Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

dwRK

|

Jan 26 2022, 07:03 AM Jan 26 2022, 07:03 AM

|

|

QUOTE(TOS @ Jan 25 2022, 09:03 PM) With money coming in just a moment ago. Indeed I can confirm BATECH is the cheapest at 1.52-1.54 CHF per trade. Thanks for your help. Do you know where to find real-time quotes for SIX-listed shares. I checked many sites like investing.com, the official SIX group page and Google Finance but the quotes are always delayed by 15 minutes. Kind of scary if you are a trader (luckily I am not). sorry dunno about six real time |

|

|

|

|

|

dwRK

|

Jan 26 2022, 06:47 PM Jan 26 2022, 06:47 PM

|

|

QUOTE(TOS @ Jan 26 2022, 04:07 PM) For those who are in Swiss shares but need some real-time data for reference, here is one: https://www.investing.com/indices/switzerland-20-futuresSMI 20 futures. It's real-time and since the Nestle, Novartis and Roche account for half of it, you can have a general sense of the market movement. not accurate futures sometimes do not track the underlying at all... as i'm typing its off by 100+ points. yours is also derived... meaning its adding up the rest of the components you can try this... https://capital.com/nestle-sa-share-price ...its price matching bot should track the price more accurately, it will be off just a bit because of the cfd spread for fees... you can also look at nesn cfd inside ibkr This post has been edited by dwRK: Jan 27 2022, 06:47 AM |

|

|

|

|

|

dwRK

|

Jan 28 2022, 08:03 PM Jan 28 2022, 08:03 PM

|

|

QUOTE(lhshyong @ Jan 28 2022, 03:28 PM) Halo all taiko, I would like to do some market survey, need get some opinion or advice. We are solution provider, currently we have working on one auto trading system that connected IB. Based on user predefined indicator rules and target to reduce workload and free up user time in front pc. would like to know does this system have market potential and demand? show me details pls... |

|

|

|

|

|

dwRK

|

Feb 2 2022, 03:56 PM Feb 2 2022, 03:56 PM

|

|

QUOTE(lhshyong @ Feb 2 2022, 01:41 AM) Hi, what details you want to know ? Here some feature details - Its web based system - Create strategy for trading asset, 1 minutes, 5 , 15, 30 to 1 hour timeframe - Supports FX, Stock, Options - Rules based on sma indicator / price / index etc. - Transaction history table - Portfolio dashboard - Backtesting We would like to understand what are the common pain points and see any chance we able to improve it. hi... do you have a working demo or trial? web based... means browser needs to be open, running your script? can run headless? how many assets can be traded at the same time? how many rules/indicators can you use for a strategy? how many timeframes can you use for a strategy? thanks... |

|

|

|

|

|

dwRK

|

Feb 3 2022, 04:55 PM Feb 3 2022, 04:55 PM

|

|

QUOTE(TOS @ Feb 3 2022, 03:04 PM) Not sure if anyone still have stakes in O&G companies these days. Shell's Q4 result just a moment ago: https://www.shell.com/investors/results-and...21/q4-2021.htmli have a lot...  |

|

|

|

|

|

dwRK

|

Feb 3 2022, 05:17 PM Feb 3 2022, 05:17 PM

|

|

QUOTE(lhshyong @ Feb 3 2022, 04:12 PM) » Click to show Spoiler - click again to hide... « Unfortunately, we dont have trial now, we need to setup demo in advanced.

We can share some screen photo.

Web, server engine is running 24X7, browser just used to check status from anywhere with internet.

total asset can trade at same time depends on server spec, api and time frame, currently the system is running on 40-50 strategy.

Currently we only setup with 3-4 MA indicator , several index , eg VIX, STOCH etc. should able extend up to most common indicators.

time frame have 1 ,5, 30 minutes , 1 hour and daily just used for reference. anyway time frame can extend as needed.

Hope this answer your question, anything else you inter est to know ?

Do you think this kind of auto trade system has demand in community ? Thanks bro thanks for the feedback automated trading is more prevalent in forex and crypto. there are plenty of free and paid EA bots for the MT4/5 platforms, and quite a bit running Java, Python, etc for crypto. imho... I don't think there is any demand here in lowyat for automated stock trading... from what I can see, most ppl here are long term value stock/etf investors myself trade futures hence this piqued my interest... I also have a crypto bot so am familiar with the workings and limitations |

|

|

|

|

|

dwRK

|

Feb 3 2022, 08:09 PM Feb 3 2022, 08:09 PM

|

|

QUOTE(TOS @ Feb 3 2022, 06:18 PM) You are proprietary day trader (PDT)?  pdt.... pattern, not proprietary...  pdt only on stocks/etfs... futures excluded... anyways my accounst not constraint by pdt... so I just trade as I pleased... last year just traded one month, lepak 11... lol This post has been edited by dwRK: Feb 3 2022, 08:11 PM |

|

|

|

|

|

dwRK

|

Feb 3 2022, 08:24 PM Feb 3 2022, 08:24 PM

|

|

QUOTE(TOS @ Feb 3 2022, 08:18 PM) Wah day trader  You use IB to day trade? no lah... scalping n day trade too much work... swing and position trades fits me better ib for stocks... tda for futures... and others...  |

|

|

|

|

|

dwRK

|

Feb 3 2022, 11:14 PM Feb 3 2022, 11:14 PM

|

|

QUOTE(TOS @ Feb 3 2022, 10:44 PM) Finally manage to buy 1 ROG share at 347.1. dwRK the spread if very high lah for the CFD data. I queue at 347 for very long but the CFD displays very low range of 346.6-346.8, thought something wrong with IBKR why my order didn't go through... okie... I guess cfd ppl more pessimistic... sorry my advice not so good... |

|

|

|

|

|

dwRK

|

Feb 5 2022, 09:54 PM Feb 5 2022, 09:54 PM

|

|

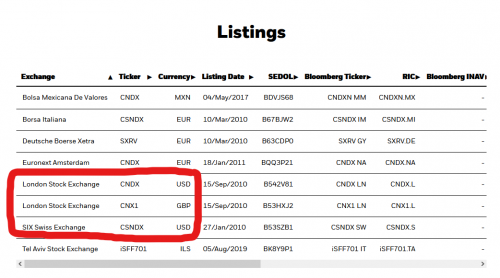

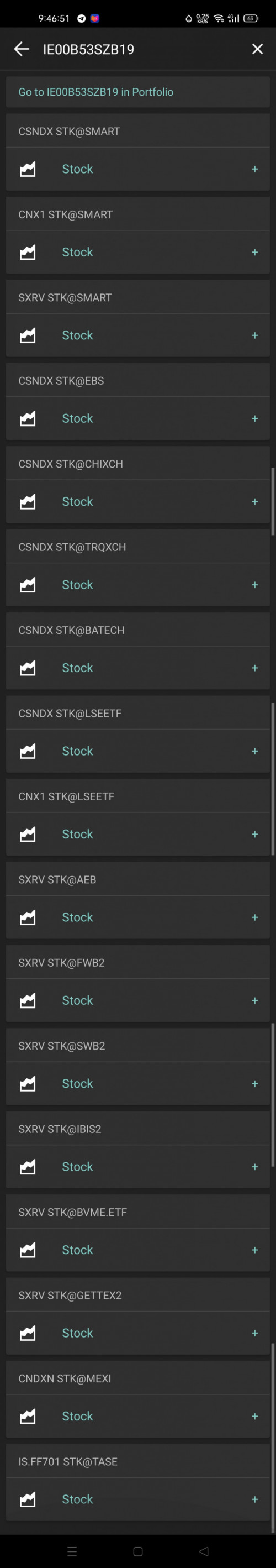

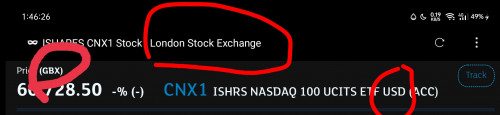

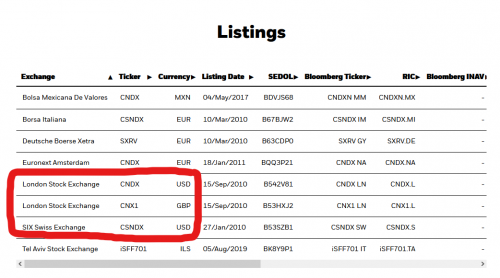

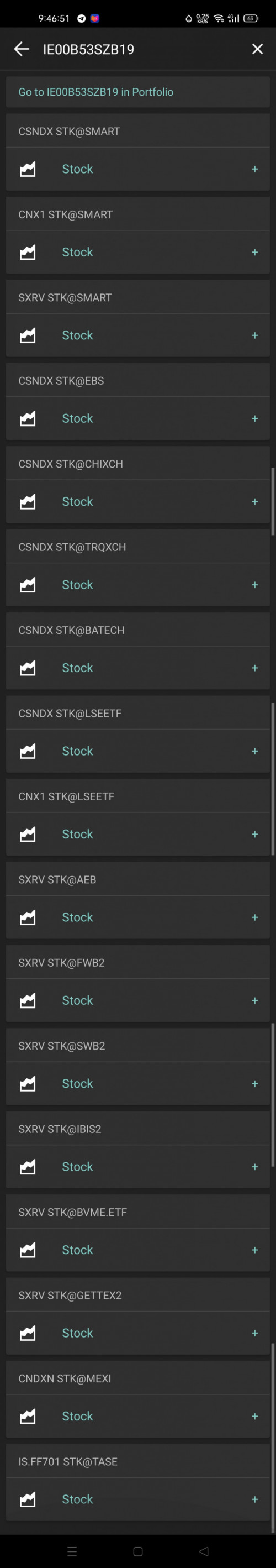

QUOTE(Hoshiyuu @ Feb 5 2022, 05:13 PM) I dug deeper, and it seems like IB only has listing for CNX1 traded in GBP with it improperly labelled as ISHARES NASDAQ 100 USD ACC, and CNDX is nowhere to be found, you are not alone in this. Perhaps you can try looking up CSNDX on the SIX Swiss Exchange (displayed as EBS on IB). It's the same fund essentially, same ISIN - just listed on a different stock exchange. You will need to enable Swiss Exchange trading permission - it'll prompt you so when you try to buy it.  As mentioned, there is a slight edge to owning QQQ via NASDAQ over it's Irish domiciled counterpart simply due to its much lower expense ratio contributing to bigger net yield even taking account of 15% higher withholding tax, however the QQQ one is a distributing type ETF, so you might have to keep that in mind. lol IE00B53SZB19 = ISHARES NASDAQ 100 USD ACC... is it's correct name not mislabeled these are on IB...  This post has been edited by dwRK: Feb 5 2022, 10:06 PM This post has been edited by dwRK: Feb 5 2022, 10:06 PM |

|

|

|

|

|

dwRK

|

Feb 6 2022, 01:23 AM Feb 6 2022, 01:23 AM

|

|

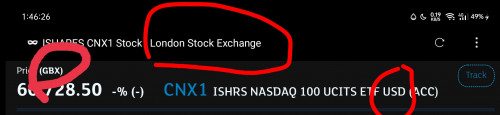

QUOTE(Hoshiyuu @ Feb 5 2022, 11:31 PM) Yeah, and yet CNDX is not available on LSEETF, only CNX1 is, and while it says ISHARES NASDAQ 100 USD ACC, it's traded in GBP when you try to get a quotation. there are 2 listed on London Stock Exchange... cndx in USD & cnx1 in GBP... ib shows it as csndx... instead of cndx this "named" etf denominated in USD, can be traded in USD, GBP & EUR... from London Stock Exchange website... see name... all ok  This post has been edited by dwRK: Feb 6 2022, 01:56 AM This post has been edited by dwRK: Feb 6 2022, 01:56 AM |

|

|

|

|

|

dwRK

|

Feb 7 2022, 06:37 AM Feb 7 2022, 06:37 AM

|

|

QUOTE(Yggdrasil @ Feb 7 2022, 02:21 AM) If you buy EQQQ instead, it's exactly the same expense ratio as QQQ because same issuer i.e. Invesco. Only downside is the spread can be thin especially if you panic sell and it stops trading earlier than US market. On the other hand, you might avoid estate taxes opting for EQQQ instead. iirc... eqqq is distributing... op wants accumulating... |

|

|

|

|

|

dwRK

|

Feb 8 2022, 10:42 AM Feb 8 2022, 10:42 AM

|

|

QUOTE(Toku @ Feb 7 2022, 06:32 PM) Money in your hand is always better. Your allocation at the right time and right place is much better than just blindly top up at every dividend distribution. And the estate tax avoidance is good for long term investor. US estate tax will apply for any amount >$60k in any US assets (the bar is low). That is why most of the ETF are Ireland domiciled. some ppl are really passive investors... whilst others very active... no right or wrong way here... at least there are plenty of choices... BTW... eqqq is London This post has been edited by dwRK: Feb 8 2022, 07:00 PM |

|

|

|

|

|

dwRK

|

Feb 8 2022, 10:49 AM Feb 8 2022, 10:49 AM

|

|

QUOTE(Davidtcf @ Feb 8 2022, 09:10 AM) agree, I went and bought some SG REITs right after 2nd day of CNY, then suddenly prices drop like few %. If know earlier would have waited then come in to buy. Sometimes holding for a few days is better.. especially right after 2 days CNY holiday break at the SG stock market. Morning and evenings are bad times to buy, as that's when many desperate buyers. If sell then it is good time. Middle of the month usually market will cool down also, as people wait for their next salary/income to invest.. most are broke that time. Next drop for US likely in March this year, as Fed already hinted they might increase interest rates once again. Now stocks are not rallying yet as many are still in red. Good time if you want to accumulate stocks at discount.. but nobody know if they will drop further. Feds might increase multiple times interest rates just to combat inflation @US. What happens in US will affect the rest of the world's stock market. you bought... and it dropped... so now say better to wait... you didn't buy... and it rises... surely you'd say should have bought earlier... lol |

|

|

|

|

|

dwRK

|

Feb 10 2022, 07:11 PM Feb 10 2022, 07:11 PM

|

|

TOS & friends... come... i find practically real-time for y'all... https://www.marketscreener.com/quote/stock/...pide&mots=roche

|

|

|

|

|

|

dwRK

|

Feb 10 2022, 07:16 PM Feb 10 2022, 07:16 PM

|

|

QUOTE(Takudan @ Feb 10 2022, 05:55 PM) (Not sure if I just asked an oxymoron... is there a restriction that GLC cannot be publicly traded?) he meant ccp glc easy ban by usa for its selfish reason... ppl holding them gg... |

|

|

|

|

|

dwRK

|

Feb 11 2022, 10:37 AM Feb 11 2022, 10:37 AM

|

|

QUOTE(Takudan @ Feb 10 2022, 10:45 PM) Oh pardon my ignorance, I was on the polar opposite of mindset: GLC means China wouldn't fine/sanction their own companies, so flourish under government's care... I forgot they also rely on international (US big bro)'s investors 😅 QUOTE(sp3d2 @ Feb 10 2022, 11:32 PM) If that is the case then just buy a GLC that is already well known under CCP. It won't get the wrath of US investors anymore and somemore CCP loves the company. Can I think like that? big brother usa likes to sanction anyone any company that threatens their self-interests... look at huawei, zte, tiktok, alibaba, tencent, etc... nothing to do with investors... everything bout politics and foreign policies... |

|

|

|

|

|

dwRK

|

Feb 15 2022, 09:59 AM Feb 15 2022, 09:59 AM

|

|

QUOTE(jaapers @ Feb 14 2022, 11:47 PM) Does ibkr allow cme futures trading? It says it does, buy i can't find the crude palm oil futures cme yes. not offered. go local fcpo lor. This post has been edited by dwRK: Feb 15 2022, 10:00 AM |

|

|

|

|

|

dwRK

|

Feb 19 2022, 11:45 AM Feb 19 2022, 11:45 AM

|

|

QUOTE(AthrunIJ @ Feb 19 2022, 10:15 AM) Halo, noted. Thanks for the info. Last question, country specific ibkr is just basically following the host country law right. It doesn't matter if I open a sg ibkr or UK ibkr as I have read online so far? country specific ibkr is for its residents... other countries' ppl cannot open, will automatically go under inkr usa... unless you open tsg and delink will continue follow ibkr uk... for estate tax purposes uk is better than us... less tax This post has been edited by dwRK: Feb 19 2022, 02:29 PM |

|

|

|

|

|

dwRK

|

Feb 19 2022, 02:27 PM Feb 19 2022, 02:27 PM

|

|

QUOTE(Ramjade @ Feb 19 2022, 11:56 AM) i should write uk is better than us... less tax ...updated This post has been edited by dwRK: Feb 19 2022, 02:30 PM |

|

|

|

|

Jan 26 2022, 07:03 AM

Jan 26 2022, 07:03 AM

Quote

Quote

0.2666sec

0.2666sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled