I started working when I was 21 and now 26.

My first job of 4 years had performance incentives and commission. Times were good and I started 3 savings plans introduced by my insurance agent (the plans are from the insurance company itself). The plans are as follows:

» Click to show Spoiler - click again to hide... «

A. Contribute RM3,600 per year indefinitely. By age 65 I would have contributed around RM150,000 but the plan's cash-out value would be around RM450,000. Will be higher if I let it sit longer.

B. Contribute RM12,000 per year for 20 years (total RM240,000). By my mid 40s I will stop contributing but the cash value continues to grow until whenever I close the account. By age 65 the cash-out value is around RM900,000, RM1.1mil at age 70.

C. Contribute RM15,000 per year for 20 years (total RM360,000). By my mid 40s I will stop contributing but the cash value continues to grow until age 55 where the account matures and closes. Cash-out value is around RM700,000.

After I changed jobs last year (New job dont have incentives and commission. Admittedly this was a financial mistake), I did not get the increment and bonus I expected due to "below average company performance". It looks like it may be the same next year.

Long story short, I predict my

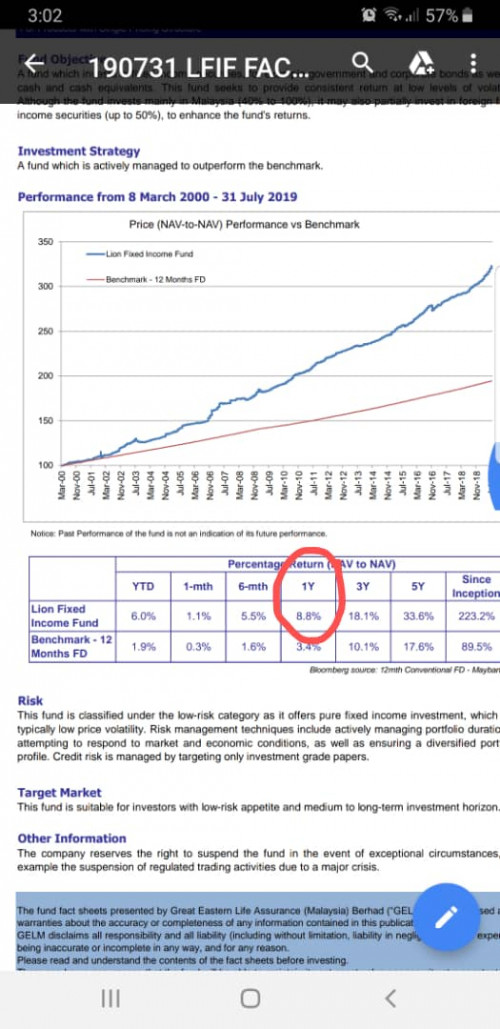

total income next year to be just barely enough to cover living costs (and I live quite minimally) and contribute to my savings plans. There may not be surplus (or very little) for emergency funds and unforseen expenses. I have about RM50,000 in F.D and thinking of putting a portion of them in other investment options.

I

am looking around for a better paying job.

In case of a serious emergency I can still withdraw from any of the above savings plans but the lost amount will have a compounded effect on the future cash-out value unless I return the money soon enough.

Hint: mum is 63y.o, dad is 68.

Would appreciate your advice and feedback on my situation.

Why not u look for a proper advice and direction on how to move forward with your financial?

Having emergency fund is good, but placing it in a better return (other than amanah saham fixed price) can be a better option

No more buying saving plan and try not to touch it , else u lose a fair bit. Getting a professional to advise you based on your overall situation may shed a better light to you, rather than hunting from ppl who r doing from their own experience . Anyway it's free analysis and no selling of products involved if the person is a real professional

Aug 28 2019, 10:53 PM

Aug 28 2019, 10:53 PM

Quote

Quote

0.0236sec

0.0236sec

0.73

0.73

6 queries

6 queries

GZIP Disabled

GZIP Disabled