As per last briefing,.. said the timetable will be announced in beginning of October.

In the meantime, we go after AAPL and TSLA and Tik-Tok events first, bros,..

Hong Kong Exchange & HK Stocks, Per title post-Extradition Bill W/drawal

Hong Kong Exchange & HK Stocks, Per title post-Extradition Bill W/drawal

|

|

Sep 2 2020, 01:15 PM Sep 2 2020, 01:15 PM

|

Senior Member

9,361 posts Joined: Aug 2010 |

As per last briefing,.. said the timetable will be announced in beginning of October.

In the meantime, we go after AAPL and TSLA and Tik-Tok events first, bros,.. |

|

|

|

|

|

Sep 2 2020, 01:59 PM Sep 2 2020, 01:59 PM

|

Junior Member

764 posts Joined: May 2018 |

|

|

|

Sep 2 2020, 05:50 PM Sep 2 2020, 05:50 PM

|

All Stars

24,466 posts Joined: Nov 2010 |

QUOTE(Hansel @ Sep 2 2020, 01:15 PM) As per last briefing,.. said the timetable will be announced in beginning of October. bro, while waiting for Ant Fintech, look at 03033 again.In the meantime, we go after AAPL and TSLA and Tik-Tok events first, bros,.. closed 7.935 today, +2.99%. i will prepare some fund for Ant Fintech! QUOTE(markedestiny @ Sep 2 2020, 01:59 PM) dividend is old school, tak pakai now....now with zero/near zero int/discount rates, GROWTH stocks get explosive valuations. traditional property, commodites O&G, banks, malls, leisure... wun be same again. no choice, must follow... tech, online, etc. unless covid miraculously disappears like DT hopes, and no other covid comes next 10 years... fat hopes. |

|

|

Sep 2 2020, 06:18 PM Sep 2 2020, 06:18 PM

Show posts by this member only | IPv6 | Post

#484

|

Senior Member

3,482 posts Joined: Sep 2007 |

QUOTE(AVFAN @ Sep 2 2020, 05:50 PM) bro, while waiting for Ant Fintech, look at 03033 again. Seems like 3033 fund heavy buy into 0772 and 9988 these few days. Thanks to the fund closed 7.935 today, +2.99%. i will prepare some fund for Ant Fintech! dividend is old school, tak pakai now.... now with zero/near zero int/discount rates, GROWTH stocks get explosive valuations. traditional property, commodites O&G, banks, malls, leisure... wun be same again. no choice, must follow... tech, online, etc. unless covid miraculously disappears like DT hopes, and no other covid comes next 10 years... fat hopes. This post has been edited by foofoosasa: Sep 2 2020, 06:19 PM |

|

|

Sep 2 2020, 06:40 PM Sep 2 2020, 06:40 PM

|

All Stars

24,466 posts Joined: Nov 2010 |

|

|

|

Sep 2 2020, 06:55 PM Sep 2 2020, 06:55 PM

|

All Stars

24,466 posts Joined: Nov 2010 |

|

|

|

|

|

|

Sep 2 2020, 07:31 PM Sep 2 2020, 07:31 PM

|

Junior Member

12 posts Joined: Jun 2010 |

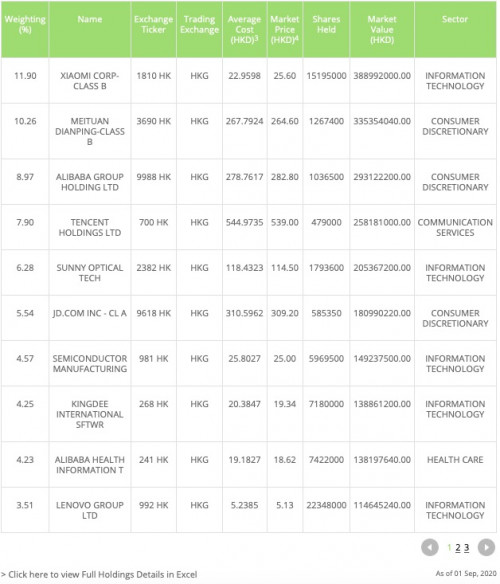

QUOTE(AVFAN @ Sep 2 2020, 06:40 PM) as at 1/9/2020's holding get it from CSOP's website http://www.csopasset.com/en/products/co-chst |

|

|

Sep 2 2020, 07:35 PM Sep 2 2020, 07:35 PM

|

All Stars

24,466 posts Joined: Nov 2010 |

QUOTE(cw81 @ Sep 2 2020, 07:31 PM) TQ for update! |

|

|

Sep 2 2020, 07:40 PM Sep 2 2020, 07:40 PM

Show posts by this member only | IPv6 | Post

#489

|

Senior Member

3,482 posts Joined: Sep 2007 |

QUOTE(cw81 @ Sep 2 2020, 07:31 PM) Scroll to second and third page list as well. I hope tech stocks have more bull coming |

|

|

Sep 2 2020, 07:44 PM Sep 2 2020, 07:44 PM

Show posts by this member only | IPv6 | Post

#490

|

Senior Member

3,482 posts Joined: Sep 2007 |

|

|

|

Sep 2 2020, 07:50 PM Sep 2 2020, 07:50 PM

|

All Stars

24,466 posts Joined: Nov 2010 |

QUOTE(foofoosasa @ Sep 2 2020, 07:44 PM) Can scroll to second and third page reveal more of their holding. on debut day, the gorengers went out of whack... way out of line.BTW their entry price of the holding is quite high consider it only launch few days back. Hmm... since yesterday, it is tracking the HS Tech index nicely. e.g. today, etf closed HKD7.935 while HST index closed 7,909.35. |

|

|

Sep 2 2020, 07:58 PM Sep 2 2020, 07:58 PM

Show posts by this member only | IPv6 | Post

#492

|

Senior Member

3,482 posts Joined: Sep 2007 |

QUOTE(AVFAN @ Sep 2 2020, 07:50 PM) on debut day, the gorengers went out of whack... way out of line. I only know many investor complain csop is a scammer due to the goreng on the first day. Lol 😂 since yesterday, it is tracking the HS Tech index nicely. e.g. today, etf closed HKD7.935 while HST index closed 7,909.35. My bet is next coming months HS tech index will outperform hang seng index ( now already happening) just like nasdaq outperform dow jones. |

|

|

Sep 3 2020, 10:21 AM Sep 3 2020, 10:21 AM

Show posts by this member only | IPv6 | Post

#493

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

For Chinese investors and those who understand Mandarin:

https://www.mpfinance.com/fin/columnist2.ph...&issue=20200903 |

|

|

|

|

|

Sep 3 2020, 02:59 PM Sep 3 2020, 02:59 PM

|

Senior Member

9,361 posts Joined: Aug 2010 |

QUOTE(moosset @ Aug 30 2020, 09:55 PM) QUOTE(AVFAN @ Aug 31 2020, 11:09 AM) just did some fresh reading on Ant Fintech... very intersting, very promising... will keep an eye on it. https://www.marketwatch.com/story/ant-group...ber-11596494575 https://marker.medium.com/how-ant-group-bec...ld-7afae29ec1d3 QUOTE(markedestiny @ Sep 2 2020, 01:59 PM) QUOTE(AVFAN @ Sep 2 2020, 05:50 PM) bro, while waiting for Ant Fintech, look at 03033 again. How are you, bros ??closed 7.935 today, +2.99%. i will prepare some fund for Ant Fintech! dividend is old school, tak pakai now.... now with zero/near zero int/discount rates, GROWTH stocks get explosive valuations. traditional property, commodites O&G, banks, malls, leisure... wun be same again. no choice, must follow... tech, online, etc. unless covid miraculously disappears like DT hopes, and no other covid comes next 10 years... fat hopes. Yeah,... I'm pusghing my hands into tech now,... more into Nasdaq, but keeping a silent awareness in my mind on the dotcom bubble that happened back in the 2000s. My dividend plays are still ongoing, sustainig on their own today, I have not sold them, but am not adding anymore. If I add into them today, I would be averaging up and the effect o this would be lowering my ROI (yield). So,... I've decided not to add anymore. I'm up 60% to 70% plus on the divdiend stocks that I bought many years ago. It's mentally draining at times, dipping into a new game.... but well, it's something new and hence, the excitement,.... I made money on the recent stock splits of AAPL and TSLA. Guessed I was LUCKY,... no skills here,... I bought into both ctrs just before they announced stock splits. I engaged the skills I picked-up from the recent Vicom stock split,... and rode up high before disposing on last Friday beingthe last day of trading pre=split for both ctrs. Emm,... I think with Chairman's Powell's sppeech last Thrsday night,... the REITs will benefit too with a prolonged low interest rate environment, not only the growth stocks. Not good, though, for investment grade bonds and term deposits. |

|

|

Sep 3 2020, 03:09 PM Sep 3 2020, 03:09 PM

|

Senior Member

9,361 posts Joined: Aug 2010 |

Bros,... sorry to sidetrack, just a heads-up here,... after I put in some updates into the Forex thread, I took a peep at the Gloves Counters,....

TG dropped 66.3% today,............wow,... what happened ?? |

|

|

Sep 3 2020, 03:16 PM Sep 3 2020, 03:16 PM

Show posts by this member only | IPv6 | Post

#496

|

Senior Member

3,482 posts Joined: Sep 2007 |

QUOTE(Hansel @ Sep 3 2020, 03:09 PM) Bros,... sorry to sidetrack, just a heads-up here,... after I put in some updates into the Forex thread, I took a peep at the Gloves Counters,.... u mean top glove? bonus issuance right?TG dropped 66.3% today,............wow,... what happened ?? sorry for OT This post has been edited by foofoosasa: Sep 3 2020, 03:16 PM |

|

|

Sep 3 2020, 03:32 PM Sep 3 2020, 03:32 PM

|

All Stars

24,466 posts Joined: Nov 2010 |

|

|

|

Sep 3 2020, 03:36 PM Sep 3 2020, 03:36 PM

|

Junior Member

764 posts Joined: May 2018 |

QUOTE(Hansel @ Sep 3 2020, 02:59 PM) How are you, bros ?? This post has been edited by markedestiny: Sep 3 2020, 03:37 PMYeah,... I'm pusghing my hands into tech now,... more into Nasdaq, but keeping a silent awareness in my mind on the dotcom bubble that happened back in the 2000s. My dividend plays are still ongoing, sustainig on their own today, I have not sold them, but am not adding anymore. If I add into them today, I would be averaging up and the effect o this would be lowering my ROI (yield). So,... I've decided not to add anymore. Good for you to experiment new things I've been pretty flexible when it comes to investing since last Dec; going from value to growth stocks and exploring different investment assets which I would have not touched earlier. I'm up 60% to 70% plus on the divdiend stocks that I bought many years ago. It's mentally draining at times, dipping into a new game.... but well, it's something new and hence, the excitement,.... I made money on the recent stock splits of AAPL and TSLA. Guessed I was LUCKY,... no skills here,... I bought into both ctrs just before they announced stock splits. I engaged the skills I picked-up from the recent Vicom stock split,... and rode up high before disposing on last Friday beingthe last day of trading pre=split for both ctrs. Are you awared that the US market is in the midst of a melt-up and the top could come off any time from now.., those who holding growth tech stocks should have notice their holdings drifting higher. Anyway I have a strong gut feeling you are disposing the two stocks just in time to lock your gains... Emm,... I think with Chairman's Powell's sppeech last Thrsday night,... the REITs will benefit too with a prolonged low interest rate environment, not only the growth stocks. IMO, I don't think REITs would stand to benefit given the large volume of defaults and closures that are taking place in US especially, although the interest rate is keep low. It's not in my priority list anymore (but I will revisit again when the market gets better) and I have actually sold off my SGREITs with small losses few months back. Data center REITs would be a much better bet if you are still looking into REITs. Not good, though, for investment grade bonds and term deposits. |

|

|

Sep 3 2020, 06:55 PM Sep 3 2020, 06:55 PM

|

Senior Member

9,361 posts Joined: Aug 2010 |

QUOTE(foofoosasa @ Sep 3 2020, 03:16 PM) QUOTE(AVFAN @ Sep 3 2020, 03:32 PM) Ohh yeah, right,... I read abt this sometime back,... forgot abt it,.... Riverstone too doing the same too, right ? I recalled it was 1-for-2. But EGM date has yet to be set,.... |

|

|

Sep 3 2020, 06:56 PM Sep 3 2020, 06:56 PM

|

Senior Member

9,361 posts Joined: Aug 2010 |

|

| Change to: |  0.0910sec 0.0910sec

0.81 0.81

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 10:31 PM |