2. In any insurance quote, check the 'Illustration of Expected Benefits' table, it tells you how much exactly your contribution goes to - distribution cost, premium charges, insurance charges, management fees and balance fund for 'investment'. Also check what is the return % assumption, that's the favorite part of insurance agent when they tell you that you will get RMx mil 50 years later.

3. For example, Great Eastern uses 7-8% for their investment return, but the fact is

QUOTE(kbandito @ Jun 13 2019, 10:50 AM)

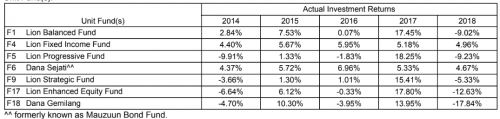

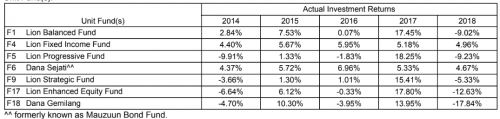

This is Great Eastern's latest fund performance.

On a 5-year CAGR basis, the Fixed Income Fund made 5.2% average per year, the Balance Fund made 3.4%/year, and the Progressive Fund made -0.8%/year (negative).

They need to sack the fund managers for not able to outperform idiot-proof fixed income fund. I know last year was tough but 5-year CAGR performance of that is abso-effing-lutely unacceptable.

On a 5-year CAGR basis, the Fixed Income Fund made 5.2% average per year, the Balance Fund made 3.4%/year, and the Progressive Fund made -0.8%/year (negative).

They need to sack the fund managers for not able to outperform idiot-proof fixed income fund. I know last year was tough but 5-year CAGR performance of that is abso-effing-lutely unacceptable.

Aug 25 2019, 02:42 PM

Aug 25 2019, 02:42 PM

Quote

Quote 0.0281sec

0.0281sec

0.82

0.82

6 queries

6 queries

GZIP Disabled

GZIP Disabled