QUOTE(Takudan @ Sep 22 2021, 02:15 AM)

question about dividends payout on IBKR:

how do I understand my dividend reports?

i tried generating a HTML Activity statement YTD, and i see a lot of things that i don't und lol. First of all, I see two sections,

Dividends

This looked straightforward, it tells me the WHT and so I can correctly verify that

- US stock 30% WHT

- Swiss stock 35% WHT

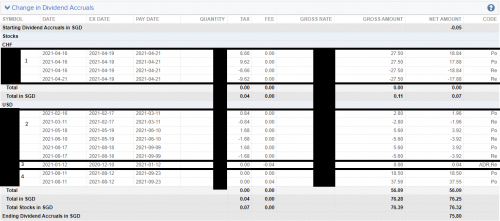

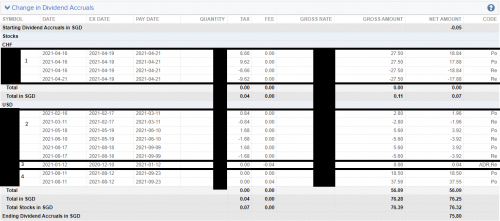

Change in dividends accrual

now this table lost me...

I masked out the counters to reduce "advice distractions" so please bear with me each horizontal line separates the counters, so we have 4 counters in question.

each horizontal line separates the counters, so we have 4 counters in question.

Counter 1 and 2 were in the above section. The taxed amount tallies with above, but how do I understand this table....? why is it adding and subtracting back?

Counters 3 and 4 are ADRs, in fact they do not show up in the section above on WHT - but I thought ADRs are still subject to WHT......?

P.S. I'm not hunting dividends, but knowing how dividend payouts typically lower the stock counters and the reinvestment isn't happening (recall another forumer mentioned before that it does not happen if the payout doesn't amount to at least one share(?)), I want to understand how much I'm actually getting/losing, and therefore assess my position better.

it is an accrual account.. this is used to track payments...how do I understand my dividend reports?

i tried generating a HTML Activity statement YTD, and i see a lot of things that i don't und lol. First of all, I see two sections,

Dividends

This looked straightforward, it tells me the WHT and so I can correctly verify that

- US stock 30% WHT

- Swiss stock 35% WHT

Change in dividends accrual

now this table lost me...

I masked out the counters to reduce "advice distractions" so please bear with me

Counter 1 and 2 were in the above section. The taxed amount tallies with above, but how do I understand this table....? why is it adding and subtracting back?

Counters 3 and 4 are ADRs, in fact they do not show up in the section above on WHT - but I thought ADRs are still subject to WHT......?

P.S. I'm not hunting dividends, but knowing how dividend payouts typically lower the stock counters and the reinvestment isn't happening (recall another forumer mentioned before that it does not happen if the payout doesn't amount to at least one share(?)), I want to understand how much I'm actually getting/losing, and therefore assess my position better.

on ex date... an "iou" entry is created... on pay date, an opposite "completion" entry is created... the account will nett zero...

this is why you see a +$10.... and later a - $10...

Sep 22 2021, 08:40 AM

Sep 22 2021, 08:40 AM

Quote

Quote

0.0398sec

0.0398sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled