploading them to Google Drive and share the link.  I hope you find them interesting anyway. i just read the charts and ignore the noises...  having said... with fa info to backup ta would be perfect |

|

|

|

|

|

dwRK

|

Feb 28 2022, 05:13 PM Feb 28 2022, 05:13 PM

|

|

QUOTE(TOS @ Feb 28 2022, 05:02 PM) yo physicist. I am pretty sure a Physics student can solve this.  The calculation depends on the share price though, but since the share price fluctuates, it's nearly impossible to compute. Most people would trade less than 300k shares a month. So, if given this simplification, then you only have one condition to deal with. 0.35 USD minimum, 0.0035 USD per share thereafter, an upper bound of 1% trade value. For a single purchase, in graph, it would look something like this:  Maybe you can recall your "Monte-Carlo method" to simulate fluctuating share prices with a given purchase value and an initial stock price, then run through your simulation to find the condition of purchase which incur the minimum fee. (Sounds like an optimization problem.) and so... the outcome of buying say 100 shares... you have a fee of X(P10), Y(P50), Z(P90)... lol |

|

|

|

|

|

dwRK

|

Mar 10 2022, 10:26 AM Mar 10 2022, 10:26 AM

|

|

QUOTE(InvesttoLearn @ Mar 10 2022, 10:23 AM) Hi guys, i encountered an issue last night after selling 1 unit of share but i realized that my buying power is reduced by that selling amount. Cash account. Any sifu can help? Thank you your cash not yet comes in... t+2... |

|

|

|

|

|

dwRK

|

Mar 17 2022, 07:26 PM Mar 17 2022, 07:26 PM

|

|

QUOTE(TOS @ Mar 17 2022, 07:11 PM) dwRK Hansel A tax question (today is Roche's ex-date. Dividend coming in in 3 days time.) If assume I stay in SG for 90 days (circa 3 months), and divide the rest of my time in 2022 evenly in Malaysia and Hong Kong, i.e. say 137 and 138 days, respectively. (of course unlikely so exact since I am most likely a HK tax resident for 2022, but just a hypothetical question.) That means I will not be a tax resident of either SG, MY or HK. So if this is the case, where does my tax residency belong too? And how am I suppose to reclaim my withholding tax if I am not a tax resident of all 3 places? go look up tax residency and substantial presence test... it's not just 2022... need to see 2021...2020... you are most likely tax resident Malaysia... on the tax year you move, you can also pro-rate your days and be both tax resident Malaysia and tax resident HK... This post has been edited by dwRK: Mar 17 2022, 07:26 PM |

|

|

|

|

|

dwRK

|

Mar 18 2022, 09:21 AM Mar 18 2022, 09:21 AM

|

|

QUOTE(Lon3Rang3r00 @ Mar 17 2022, 10:07 PM) Dear Sifu/s, just wanna ask how regular you guys topup? let's say i plan to have a commitment of investing Rm200/month into IBKR, should i hold and topup every couple of month or there's not much impact? QUOTE(Hoshiyuu @ Mar 17 2022, 10:39 PM) » Click to show Spoiler - click again to hide... « It'll depend on your deposit route, but try to keep your total transaction fee under 1% (0.5% ideally for me) - if you deposit and convert RM200 every month, you are going to lose quite a bit of fixed cost every month (2USD fixed currency conversion fee at IBKR for SGD->USD, Wise conversion fee for MYR->SGD or MYR->USD is around RM4 for RM200). Might wanna just hold onto it and deposit in longer interval (bimonthly, quarterly?) and later on, use low amount of margin (1.2x or below) to smooth out the buy interval if needed. Losing 9% (MYR->(WISE)->SGD->(IBKR FX)->USD) or 2% (MYR->(WISE)->USD) of your deposit before you do anything is pretty bad. The minimum deposit amount using the cheapest route at low volume would be MYR->(WISE)->USD at RM400 per deposit (~1% cost of conversion + 0.35USD for US stock/~2USD for LSE stock purchase) - if you buy Irish domiciled ETFs and stocks, MYR1200 per deposit via the MYR-USD route would be optimal-ish I guess? In that case I would suggest buying US-domiciled equivalent and forgo the 15% withholding tax gain until you decide to commit more per month in the future to cut down on purchase cost. But don't overthink it too much either - sometimes being invested is the important part. There is a lot of nuance to this, so you can always come back and ask here with reference to what ticker you would be buying. QUOTE(Takudan @ Mar 18 2022, 12:33 AM) » Click to show Spoiler - click again to hide... « Adding on to sifu's advice above, I think you can consider tapping into your savings/short-term investments for that mini-lump sum to IBKR. For example, right now you have 10k saved up for rainy days. Take half of that, you'll have a healthy sum for a relatively lower transaction cost (conversion fee, commission etc). For the next half year, rebuild that missing 5k back into your savings, rinse and repeat. It does mean that you will be risking those few months where you're shorter on emergency funds. My point is, always prioritise on having a healthy sum of emergency funds. Holding cash gives you a lot more choices and less worries. Only invest with with an amount that you can part with for a loooong period of time (e.g. 5 years+) QUOTE(polarzbearz @ Mar 18 2022, 12:57 AM) » Click to show Spoiler - click again to hide... « Generally, the lower the amount, the less transaction fee incurred would be ideal (e.g. try to accumulate to 1k tranche; buy one fund per month; etc.). Otherwise the fees (albeit little) will add up very quickly. Just to illustrate: Wise/FTT transaction: between 1% ~ 2% depending on how much you transfer. IBKR Conversion fee: 0% (if you direct debit via Wise USD multicurrency account) or ~1-2% if you use IBKR in-app conversion, again, depending on how much you transfer. IBKR transaction fees$0.50 out of $50.00 is 1% $0.50 out of $500.00 is 0.1% For myself (just started this month after stopping my SA DCA  ), I'm going with RM2k/month into 1 fund (or max, two funds only). Will rotate my ETF choice on month-to-month basis between VWRA (primary) or my complementary sector/region ETFs (e.g. CSPX, KWEB/3067, 3040, etc.) - topping up whichever ETF's that has lower valuation / other factors at play. ideas are good and valid... but i'll give y'all a more balance view in a bull market like the us has been in the past 13 yrs... time in market is just as important so whilst depositing every month... you lose out in fees... you win back in capital gains+dividends... take voo or qqq as example, y'all can do the maths to confirm  obviously in a bear market... take your time...  |

|

|

|

|

|

dwRK

|

Mar 21 2022, 08:42 AM Mar 21 2022, 08:42 AM

|

|

QUOTE(TOS @ Mar 20 2022, 09:20 PM) Wow I can prefer my tax residency in certain locations? That means I can choose my tax residency? From what I have checked, based on dwRK's advice, the latest version of HK-MY DTA. https://phl.hasil.gov.my/pdf/pdfam/Hong_Kon...UA_366_2012.pdfBased on the (English version) Article 4, "Resident", I am a MY resident which is the case if I stay less than the 180 days in a year of assessment (or less than 360 days in 2 consecutive years of assessments). But if I meet that requirement, I am considered to be "domiciled in Malaysia", so "by reason of domicile", as paragraph 2a) says I am deemed a resident to Malaysia since my permanent home is available there. So, to me, there are no two ways about it, I am a MY tax resident. At least that is how I interpret the DTA. You have a different view? Also, unrelated to this, Takudan have you tried claiming your Nestle WHT from Swiss FTA before? Just want to know the details of the TT fees charged. If I use a local bank account like Maybank I need to pay for the inbound TT fees? What if I use my SG CIMB account, since the TT fees are waived, I presume that can be used to receive the money (i.e., in SGD)? Thanks. you always default to TR MY... you can change to TR HK if... 1. got job... work visa/permit start date you become TR HK 2. lepak > 180 days but i think need to apply to HK for letter/cert... usually you dont get a visa stay > 180 days... i dunno what circumstances you'll get this... there may be special provisions for students like in your case... where you lepak 3-4 yrs, can work max xyz hrs no need pay tax, but will never be considered as TR HK even though meet > 180 day test because you are there for a "temporary" purpose of learning... you best check with HK irb, HK forums, ex HK students, etc... |

|

|

|

|

|

dwRK

|

Mar 24 2022, 08:46 AM Mar 24 2022, 08:46 AM

|

|

QUOTE(Zephyral @ Mar 23 2022, 09:57 PM) Hi all, I have been hunting around in the CIMB SG site and some blogs but failed to get a definite answer to the transfer charges. Some of the blogs I seen about low fees involved transfer to IBKR bank account in HK or SG, but what about transfer from CIMB SG to IBKR account in the US? Specifically the Citibank NA on Wallstreet What are the charges like? you don't know how to look... https://www.cimb.com.sg/en/personal/help-su...remittance.html |

|

|

|

|

|

dwRK

|

Mar 24 2022, 11:22 AM Mar 24 2022, 11:22 AM

|

|

QUOTE(Zephyral @ Mar 24 2022, 11:06 AM) Thank you for the link. I am aware of it, but not ashamed in saying I don't quite understand which applies in this instance. ok lah then dun say cannot find... say found but dun understand...  Remittance Outward - Telegraphic Transfer Debit from SGD account or payment by SGD cash... 0.125% commission (min S$10, max S$100) + agent fee (if applicable) + cable charges (flat rate of S$30) Agent upfront charges... USD - 27 so when you wire sgd 5000 to usa... your total fee is sgd 10 + usd 27 + sgd 30 really cut throat... |

|

|

|

|

|

dwRK

|

Mar 24 2022, 11:58 AM Mar 24 2022, 11:58 AM

|

|

QUOTE(Ramjade @ Mar 24 2022, 11:26 AM) Aren't all banks in Malaysia and sg like that? That's why I avoid using banks at all cost. I don't like to give free money to banks/brokerage. malaysia charge you in cheaper ringgit...  |

|

|

|

|

|

dwRK

|

Mar 24 2022, 07:38 PM Mar 24 2022, 07:38 PM

|

|

QUOTE(evangelion @ Mar 24 2022, 07:24 PM) Just wondering, any of you able to buy russia stocks? :confused: russian market suspended |

|

|

|

|

|

dwRK

|

Mar 24 2022, 07:40 PM Mar 24 2022, 07:40 PM

|

|

QUOTE(Zephyral @ Mar 24 2022, 01:24 PM) Thank you for the breakdown. That's really quite cutthroat eh. isn't that kinda more expensive than remittance from Malaysia CIMB itself? Yes... my banks cheaper than sg... |

|

|

|

|

Feb 21 2022, 08:26 PM

Feb 21 2022, 08:26 PM

Quote

Quote

0.0508sec

0.0508sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled